Oil-Dri Corp. of America Boosts Annual Dividend 16 Consecutive Years (ODC)

By: Ned Piplovic,

Oil-Dri Corporation of America (NYSE:ODC) rewarded its shareholders with 16 consecutive years of annual dividend boosts and currently offers a 2.3% yield.

In addition to boosting its annual dividend over an extended period, the company grew its share price at nearly 17.5% for a combined total return of almost 20% during the past 12 months. The company’s next ex-dividend date will occur on February 15, 2018, and the pay date will follow just 15 days later on February 15, 2018.

Oil-Dri Corporation of America (NYSE:ODC)

Founded in 1941 and based in Chicago, Illinois, the Oil-Dri Corporation of America is a manufacturer and supplier of sorbent products for consumer and business-to-business markets. The company provides fluids absorption materials, drying agents, growing media and other products to pet care, animal health, fluids purification, crop & horticulture, industrial & automotive and sports field industries.

The company will distribute to its shareholders a $0.23 dividend payout for the first quarter of 2018, which is 4.5% higher than the $0.22 dividend paid in the first quarter of 2017. The current $0.23 quarterly distribution yields 2.3% and converts to a $0.92 annualized payout.

If the company continues to follow its own decade-long trend of raising quarterly payouts, we can expect a $0.01 dividend hike in the third quarter to $0.24. This increase would boost the total annual dividend for 2018 to $0.94 and bump the forward yield to 2.4%. Alternatively, the share price would have to rise at least 4.35% to keep up with dividend growth and to retain the current 2.3% level.

The current 2.3% yield is in line with the company’s own five-year average yield of 2.3%. Additionally, the company’s current yield is almost 5% higher than the 2.22% average yield of the entire Basic Materials sector. However, Oil-Dri Corporation’s current yield is 65% higher than the 1.4% average yield of all the companies in the Specialty Chemicals segment. Even the 1.88% average yield of only dividend-paying companies in the segment is still almost 20% below ODC’s current 2.3% yield.

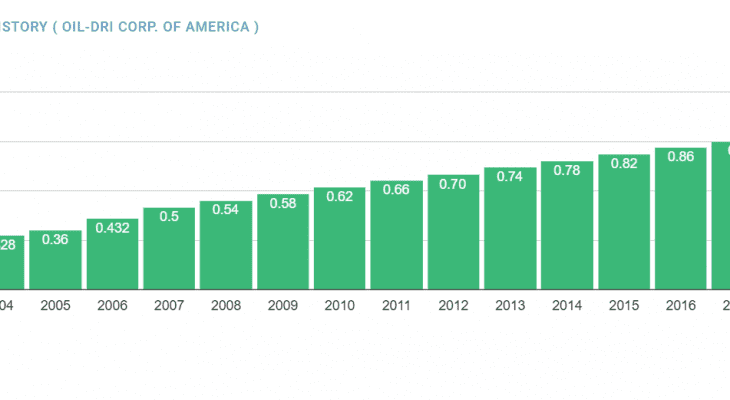

The company started distributing dividends in 1990, managed to avoid any dividend cuts in nearly three decades and boosted its annual dividend almost 80% of the time. Since 2002, the Oil-Dri Corporation hiked its annual payout at an average rate of 7.5% per year for 16 consecutive years and, consequently, enhanced its total annual distribution by almost 220%.

Please note that dividend data and charts could give the impression that the current streak of consecutive annual boosts is only five years. Based on the pay date, the total payout for 2012 was $1.06 and the 2013 total distribution was only $0.38. However, a portion of dividends for fiscal year 2013 – first and second quarter – was accelerated and paid out at the end of December 2012 as a single semiannual dividend distribution. Had the first and second quarters been paid at their regular intervals, the 2012 payout would have been $0.70, and the 2013 annual dividend would have been $0.74 – a 5.7% year-over-year enhancement.

The company’s share price traded flat at the onset of the current trailing 12-month period and reached its 52-week bottom price of $33.56 on February 8, 2017. Following a brief 6% rise over the following 90 days, the share price lost most all those gains in just two weeks and fell back to within 1.6% of the 52-week low. After that drop, the share price resumed a steadier growth and rose almost 25% by September 15, 2017.

Between mid-September and October 9, 2017, the share price spiked more than 18% and hit its all-time high of $50.33. However, that spike was extremely brief, and the share price plummeted to $41.23 over just two days, which was 3.1% lower than it was before the October spike. Since mid-October, the share price pulled back a little more and closed on January 30, 2018, at $39.50, which is more than 21% below the all-time high and 17.4% higher than it was one year earlier.

While the share price went through considerable volatility over the past year, it did grow more than 17% over the trailing 12-month period and, combined with the $0.90 annual dividend distribution, provided shareholders with a 20%-plus total return.

Dividend increases and decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic