Phillips 66 Maintains Rising Dividends, Offers 3.5% Dividend Yield (NYSE:PSX)

By: Ned Piplovic,

Phillips 66 (NYSE:PSX) has boosted its total annual dividend payout every year since being spun off from ConocoPhilips in 2012, and currently offers investors an above-average dividend yield of 3.5%.

The company’s current Dividend Yield is significantly higher than the average yield of the entire sector, as well as the company’s own average yield over the past several years. Furthermore, the company’s current dividend payout ratio of 29% is actually marginally below the lower limit of the 30% to 50% payout ratio range that investors consider desirable and sustainable.

The current dividend payout ratio indicates that Phillips 66 uses less than 30% of its earnings to cover dividend distributions. Investors generally seek a payout ratio of at least 30% because that means that the company distributes a significant portion of its earnings to the shareholders. Anything that is significantly less than 30% might not be worthwhile for income-seeking investors and some might look for higher payout ratios somewhere else.

However, Phillips 66 has its current payout ratio right at the lower edge of the desirable range. This level indicates that the company has enough earnings in reserve to maintain dividend payouts for the near future, as well as support continued dividend hikes.

A reduction in corporate earnings would mean that the company had to pay a larger portion of its earnings to cover dividend payouts. However, the currently low ratio means that Phillips 66 could increase its payout ratio by nearly two-thirds and still remain below the 50% level generally considered by investors as sustainable. Only once the payout ratio exceeds the 50% by a significant margin should investors begin worrying about elimination of dividend hikes and start worrying about dividend cuts as the payout ratio begins approaching 100%.

While the rising dividend contributed to the dividend yield rise over the past year, the declining share price was the main driver of the increase. However, the share price has embarked on a recent uptrend and has gained more than 25% since the end of May 2019. While not sending a clear bullish signal yet, the 50-day moving average has been moving higher and could cross above the 200-day average in a bullish manner as early as next month. Furthermore, the company’s mostly positive financial results as well as increasing oil prices on rising global demand could extend that trend and send the share price even higher.

Therefore, investors with a slightly higher risk tolerance might consider taking a position early on and locking in what could be a substantial price discount. However, as with all investing moves, interested investors must conduct their own due diligence to confirm the stock’s growth potential, as well as compatibility with their own investment portfolio strategy.

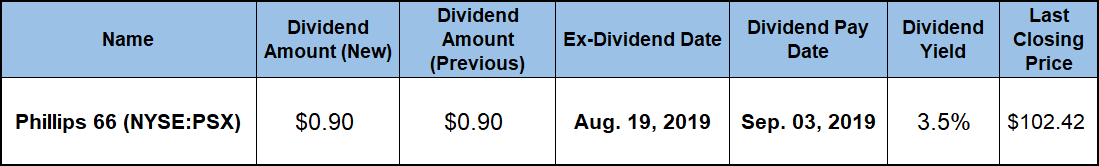

Those investors that choose to take position in the PSX stock, should consider doing so before the August 19, 2019, ex-dividend date to capture the next round of dividend payouts. Phillips 66 will distribute the next round of its dividends to all shareholders of record prior to the ex-dividend date on the September 3, 2019, pay date.

Phillips 66 (NYSE:PSX)

Headquartered in Houston, Texas, and tracing its roots to 1875, Phillips 66 operates as a diversified energy manufacturing and logistics company. The company processes, transports, stores and markets fuels and products globally through four segments: Midstream, Chemicals, Refining, and Marketing and Specialties (M&S). The Midstream business segment focuses on processing, transport and marketing of natural gas and natural gas liquids in the United States. As of July 2019, the Refining segment’s 13 refineries primarily in the United States and Europe had the capacity to refine 2.2 million barrels of crude oil into various petroleum products, including gasolines, distillates and aviation fuels. The Chemicals segment manufactures and markets various specialty chemical products, including organosulfur chemicals, solvents, catalysts, drilling chemicals and mining chemicals. Lastly, the M&S segment markets refined petroleum products, manufactures and sells specialty products, such as waxes, solvents and polypropylene, as well as generates electricity and distributes it in the Texas market. The company’s origins go back to the foundation of Continental Oil and Transportation Company in 1875. However, Philips 66 began trading on the New York Stock Exchange as a standalone company in May 2012, following a separation of its assets from the ConocoPhillips company.

The current $0.90 quarterly dividend is 12.5% higher than the $0.80 payout from the same period last year. This new quarterly amount is equivalent to a $3.60 annualized distribution and a 3.5% forward dividend yield, which is nearly 21% higher than the company’s own 2.92% average yield over the past five years. Furthermore, the company’s current 3.5% dividend yield is also 65% higher than the 2.13% simple average yield of the overall Basic Materials sector.

Since beginning dividend distributions as an independent business entity in 2012, Phillips 66 has enhanced its total annual dividend amount nearly four-fold. This pace of advancement corresponds to an average growth rate of 21% per year over the past seven consecutive years.

While continuing to increase every year, the dividend payouts were unable to overcome the share price decline in 2018. However, the dividend income payouts did manage to cut the share price pullback of nearly 9% to a 5.6% total loss over the past 12 months. Total returns over the past three and five years were significantly better at 49% and 43%, respectively.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic