National Fuel Gas Company Offers Shareholders 48th Consecutive Annual Dividend Hike (NFG)

By: Ned Piplovic,

Featured Image Source: https://www.natfuel.com/gathering/midstream/default.aspx

The National Fuel Gas Company (NYSE:NFG) has been paying dividends for more than a century and has rewarded shareholders with its 48th consecutive annual divdend hike.

Additionally, the company’s current 3.2% dividend yield is a double-digit percentage above the simple average yield of the overall Utilities sector. In addition to the long record of rising dividend payouts, the company’s share price rose for a decade before experiencing a drop of more than 40% in 2001 and 2002. However, while still experiencing higher volatility than it did before 2001, the share price has been recovering since July 2002 and its 50-week moving average (MA) has been rising steadily since April 2003.

The company’s share price suffered another significant pullback in early February 2018. Nevertheless, the share price resumed its recent uptrend immediately after that drop and has continued to ascend, which could be an opportunity for interested investors to take or extend their long position in this equity at the currently discounted share price.

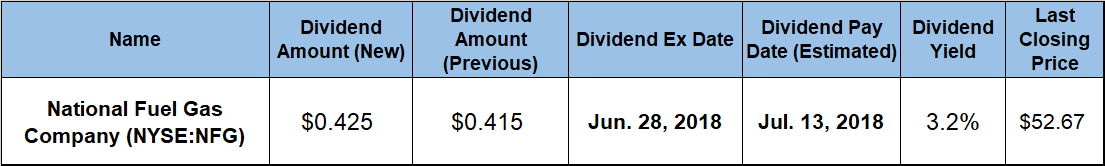

The National Fuel Gas Company will distribute its next dividend on company’s July 13, 2018, pay date to all its shareholders of record prior to the June 28, 2018, ex-dividend date.

National Fuel Gas Company (NYSE:NFG)

Based in Williamsville, New York, and founded in 1902, the National Fuel Gas Company operates as a diversified energy company through five business segments. The Exploration and Production segment’s focus is exploration, development and production of natural gas and oil reserves in California and in the Appalachian region of the United States. As of December 30, 2017, the company had proved developed and undeveloped reserves of more than 30,000 thousand barrels of oil and more than 2 million cubic feet of natural gas. The Pipeline and Storage segment provides interstate natural gas transportation and storage services through an integrated gas pipeline system extending more than 2,300 miles from Southwestern Pennsylvania to the New York-Canadian border. This segment also operates approximately 30 underground natural gas storage fields and the Empire Pipeline – a 250-mile integrated pipeline system in New York state. Additionally. the Gathering segment builds, owns and operates natural gas processing and pipeline gathering facilities in the Appalachian region. Also, the company’s Utility segment sells natural gas or provides natural gas transportation services to more than 750,000 customers in Buffalo, Niagara Falls and Jamestown, New York, as well as Erie and Sharon, Pennsylvania. Finally, the Energy Marketing segment markets natural gas to industrial, wholesale, commercial, public authority and residential customers primarily in New York and Pennsylvania.

The share price experienced a moderate level of volatility and started the trailing 12 months approximately 10% above its current price. The share price reached its 52-week high of $59.84 on July 27, 2017. After peaking in late July, the share price traded mostly in the $57 to $58 range over the subsequent four months. The share price experienced a slow declining trend in December 2017 and January 2018 before falling more than 12% between January 26, 2018, and February 5, 2018. Amid more volatility, the share price bottomed out at its 52-week low of $49.10 on March 8, 2018 before resuming its current uptrend. After its 52-week low in early March, the share price gained 7.3% and closed on June 15, 2018, at $52.67.

The National Fuel Gas Company offered its shareholders a 2.4% quarterly dividend hike for the upcoming round of dividend payouts. This dividend hike raised the company’s quarterly dividend from the $0.415 amount in the previous period to the current $0.425 payout. The new quarterly dividend amount is equivalent to a $1.70 annualized payout and a 3.2% yield, which is almost 20% higher than the company’s own 2.7% average yield over the past five years. Additionally, the company’s current yield is 16.5% above the 2.77% simple average yield of the entire Utilities sector.

The company started paying dividend just one year after its founding in 1902 and has rewarded its shareholders with another dividend hike for the upcoming dividend payout, which will be the company’s 48th consecutive annual dividend hike. Over the past two decades, the company has nearly doubled its total annual dividend amount buy growing the annual payout at an average rate of 3.2% per year. With the current dividend payout ratio at 36%, the company can continue its record of dividend boosts for many years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic