PNC Financial Services Offers Shareholders 21% Quarterly Dividend Hike (PNC)

By: Ned Piplovic,

PNC Financial Services Group, Inc. (NYSE:PNC) continued its streak of double-digit-percentage dividend hikes for the third consecutive year with a 21.1% increase to its quarterly distribution.

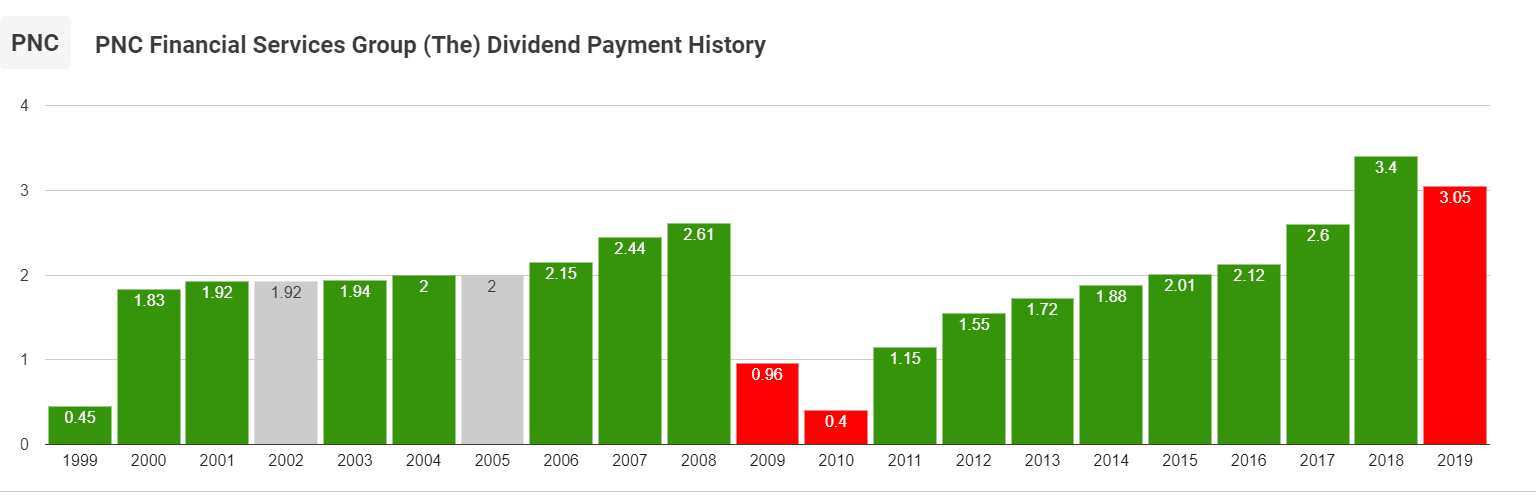

As most of the company’s peers in the Financial sector, the PNC Financial Services Group cut its quarterly dividend significantly in the aftermath of the 2008 financial crisis. After distributing a $0.66 quarterly dividend in the first quarter of 2009, PNC cut its quarterly payout 85% to $0.10 in the following period.

PNC also failed to raise its annual dividend twice in the decade preceding the 2009 cut. However, while the company paid a flat annual dividend in 2002 and 2005, as it did in the years immediately preceding those two years, the 2009 reduction was PNC’s only dividend cut in the past two decades.

Since 1999, PNC has enhanced its annual dividend 16 times, or 80% of the time. While interrupting its multi-year share-price uptrend and declining since early March 2018, the stock still managed to deliver asset appreciation of more than 7% in the past year.

In addition to boosting its annual dividend payout amount over the past nine consecutive years, PNC complemented its income distributions with robust asset appreciation since hitting its share price 28-year low in March 2009. After bottoming out in early 2009, the share price reversed direction and advanced nearly nine-fold before reaching its most recent all-time high in March 2018.

While the stock gave back some of those gains in the second half of 2018, the share price has been rising since the beginning of 2019 and is still 660% higher than it was in March 2009. The pullback in 2018 might scare away some investors. However, the share has reestablished a steady uptrend over the past six months.

The 50-day moving average crossed above the 200-day average in a bullish manner in late-May 2019, suggesting a potential continuation of the current uptrend. Furthermore, the share price has been trading above both averages for more than 30 days, which is another indicator to support a potential extension of the current uptrend.

All interested investors must conduct their own due diligence to decide the future outlook of the share price trend and the compatibility of the PNC stock with their investment portfolio goals. Even investors that are unsure about the share price direction can enjoy a steady flow if income payouts at yields that outperform industry averages.

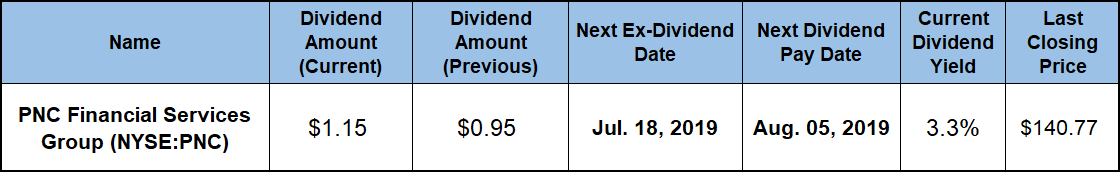

However, to enjoy the benefits of these dividend distributions, investors must claim stock ownership before the upcoming ex-dividend date on July 18, 2019. PNC will deliver the next round of quarterly dividend payouts to all eligible shareholders on the August 5, 2019, pay date.

PNC Financial Services Group, Inc. (NYSE:PNC)

Headquartered in Pittsburgh and founded in 1922, PNC Financial Services Group, Inc. operates as a diversified financial services company through four segments: Retail Banking, Corporate & Institutional Banking, Asset Management Group and BlackRock. The Retail Banking segment offers deposit, lending and brokerage services, as well as investment and cash management services to individual consumers and small business customers. As of March 31, 2018, this segment operated a network of approximately 2,400 branches and 9,000 automated teller machines (ATMs). The Corporate & Institutional Banking segment provides loans, cash and investment management, receivables management, merger and acquisition advisory, foreign exchange and other services. Additionally, the Asset Management Group segment provides investment and retirement planning, customized investment management and private banking, as well as credit and trust management and estate planning. Lastly, the PNC Group holds a minority ownership stake in the investment management firm BlackRock (NYSE:BLK), which offers investment and risk management services to institutional and retail clients.

The share price entered the trailing 12-month period on the overall downtrend from the stock all-time peak in March 2018. After passing through its 52-week high of $146.33 on August 8, 2018, the share price declined an additional 25% before hitting its 52-week low of $109.71 on December 24, 2018.

However, as the downward pressure of the overall market correction from the end of 2018 lifted, the share price reversed course and headed higher. The share price experienced a couple of minor pullbacks but followed an overall uptrend towards its $140.77 closing price on July 9, 2019. While 3.8% short of the all-time peak from March 2018, the July 9, 2019, closing price was 1.4% higher than it was one year ago, 28% higher than the 52-week low from late-December 2018 and nearly 70% higher than it was five years ago.

PNC increased its new quarterly payout 21.1% from $0.95 in the previous period to the current $1.15 quarterly dividend payout. This new quarterly dividend distribution is the company’s highest dividend payout ever and corresponds to a $4.60 annualized amount. The current 3.3% dividend yield is 45% higher than the company’s own 2.25% dividend average over the past five years.

PNC increased its new quarterly payout 21.1% from $0.95 in the previous period to the current $1.15 quarterly dividend payout. This new quarterly dividend distribution is the company’s highest dividend payout ever and corresponds to a $4.60 annualized amount. The current 3.3% dividend yield is 45% higher than the company’s own 2.25% dividend average over the past five years.

Furthermore, the current yield is also 8.2% higher than the 3.02% average yield of the overall Financials sector, as well as more than twice the 1.56% simple average yield of all the companies in the Money Center Banks industry segment. Moreover, PNC’s current yield is also 18.4% higher than the 2.76% yield average of that segment’s only dividend-paying companies.

Since resuming dividend hikes in 2011, PNC enhanced its total annual dividend more than 11-fold, which translates to an average annual growth rate of more than 31%. However, the quarterly dividend jump from $0.10 to $0.35 in 2011 skewed that measure. Excluding 2011 from the calculation returns a four-fold payout increase at an average annual growth rate of 18.9% for the past eight years. Even after missing two annual dividend boosts and an 85% dividend cut, PNC’s total annual dividend payout rose more than 150% over the past 20 years, which is equivalent to a 4.7% annual dividend growth rate.

The share-price decline in 2018 limited the shareholders total return to approximately 5.5% over the past 12 months. The total return over the past five years was nearly 75%. However, the shareholders enjoyed the best total returns of 85% over the past three years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic