Provident Financial Boosts Quarterly Dividend 33% (PFS)

By: Ned Piplovic,

Provident Financial Services, Inc. (NYSE:PFS) continued its seven-year rising dividend streak by boosting its dividend payout by one-third from the previous quarter to offer a current yield of 3%.

In addition to the current streak of consecutive dividend boosts, the company avoided any dividend cuts since it started distributing dividends in 2003. While the current share price only marginally higher than it was last year, the share price returned double-digit percentage growth since early September 2017.

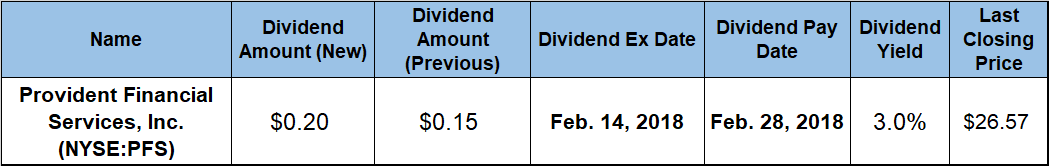

Provident Financial Services will distribute its next dividend payout on February 28, 2018, to all its shareholders of record before the February 14, 2018 ex-dividend date.

Provident Financial Services, Inc. (NYSE:PFS)

Headquartered in Jersey City, New Jersey and founded in 1939, the Provident Financial Services, Inc. operates as the holding company for Provident Bank. The bank offers a broad array of deposit, loan and investment products throughout northern and central New Jersey, as well as eastern Pennsylvania. Additionally, the bank offers wealth management, trust and fiduciary services through its wholly owned subsidiary – Beacon Trust Company.

The company hiked its dividend by 33.3% from $0.15 in the previous quarter to the $0.20 current payout for the first quarter of 2018. This new quarterly dividend yield converts to an annualized payout of $0.80 and a 3% forward yield.

The company has been paying dividends since 2003 and missed raising its annual payout only twice over the past 15 years. While many banks were forced to cut their dividends in the aftermath of the 2008 financial crisis, Provident Financial Services managed to pay the same annual dividend in 2009 and 2010 as it did in 2008.

Since it resumed raising its dividend in 2011, the bank grew its annual payout at an average rate of 7.8% per year and nearly doubled its annual dividend amount over the past eight years. Even with the three years of flat dividend payouts between 2008 and 2010, the company managed to grow its total dividend payout at 10.5% annually for a 344% gain since the company first started rewarding its shareholders with dividends in 2003.

The share price began the current trailing 12-month period at $26.06 and then declined 10.4% towards its 52-week low of $23.34 by May 31, 2017. While the price reversed trend and rose 14% over the next 60 days, the trend was short-lived and another 60 days later the share price was back down to within 0.7% of the 52-week low from May.

After the near-low in September, the share price embarked on another uptrend and ascended more than 23% to reach its all-time high of $28.75 on November 29, 2017. After peaking in late November, the share price pulled back 7.6% and closed on February 1, 2018, at $26.57, which was just 2% above the share price from one year earlier.

In its fourth quarter and year-end earnings call on January 26, 2018, the company reported earnings per share (EPS) of $0.36. After exceeding EPS expectations in each of the first three quarters, the company’s fourth-quarter earnings missed the $0.38 estimates by 5.6%. The company’s EPS for fiscal 2017 was $1.45.

The low asset appreciation of only 2% kept the total return for the year to 3.7%. However, longer-term investors were rewarded with a 66% total return over the past three years and a 102% total return over the past five years.

The share price downtrend between the beginning of February and the end of May 2017 caused the 50-day moving average (MA) to cross below the 200-day moving average in a bearish manner on June 12, 2017. However, since the trend reversal in early September, the 50-day MA rose to cross back above the 200-day MA on October 20, 2017, and continues to rise.

While the share price dropped 4% on the day of the earnings news and fell below the 50-day MA, the share price recovered 12% of that loss in less than a week. If the share price manages to rise back above the 50-day mark in the next couple of weeks, that would indicate that the share price could continue to rise over the next few quarters.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic