Navient Corporation Offers 4.5% Dividend Yield, Double-Digit-Percentage Total Returns (NASDAQ:NAVI)

By: Ned Piplovic,

After several years of negative total returns driven by share price struggles, the Navient Corporation (NASDAQ:NAVI) has delivered a total return of more than 30% over the trailing 12-month period to complement its 4.5% dividend yield.

Despite steady payouts over the past several years, Navient Corporation’s dividend income distributions were unable to overcome the declining share price. However, with a resurging share price, the company’s shareholders have been rewarded with above-average total returns over the past year.

The Navient Corporation’s earnings growth projections for the next year imply a continuation of the current trend. Additionally, the company’s current Return on Equity (ROE) is nearly 28% higher than the industry average, which gives the Navient Corporation a significant advantage over its peers.

Furthermore, the company’s current dividend payout ratio of 31% is just slightly above the lower limit of the 30% to 50% range, which investors generally consider sustainable over extended periods. Additionally, the current payout ratio indicates that the company currently uses less than one-third of its earnings to cover dividend distributions. Therefore, the dividend payouts are well-covered by the company’s earnings and sustainable over the long term.

The current payout ratio is even lower than the company’s 37% payout ratio average over the last five years. A low payout ratio offers investors a level of confidence that the company should be able to continue delivering the current level of dividend payouts and even allows the company to potentially boost its dividend distribution amount in the future. Only once the payout ratio begins approaching the 50% level should investors start worrying about the company’s ability to support its dividend distributions.

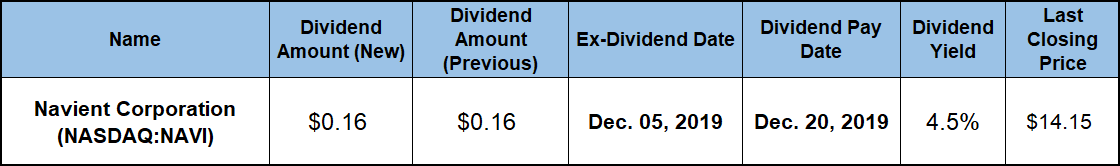

The Navi Corporation will distribute the next round of dividend payouts on the December 20, 2019, pay date to all shareholders of record as of the Dec. 6 record date. To lock in shareholder of record status and eligibility to receive the upcoming dividend distributions next month, investors must claim stock ownership before the December 5, 2019, ex-dividend date. For any transactions that occur on the ex-dividend date, the selling party is considered the owner of the stock. Therefore, the buyer of the stock on the ex-dividend date is not eligible for the dividend distribution immediately following the upcoming ex-date.

Navient Corporation (NASDAQ:NAVI)

Based in Wilmington, Delaware, and founded in 1973, the Navient Corporation provides asset management and business processing services to education, health care and government clients and operates in three segments — Federal Family Education Loan Program (FFELP) Loans, Private Education Loans and Business Services. The company’s portfolio contains education loans insured or guaranteed under the FFELP and private education loans. Additionally, the company holds education loans owned by the United States Department of Education (ED), financial institutions and nonprofit education lenders. The company also offers asset recovery and other business processing services for loans and receivables on behalf of guarantors of FFELP loans and higher education institutions, as well as federal, state, court and municipal clients.

The Navient Corporation began distributing dividends to its shareholders in the second quarter of 2014 with an initial $0.15 quarterly payout. The company raised its dividend amount 6.7% to a $0.16 quarterly distribution for the first quarter the following year and continues to pay the same amount as of the last quarterly payout in 2019. The company’s current quarterly distribution is equivalent to a $0.64 annualized payout and offers shareholders a 4.47% forward dividend yield.

After losing more than half of its value during 2015, the company’s share price has advanced nearly 60% since January 2016. This share price growth pushed Navient’s current yield below its long-term average. The current 4.47% forward yield is 8.3% below the company’s 4.88% yield average over the past five years.

However, despite trailing its five-year average, Navient Corporation’s current yield outperformed yield averages of the company’s industry peers. Compared to the 4.12% simple yield average of the overall Financial sector, Navient Corporation’s current yield is 8.6% higher. Furthermore, Navi Corporation’s current yield is 62% higher than the 2.76% average yield of the company’s peers in the Credit Services industry segment. Moreover, the current yield is even 12.5% higher than the 3.98% simple yield average of the segment’s dividend-paying companies

With the flat dividend distributions, the share price deficit has overpowered the income payouts and delivered total losses over the extended time horizon. Over the past five years, the share price has lost nearly one-third of its value. Despite steady payouts, dividend income payouts managed to cut the deficit only to 16.4% for the last five years. Dividend income managed to offset almost 60% of the Navient Corporation’s 20% share price decline and limited losses over the last three years to just 8%.

However, unlike the above-mentioned trend over extended periods, Navient Corporation’s share price has staged a resurgence since the beginning of 2019. Nearly 60% higher than its 52-week low in late 2018 and more than 25% above its level from one year ago, the share price combined with the reliable quarterly dividend payouts for a total return of more than 35% over the trailing 12 months.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic