Microsoft Corporation Announced 14th Consecutive Annual Dividend Hike (NASDAQ:MSFT)

By: Ned Piplovic,

While not known for extraordinarily high dividend yields, the Microsoft Corporation (NASDAQ:MSFT) has continued raising its quarterly payouts and has announced its 14th consecutive annual dividend hike for the last quarter of the calendar year.

This current boost is the company’s 14th boost annual dividend hike in the 16 years since Microsoft began dividend payouts. The share price rose significantly faster than the dividend payouts over the past year. This growth disparity pushed the company’s current yield below the market average of approximately 2%. However, while lower than market averages at its lower level, Microsoft’s current yield still outperforms most of its industry peers and the average yield of the overall Technology sector.

Microsoft’s current dividend payout ratio of just 36% indicates that the company uses only a little more than one third of its earnings to cover dividend distributions. At this level, Microsoft’s current payout ratio is barely inside the 30% to 50% payout range generally considered attractive by income investors. These investors generally seek a payout ratio of at least 30%, which indicates that a company uses a substantial portion of its earnings to return cash to its shareholders.

Additionally, the current yield is only half of the company’s own 62% average payout ratio over the past five years. This shift indicates that Microsoft’s earnings have increased substantially over the past few years and that the company should be able to extend its current consecutive annual dividend hike streak into the foreseeable future.

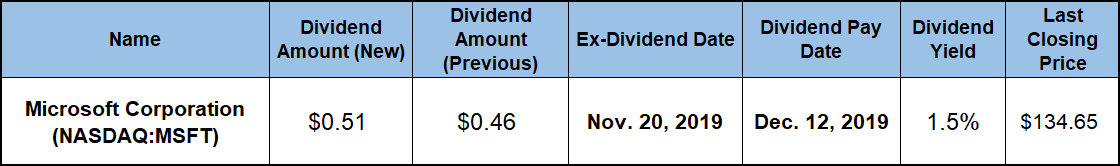

While pure income investors might balk at the relatively low dividend yield, other investors should consider picking a stock that supplements its robust asset appreciation with a steady stream of rising dividend income. However, interested investors should make sure to claim stock ownership before the next ex-dividend date on November 20, 2019. All shareholders of record prior to that ex-dividend date will be eligible to receive the next quarterly dividend distribution on the December 12, 2019, pay date.

Microsoft Corporation (NASDAQ:MSFT)

Founded in 1975 and headquartered in Redmond, Washington, the Microsoft Corporation develops, licenses, and supports software products, services and devices worldwide. The company’s Productivity and Business Processes segment offers Office 365 commercial products and services for businesses, including Office, Exchange, SharePoint, Skype for Business, and related Client Access Licenses (CALs). Additionally, this segment provides consumer productivity Office suite of applications, as well as the Office 365 consumer services, such as Skype, Outlook.com and OneDrive. The Dynamics segment provides business applications for financial management, enterprise resource planning, customer relationship management, supply chain management and the LinkedIn online professional network.

The Intelligent Cloud segment licenses server products and cloud services, such as Microsoft SQL Server, Windows Server, Visual Studio, System Center, as well as Azure, a cloud platform with computing, networking, storage, database and management services. Additionally, this segment provides the Premier Support and Microsoft Consulting enterprise services, which assist in developing, deploying, and managing Microsoft server and desktop solutions. Training and certification to developers and IT professionals on Microsoft products area also part of the Intelligent Cloud segment.

Microsoft’s More Personal Computing segment comprises licensing of the Windows operating system to Original Equipment Manufacturers (OEM), patent licensing, Windows Internet of Things, MSN display advertising and Windows Phone licensing. Additionally, this segment designs and manufactures electronic devices that include the Microsoft Surface tablet devices, phones and PC accessories, as well as search and advertising through the company’s Bing and Bing Ads platforms. This segment also provides gaming platforms, including Xbox hardware, Xbox Live and video games.

Microsoft’s upcoming dividend distribution of $0.51 in early December, is nearly 11% higher than the company’s $0.46 payout from the most recent period. This new quarterly payout amount corresponds to a $2.04 annualized distribution and a 1.52% forward dividend yield. While the annual dividend payout advanced a respectable 77% over the past five years, the share price has tripled over the same period. The faster share price growth suppressed the current yield 25% below Microsoft’s own 2% yield average over the last five years.

While trailing behind its own five-year average, Microsoft’s current yield outperformed the 0.94% simple yield average of the entire Technology sector by more than 60%. Additionally, Microsoft’s current yield is also nearly triple the 0.52% average yield of the company’s peers in the Application Software industry segment.

Between 2005 and its 14th consecutive annual dividend hike payout, Microsoft’s total annual dividend payout amount expanded nearly 540%. That level of advancement is equivalent to an average growth rate of 14.1% per year.

The rising dividend income and growing capital gains combination resulted in sizable total returns over the last few years. Just over the trailing 12 months, Microsoft delivered to shareholders an 18.7% total return on their investment. Shareholders that held the Microsoft stock for the past three years enjoyed a total return of 143%. Furthermore, Microsoft shareholders more than tripled their investment with a total return of 212% over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic