Offering a Timely Tax Shelter For 2020

By: Bryan Perry,

For some investors who are looking to lighten up or rebalance portfolios into the teeth of this torrid rally, there is a special tax shelter that offers some pretty attractive benefits that are quite unique.

While most of us have heard of Opportunity Zones, I imagine most folks don’t know how they work or how they might fit into one’s portfolio. Inspired by entrepreneur and philanthropist Sean Parker, co-founder of Napster and early puppet-master of Facebook, his foundation set out to help shape public policy for the greater good where the government simply fell short due to the usual bureaucratic and political red tape that constantly thwarts real societal progress.

From Parker’s Foundation, He Describes ‘The Opportunity’

The Great Recession of 2008-09 was the sharpest downturn in economic activity since the Great Depression. While many parts of the country have since recovered, the gap between the richest and poorest American communities has widened since the Great Recession ended.

America is suffering from deepening geographic inequality linked to economic inequality — distressed areas are faring worse as the most prosperous areas have enjoyed tremendous growth. As gains continue to consolidate in the largest and most dynamic counties, other areas are left behind, searching for their place in the new economy. We must find a new toolkit for ensuring broad access to opportunity and helping both people and places realize their economic potential.

Opportunity Zones were proposed by Senators Tim Scott (R), Cory Booker (D) and Rep. Ron Kind (D), as well as supported by Sean Parker’s Economic Innovation Group.

Opportunity Zones were created under the Tax Cuts and Jobs Act of 2017, signed into law by President Donald J. Trump on December 22, 2017. Opportunity Zones are lower-income census tracts nominated by state governors and certified by the U.S. Department of the Treasury.

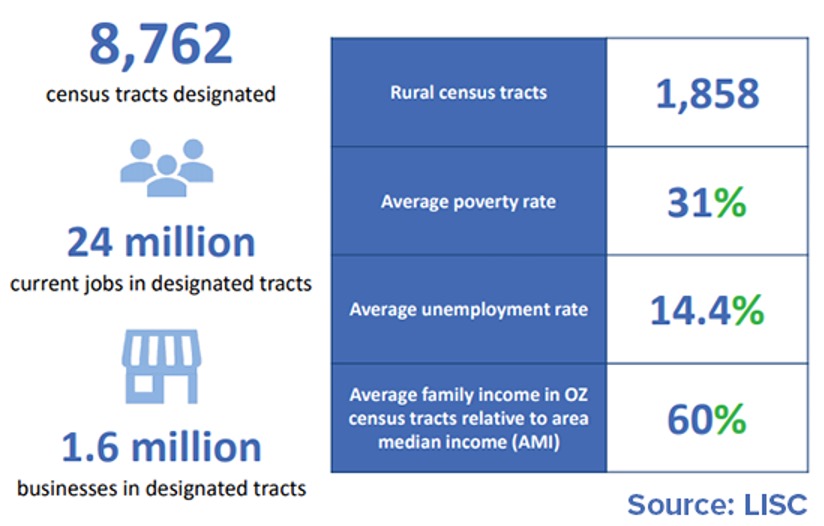

The United States has over 8,700 designated Opportunity Zone census tracts throughout the country, in every state and every U.S. territory.

The primary focus of the Opportunity Zone program is to stimulate economic development and job creation, by incentivizing long-term investment in low-income communities. This is a prime example of the public-private partnership arrangement I wrote about last week where private capital partnering with federal and state government can serve to rebuild and help distressed communities prosper.

The Opportunity Zone program enables investors to reinvest capital gains into Qualified Opportunity Funds (QOFs) that put that capital to work by financing new construction projects in low-income communities. In exchange, investors receive certain federal (and possibly state) capital gains tax advantages.

So many investors have deeply embedded capital gains from savvy purchases of stocks with an extremely low-cost basis, making for disposition of such assets a severe taxable event.

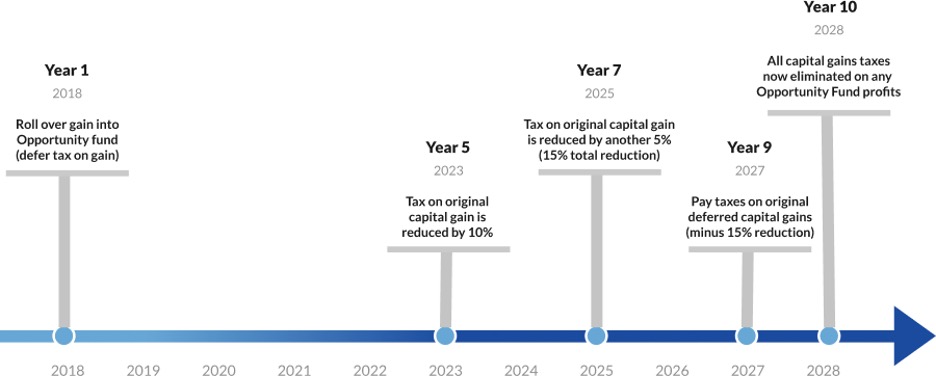

So, here’s the deal on Qualified Opportunity Zone Fund investing. Clients who re-invest their qualifying capital gains into a QOF within 180 days of recognition of that capital gain are eligible for the following tax benefits:

- Deferral of Capital Gains Taxes: Capital gains taxes will be deferred until the earlier of the end of 2026, an inclusion event or the date on which an investor sells its QOF investment. Capital gains eligible for deferral through reinvestment in a QOF include both short and long-term capital gains resulting from the sale of a wide array of asset classes, including, without limitation: stocks, bonds, commodities, certain cryptocurrencies, artwork, automobiles, jewelry and real estate.

- Reduction of Deferred Capital Gains Taxes: Investors will receive a 10% step-up in the basis of any capital gains that are reinvested in QOFs if the QOF investment is held for at least five years.

- Complete Elimination of Capital Gains Taxes: QOF investors are exempt from federal taxation on capital gains derived from the appreciation of their QOF investment if the QOF investment is held for at least 10 years.

- Possible State Income Tax Benefits: Depending on the state where the investor is domiciled and whether that state conforms with federal Opportunity Zone regulations, an investor may be entitled to receive the same federal Opportunity Zone capital gains tax benefits (deferral, reduction and elimination of taxes) on a state income tax level.

Source: www.irs.gov

Source: Activated Capital

Investors who are still working, earning large incomes now, and plan to retire by 2026 can move into a much lower tax bracket — this is a highly attractive proposition for them to consider. The current basic capital gains rates are 0%, 15%, and 20%, depending on one’s taxable income. A savings of 5% on a capital gain of $500,000 is real money.

No matter if the capital gains are derived from short-term or long-term investments, those gains, if invested within 180 days of the sale of the asset and put into a Qualified Opportunity Fund (QOF), the tax payments for those capital gains are deferred until 2026. Plus, all the capital appreciation achieved from the properties within the Opportunity Zone Fund is free of taxation, similar to how a Roth IRA functions.

According to www.opportunitydb.com, there are 247 Opportunity Zond Funds with a total investment capacity of $56 billion as of July 1, 2020. The projects within these funds can include affordable multi-family residential housing, student housing, workforce housing, renewable energy, hospitality, retail, manufacturing, industrial, medical, warehouse properties and mixed-use.

The 247 Opportunity Zone Funds available are all private funds, with the exception of Belpointe REIT (BELP) — the only listed QOF. I have no position, but it’s always nice to have the option of exiting an asset with the click of a mouse. Private funds typically have restrictive redemption features like surrender fees, specific exit periods and can be subject to discounted gray-market bids for units. So, consult with your tax advisor before considering such a tax-sheltered investment.

But, by and large, Opportunity Zone Funds are a sound approach where those fortunate enough to score big profits from the bull market can invest those capital gains into thousands of America’s struggling areas and help build a future for those seeking a better way of life without having to leave their community. This is how capitalism can work wonders in tandem with good government public policy for the benevolence of others if executed properly with good intent.

Connect with Bryan Perry

Connect with Bryan Perry