Mercer International Offers Investors 3% Dividend Yield, 40%-Plus One-Year Total Return (MERC)

By: Ned Piplovic,

Over the past year, Mercer International, Inc. (NASDAQ: MERC) rewarded shareholders with a 40% total return on investment and currently offers a forward dividend yield of 3%.

While Mercer International started distributing dividends only a few years ago, in 2015 to be exact, the company has maintained a steady dividend distribution every quarter. The current dividend payout ratio of 36% is on the lower end of a sustainable range, a good indication that the company is financially stable enough to support its current dividend distribution.

As a result of the low payout ratio, Mercer was able to raise its dividend 8.7% for first time at the beginning of 2018. With a rising share price, it is a reasonable guess that Mercer may continue to raise its dividend payouts every year to maintain the current yield level and keep pace with the stock’s uptrend.

Speaking of that uptrend, the share price rose 150% over the past five years and is currently trading at levels not seen since 1996. Even so, the share price is still nearly 15% below the $19 average target price of Wall Street analysts. Two-thirds of the analysts covering the stock rate it as either a “Buy” or a “Strong Buy.”

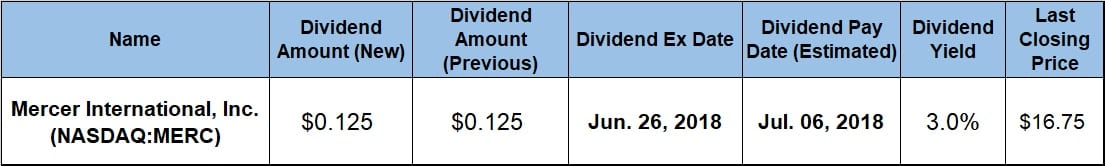

Mercer’s next ex-dividend date is on June 26, 2018, and the company will distribute its next round of dividends on the July 6, 2018 pay date.

Mercer International, Inc. (NASDAQ:MERC)

Headquartered in Vancouver, Canada and founded in 1968, Mercer International Inc. manufactures and sells northern bleached softwood Kraft (NBSK) pulp and other wood products. Mercer International operates in two segments: Pulp and Wood Products. Additionally, the company manufactures, distributes and sells lumber and other residual wood products. The company’s current pulp production capacity comprises three mills — one in British Columbia and two in Germany. Additionally, Mercer acquired one of Germany’s largest sawmills in April 2017 and launched Mercer Timber Products, which is the company’s entry into the softwood lumber sector.

As mentioned earlier, Mercer’s current $0.125 per share quarterly dividend is 8.7% higher than the $0.115 quarterly payout from the same period last year. This new quarterly payout amount translates to a $0.50 annualized dividend distribution and a 3% forward dividend yield. Compared to the 1.76% average yield of the company’s peers in the overall Consumer Goods sector, Mercer’s current 3% dividend yield is 70% higher. Additionally, the company’s current dividend yield also outperformed the simple average yield of all the companies in the Paper & Paper Products industry segment by more than 30%.

The main driver behind Mercer’s first dividend hike since 2015 was its strong share price growth in the past year. However, that rise was not without volatility. The share price declined over 10% between the onset of the trailing 12 months and the 52-week low of $10.45 on September 15, 2017. After bottoming out in mid-September, the share price surged more than 40% by the beginning of November 2017 to test the $15 resistance level, but was unable to break through.

After bouncing off the $15 resistance level, the share price experienced additional volatility and traded sideways in the $12.50 to $14.50 range until the beginning of May 2018. However, after the beginning of May 2018, the share price surged again, broke the $15 resistance and continued to rise before closing at its new 52-week high of $17.00 on June 11, 2018. This closing price was 48% higher than it was 12 months earlier, more than 60% above the 52-week low from September 2017 and about 150% higher than it was five years ago.

A share price drop of more than 50% between March 2015 and February 2016 limited the company’s three-year total return to just 30%. However, the total return over the past 12 months was significantly higher at 47.7%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic