National Retail Properties Offers 5% Dividend Yield, 28 Consecutive Years of Dividend Boosts (NNN)

By: Ned Piplovic,

National Retail Properties, Inc. (NYSE:NNN) has rewarded its shareholders with 28 consecutive years of dividend boosts and currently offers a dividend yield of nearly 5%

The company’s share price declined approximately 14% over the last year because of moderate volatility and overall market selloff. However, the share price has a steadily rising trend that combines with the company’s rising dividend payouts for double-digit percentage total returns over the long term.

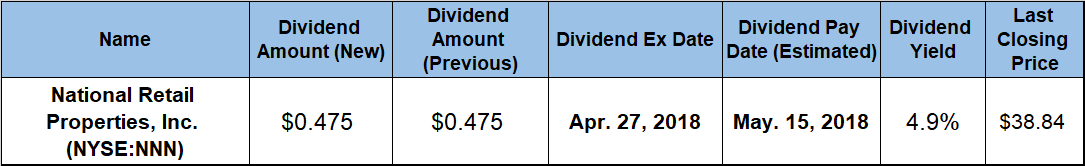

The company will distribute its next dividend on the company’s May 15, 2018, pay date to all its shareholders of record prior to the April 27, 2018, ex-dividend date.

National Retail Properties, Inc. (NYSE:NNN)

Owners of the Golden Corral restaurant chain created National Retail Properties, Inc. in 1984 to reward their employees with stock. Initially, the company owned and leased only Golden Corral restaurant location properties. However, the company started expanding its investment strategy to all retail property sectors in 1994. As of March 2018, the company owned nearly 2,800 properties across 48 U.S. states. Hawaii and Vermont were the only states where the REIT had no properties. Almost 20% of properties are various restaurant locations, 18% are convenience stores and nearly 7% of properties are operated as auto services, such as repair shops and car washes. Among individual companies, Sunoco gas stations are number one in terms of most individual locations with 124 and the highest share of total base rent — 5.1%. In terms of total base rent, Camping World (4.2%), Mister Car Wash (4.1%), LA Fitness (3.8%) and AMC Theaters (3.4%) round out the top five. However, Bell American — Taco Bell — with 115 locations, GPM Investments, the sixth largest convenience store chain in the country, with 103 stores, SunTrust with 101 locations and Mister Car Wash with 96 locations follow Sunoco to comprise the top five clients in terms of store count.

The company’s share price started the trailing 12-month period from its 52-week high of $45.47 on April 20, 2017. However, the share price plunged nearly 20% in less than a month and closed on May 16, 2017 at $36.72. After this sharp drop, the share price slowly regained nearly 80% of that loss by December 18, 2017, to close at $43.62 — just 4% below the April 2017 peak. Unfortunately, the share price started declining slowly in late December 2017 and continued to deteriorate throughout January 2018 before dropping significantly with the rest of the markets in the first week of February 2018. The share price fell to its new 52-week low of $36.52 on February 8, 2018, but reversed trend immediately and started rising again. Since the February low, the share price gained 6.4% and closed on April 18, 2018, at $38.84. This closing price is still approximately 14% below its April 2017 peak and almost identical to its price level from five years earlier. The recent share price decline over the last 12 months is characteristic of moderate volatility that the NNN price experienced over the past decade. However, the share price has a definitive growing trend over longer terms. Since December 2008, the company grew its share price 176%.

While the company’s share price goes through periodic volatility bursts, the annual dividend payouts have been growing steadily over the past 28 consecutive years. The current $0.475 quarterly dividend distribution is 4.4% higher than the $0.455 payout from the same quarter last year. The current quarterly distribution converts to a $1.90 annualized amount and a 4.9% forward yield. Additionally, the company has hiked its quarterly payout in the third quarter of the calendar year over the past several years. If the company continues to follow its dividend pattern, the July dividend payout should be another $0.02 increase over the current payout.

The company has boosted its annual payout every year since its started its dividend distributions in 1990. Over the past 20 years, the company has grown its total annual amount at an average rate of 3.6% per year and doubled its annual dividend distribution since 1998. The company’s dividend distribution partially offset the 14% share price decline and kept the total shareholder loss to 8.7% over the past 12 months. However, over the past three years, shareholders received a 10.2% total return, and over the past five years, a total return of more than 30% was produced.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic