Monmouth Real Estate Offers Four Years of Dividend Hikes (MNR)

By: Ned Piplovic,

Monmouth Real Estate Investment Corporation (NYSE:MNR) has offered four consecutive years of dividend hikes and rewarded its shareholders with a total return of more than 13% just over the past 12 months.

While the company managed to avoid cutting its dividend payouts over the past two decades, the four consecutive dividend hikes over the past four years equals the number of annual dividend hikes in the preceding 16 years.

After doubling between August 2015 and the end of 2017, the company’s share price dropped 23.6% at the beginning of the current year. However, after hitting its 52-week low in late February 2018, the share price reverted to its rising trend and regained two-thirds of those losses by early August 2018.

The price drop caused the share price’s 50-day moving average (MA) to drop below the 200-day MA in early March 2018. However, as the share price started recovering, the 50-day MA has been rising as well since April 24, 2018, and is currently less than 1% below the 200-day MA. At this time, the 50-day MA appears to be on its way to breach above the 200-day MA in bullish manner as early as next week, which would be an indication of a prolonged uptrend.

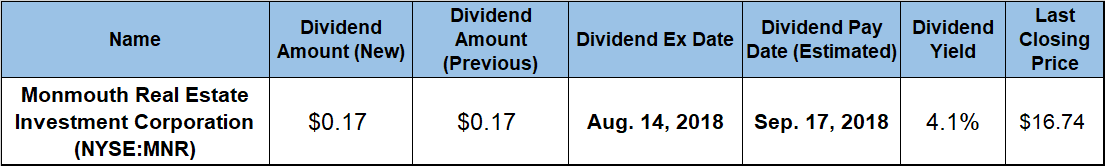

The company will distribute its next dividend on company’s September 17, 2018, pay date to all its shareholders of record prior to the August 14, 2018, ex-dividend date.

Monmouth Real Estate Investment Corporation (NYSE:MNR)

Headquartered in Freehold, NJ, and founded in 1968, the Monmouth Real Estate Investment Corporation is a public equity Real Estate Investment Trusts (REITs). The company specializes in single tenant, net-leased industrial properties, subject to long-term leases, primarily to investment-grade tenants. As of August 2018, the trust’s property portfolio consisted of 109 properties across 30 states with approximately 20.5 million square feet of rentable space. The current occupancy rate is 99.6% and 85% of all revenues comes from investment grade tenants. In addition to its real estate properties, the company owns a portfolio of REIT securities. MNR expanded its leasable square footage 150% and increased the company’s market capitalization more than four-fold since 2011. These investments seem to have paid off as the trust more than doubled its total revenues since 2013 and increase its Adjusted Funds from Operations (AFFO) per diluted share more than 65% over the same period. As of the end of 2017, MNR’s total return of 345% over the past 10 years ranks the company in the top ten performers among all the REITs and as the top performer in Industrial REITs subsegment.

The REIT’s upcoming quarterly dividend distribution of $0.17 is 6.3% above the $0.16 payout from the same quarter last year. This new quarterly amount is equivalent to a $0.68 annualized distribution and yields 4.1%. While 34% higher than the 3.04% simple average dividend yield of the entire Financials sector, MNR’s current yield is 17% lower than the company’s own 4.9% average yield over the past five years.

During the current four-year streak of consecutive dividend hikes, the REIT enhanced its total annual dividend payout by 13%, which corresponds to an average growth rate of 3.2% per year. The 13% dividend growth over the past four years might not seem like a lot. But, that total growth is still more than the 12% total annual progress over the previous 16 years. Additionally, the 3.2% average annual growth rate over the past four years is significantly higher than the 0.7% average rate between 1998 to 2014.

The company’s share price ascended 8.5% during the first four months of the trailing 12-month period before peaking at $18.19 on December 4, 2017. After the December 2017 high, the share price broke its two-year uptrends and declined 23% to reach its 52-week low of $13.89 on February 21, 2018. However, since bottoming out in February, the share price resumed its uptrend and recovered two-thirds of these losses to close on August 2, 2018, at $16.74 — just 8% short of its 52-week high from December 2018. Additionally, the August 2, 2018, closing price was 10.3% higher than it was one year earlier, 20.5% above the February low, and 87% higher than it was five years ago.

Despite the 20%-plus decline at the beginning of 2018, the share price still posted a double-digit-percentage gain for the year, which combined with the rising dividend income for a total return of 13.2% over the last 12 months. Shareholders enjoyed an even better total return of 87% over the past three years and more than doubled their investment over the past five years with a total return of 105%.

Dividend hikes and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic