One Liberty Properties Rewards Shareholders with 6.4% Yield, Fifth Consecutive Annual Dividend Boost (OLP)

By: Ned Piplovic,

Featured Image Source: Company Website

After cutting its quarterly dividend distribution nearly 40% in the first quarter of 2009, One Liberty Properties, Inc. (NYSE:OLP) hiked its annual dividend eight times in the last nine years, including its fifth consecutive annual dividend boost in 2018.

In addition to rewarding its shareholders with a dividend boost almost every year for nearly a decade, the company currently offers a 6.4% dividend yield that currently outperforms industry averages by a wide margin. Furthermore, the company’s current yield remains at a high level despite a strong share price growth over the past few years.

Even with a mild correction in early 2018, the share price still advanced by a double-digit percentage and provided a combined total return of more than 20% for the trailing 12 months. While the share price correction early in the year forced the 50-day moving average (MA) below the 200-day MA for nearly three months, the 50-day MA crossed back above the 200-day MA in mid-June and continues to rise. Additionally, the current share price has held steadily above both moving averages, which is an indication that the share price could have more room on the upside.

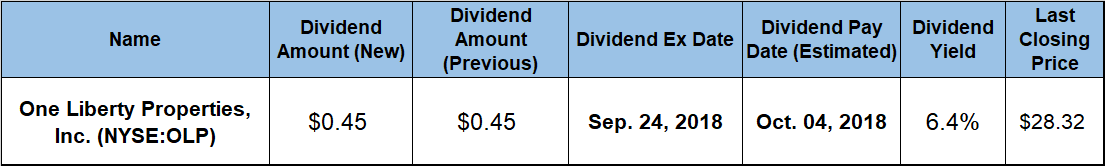

The company will distribute its next dividend on company’s October 4, 2018, pay date to all its shareholders of record prior to the September 24, 2018, ex-dividend date.

One Liberty Properties, Inc. (NYSE:OLP)

Headquartered in Great Neck, NY and founded in 1982, One Liberty Properties is a self-administered and self-managed real estate investment trust (REIT) that acquires, owns and manages a diversified portfolio consisting primarily of industrial, health and fitness, retail, restaurant and theater properties. As of September 2018, the company’s properties portfolio comprised of 119 properties in 30 states with a total leasable space of more than 10 million square feet. Industrial properties account for the largest share of company’s contractual retail income (37.3%), with retail properties contributing another 24.6%. Restaurants, health & fitness and theaters contributed less than 5% share of rent income each and other types of properties accounted for nearly 10%. The company’s largest customer in terms of contract retail revenue – Haverty Furniture Companies, Inc (NYSE:HVT) – contributed just 6.8% of revenue. Also, the company’s top five tenants account for just 22% of the company’s total revenue, which indicates diversification and reduced risk from extreme revenue fluctuations.

The company’s most recent dividend boost in January this year raised the quarterly dividend amount 4.7% from $0.43 in 2017 to the current $0.45 quarterly payout amount. This new amount converts to a $1.80 annualized distribution amount and a 6.4% forward dividend yield. Even with a dividend boost every year over the past five years, the share price rose at a higher pace than the dividend payouts, which suppressed the yield below the 6.7% five-year average.

While lower than the company’s own recent average, OLP’s current yield is approximately double the 3.04% average yield of the entire Financials sector and the 3.26% simple average yield of all companies in the Real Estate Development industry segment. Even compared to the 4.38% average yield of the segment’s only dividend-paying companies, OLP’s current yield is still 45% higher.

As a result of the fifth consecutive annual dividend boost, the company’s current annual payout amount is 36% higher than it was five years earlier, which corresponds to a 5.3% average annual growth rate over that period. Furthermore, even with missing a dividend boost and paying a flat dividend in 2012, the company still more than doubled its total annual dividend payout over the past nine years. That level of dividend growth is equivalent to an average growth rate of 8.3% per year.

After an initial 10% growth at the beginning of the trailing 12 months, the share price fell to its 52-week low of $21.76 on February 28, 2018. However, after bottoming out, the share price advanced nearly 35% before peaking at $29.26 on August 15, 2018. The share price closed on September 17, 2018 at $28.32, just 3.2% below the August peak. This closing price was 17.4% higher than it was one year earlier, 30% above the February low and 34% higher than it was five years ago.

The strong asset appreciation and the five-year dividend boost streak delivered strong returns. Just over the past year, the shareholders enjoyed a 26.4% total return. Total returns over the last three and five years were 55% and 65%, respectively.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic