Omega Healthcare Offers Shareholders 15 Consecutive Annual Dividend Hikes (OHI)

By: Ned Piplovic,

Omega Healthcare Investors, Inc. (NYSE:OHI) – one of the largest health care equity real estate investment trusts (REITs) in the United States – rewarded its shareholders with 15 consecutive years of annual dividend hikes.

Despite an impressive record of annual dividend hikes, the company recently ended a streak of boosting its dividend payout amount every quarter for nearly six years. After raising its quarterly dividend for the 23rd consecutive period at the beginning of 2018, the company paid the same amount for the remaining three quarters of the year.

While some investors might see this move as cause for concern, OHI’s fundamentals, share price trend and even technical indicators still point to a continued growth trend. In addition to the robust dividend growth, the company rewarded its shareholders with a steady share price growth for double-digit percentage total returns over the past several years.

After reaching its all-time high of $44.50 in January 2015, the company’s share price embarked on a slow downtrend and declined more than 40% over the subsequent three years. However, since pausing its decline in January 2018 and trading relatively flat in the first quarter of the year, the share price started rising again and has gained more than 50% since late April 2018.

The current uptrend revived the company’s moving averages as well in the second half of the year. The 50-day moving average (MA) started rising in late May and has crossed above the 200-day MA on June 19. Additionally, the 200-day moving average has been rising steadily since mid-August 2018. Furthermore, the company’s share price has been trading above both moving averages since the beginning of the current year.

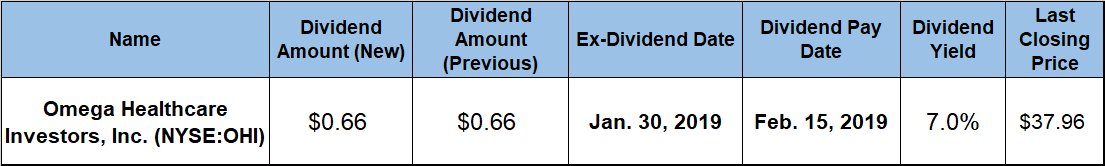

The indications that the share price might continue to grow and the company’s steady dividend income flow that yields 7% makes this stock attractive to investors seeking asset appreciation, as well as steady income distributions with annual dividend hikes. Therefore, interested investors should conduct their own research to confirm compatibility of the OHI stock with their own portfolio strategy. The company’s next ex-dividend date is set for January 30, 2019. All shareholders of record on that date will be eligible to receive the next round of dividend distributions on the February 15, 2019, pay date.

Omega Healthcare Investors, Inc. (NYSE:OHI)

Omega Healthcare Investors is a real estate investment trust (REIT) that finances sale, leaseback, construction and renovation of long-term health care facilities in the United States and the United Kingdom. When Omega Healthcare became listed on the NYSE in 1992, the company was one of the first publicly traded REITs that was explicitly structured to finance the sale, leaseback, construction and renovation of nursing and assisted living facilities. Omega Healthcare merged with Aviv REIT in 2015, which created the largest publicly traded REIT in the United States dedicated specifically to skilled nursing facilities (SNFs). As of September 30, 2018, the company had more than 900 facilities in its portfolio. In addition to 55 locations in the United Kingdom, the U.S. facilities were spread across 41 U.S. states. While OHI owns and leases the buildings, 69 third party operators manage the day-to-day operations at these facilities.

The company’s share price reached its 52-week low of $25.36 on April 20, 2018. However, after changing direction in mid-April, the share price embarked on a nine-month uptrend. Since bottoming out and changing direction in mid-April, the share price has gained more than 50% and reached its new 52-week high of $38.23 on January 17, 2019. On January 22, 2019, the share price closed at $37.96, which was just 0.7% below the 52-week high from the end of the previous week. The January 22 closing price was 41.3% higher than it was one year earlier and nearly 50% above the 52-week low from April.

OHI’s current $0.66 quarterly dividend corresponds to a $2.64 annualized payout and yields 7%, which is in line with the company’s own five-year average yield. Additionally, the company’s current dividend yield is more than double the 3.26% average yield of the entire Financial sector, as well as 75% higher than the 3.97% simple average yield of the Healthcare Facilities REITs industry segment.

Since beginning the current streak of annual dividend hikes in 2004, the company enhanced its total annual dividend payout amount 340%. This record of consecutive annual dividend hikes corresponds to an average growth rate of more than 10% per year.

The share price decline between the beginning of 2015 and April 2018 limited the shareholders’ total returns over the past three years to 37.7%. However, the rapid share price ascent since April 2018 combined with dividend payouts for a 57.5% total return over the past 12 months.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic