Prologis’ Quarterly Dividend Payouts Continue Rising to Keep Pace with Advancing Share Price (PLD)

By: Ned Piplovic,

Featured Image Source: Company Website

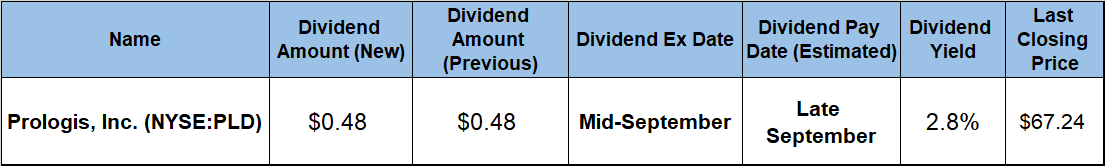

Prologis, Inc. (NYSE:PLD) – a logistics warehousing real estate investment trust (REIT) – has boosted at least one quarterly dividend in each of the past five consecutive years and currently offers its shareholders a 2.8% dividend yield.

In addition to hiking its dividend in the last five years, the company also managed to limit annual dividend cuts to just one in the past 15 years. After losing more than 80% of its value during the 2008 financial crisis, the share price rebounded fully and reached its new all-time high at the beginning of September 2018.

While the company has not yet declared its dividend for the next quarter, Prologis will most likely pay the same $0.48 quarterly dividend for the remainder of the year and potentially reward its shareholders with another quarterly dividend hike in the first period of next year. Regardless of the quarterly dividend amount, shareholders should expect the company’s next ex-dividend date in mid-September, with the pay date to follow a couple of weeks later at the end of the month.

Prologis, Inc. (NYSE:PLD)

Based in San Francisco, California and established in 1983, Prologis, Inc. is a real estate investment trust (REIT) that focuses on high-barrier, high-growth logistics real estate markets. As of June 30, 2018, the company’s owned or had investments in nearly 3,300 facilities that provided 685 million square feet of industrial space to approximately 5,000 customers across 19 countries. The company’s largest region — The Americas — comprised 2,334 buildings with a combined 435 million square feet of industrial real estate space in the United States, Canada, Mexico and Brazil. Additionally, Prologis offers 80 million square feet of industrial real estate space across 765 warehouses in 12 European countries. Lastly, Prologis’ Asian presence comprises of 170 facilities that provide approximately 70 million square feet of rentable space in China, Japan and Singapore. Additionally, on August 22, 2018, Prologis announced a completion of its all-stock acquisition of DCT Industrial Trust Inc. (NYSE:DCT) for $8.5 billion. DCT brings to the Prologis portfolio 71 million square feet of existing rentable space, 7.5 million square feet of development, redevelopment and value-added projects, 305 acres of land in pre-development with an estimated build-out potential of over 4.5 million square feet and 131 acres of land under contract, which can potentially add 1.6 million square feet of additional warehouse space.

Rising at the tail end of an uptrend that began in early 2016, the share price continued to advance early in the trailing 12-month period. However, the uptrend reversed in late November 2017 and the share price fell towards its 52-week low of $58.33 on February 8, 2018, which was 7.6% below the share price at the beginning of the trailing 12 months.

Fortunately, the share price did not remain at the bottom for long. The share price rebounded immediately after bottoming out in early February and recovered all its year-to-date loses before peaking at its new 52-week high of $67.75 on August 20, 2018. After the August peak, the share price retreated slightly and closed on September 5, 2018 at $67.24, which was just 0.8% below the August peak. That closing price was also 6.5% higher than it was one year earlier, more than 15% above the February low and more than 80% higher than it was five years ago.

The company’s current $0.48 quarterly dividend payout is more than 9% above the $0.44 quarterly dividend distribution from the same period last year. This new quarterly dividend amount corresponds to a $1.92 annualized amount, as well as a 2.8% forward dividend yield.

After a dividend cut of nearly 60% in 2009 and four years of flat dividend distributions, Prologis resumed hiking its annual dividends in 2014. Since resuming dividend boosts in 2014, Prologis enhanced its total annual dividend amount more than 70% for an average growth rate of 11.4% per year. Even with four years of flat dividend payouts, the company managed to maintain an average dividend growth rate of 9.6% while advancing its total annual dividend amount more than 130% over the past nine consecutive years.

The combination of rising annual dividends and a robust share price growth over the past several years rewarded investors with a one-year total return of nearly 9%. However, shareholders virtually doubled their investment with a 97% total return over the past three years and enjoyed a total return of 110% over the last five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic