MetLife Offers 4.2% Dividend Yield, Six Annual Dividend Hikes (MET)

By: Ned Piplovic,

Insurance giant MetLife, Inc. (NYSE: MET) has hiked its total annual dividend payout for the past six consecutive years and currently offers its shareholders a 4.2% dividend yield.

While the company’s dividend payout rose and the current dividend yield outperforms the company’s average, as well as industry averages, a significant portion of the dividend yield increase can be attributed to the share price decline in 2018. However, the company’s long-term outlook seems positive and the current share price drop could be a buying opportunity.

The company has beat Wall Street analysts’ consensus estimates for the past three consecutive quarters and the company is set to report its third-quarter financial results on November 2, 2018. However, in the lead-up to this results conference, analysts have been raising their consensus estimates, which is generally a good sign that the company will at least meet its forecasts. Furthermore, MetLife’s current share price is 25% below analysts’ average target price, which leaves a lot room on the upside.

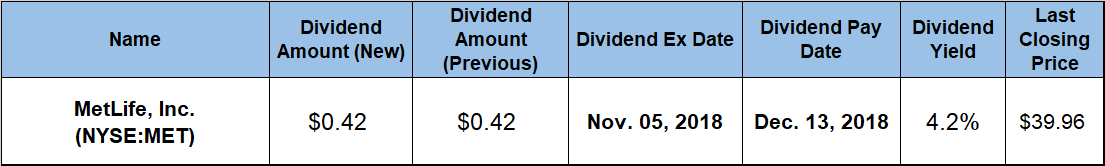

Investors convinced that the share price downtrend is due for a direction reversal and interested in taking advantage of the current share price discount should act before the upcoming ex-dividend date on November 5, 2018. The company will distribute its next round of quarterly dividend payouts to all eligible shareholders of record on the December 13, 2018, pay date.

MetLife, Inc.(NYSE:MET)

Headquartered in New York, New York, and founded in 1863, MetLife, Inc. engages in the insurance, annuities, employee benefits and asset management businesses. The company operates through five segments — United States, Asia, Europe, the Middle East and Africa, Latin America and MetLife Holdings. Through its business segments, the company offers life, dental, group short-term and long-term disability, individual disability, accidental death and dismemberment and other plans to employers. Additionally, MetLife provides pension risk transfers, institutional income annuities, tort settlements, capital markets investments and other insurance products and services. The company also offers automobile, homeowners and personal liability insurance, as well as small business property, liability and business interruption insurance products. Furthermore, MetLife provides fixed annuities and pension products, medical and credit insurance products, fixed and indexed-linked annuities, as well as protection against the costs of long-term health care services.

After gaining 67% over a two-year period, MetLife’s share price leveled off before embarking on its current decline in late January 2018. The current decline is not a real downtrend. The share price experienced a sharp drop along with the overall market pullback in the last week of January and the first week of February, traded sideways after February and then dropped again with the most recent market selloff in October 2018. The share price closed on October 29, 2018, at $39.96, which was 26% lower than it was one year earlier and just 1% above the 52-week low of $39.56 on October 26, 2018.

The company’s current $0.42 quarterly dividend is 5% higher than the $0.40 distribution from the same period last year. This current payout is equivalent to a $1.68 annualized distribution and a 4.2% forward dividend yield. The 4.2% dividend yield is 27.4% above the company’s own average yield over the past five years.

In addition to outperforming its own average yield, MetLife’s current yield is 26% higher than the 3.34% average yield of the entire Financials sector, as well as 155% above the 1.65% simple average yield of all the companies in the Life Insurance industry segment. Even excluding the companies that do not distribute dividends, the Life Insurance segment’s average dividend yield rises to just 2.43%, and MetLife’s current yield is still 73% higher.

The company has advanced its total annual dividend amount almost 130% over the past six consecutive years, which corresponds to an average growth rate of 14.6% per year. Even with only 12 annual dividend hikes since initiating dividend distribution hikes 18 years ago, MetLife boosted its total annual dividend payout amount 740% for an average growth rate of 12.6% per year. While the current share price decline is not a favorable sign for investors looking towards asset appreciation, income investors might be able to use this opportunity to gain a significant income flow into their investment portfolios.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic