QNB Corporation Enhanced Its Quarterly Dividend 3.2% (QNBC)

By: Ned Piplovic,

The QNB Corporation (OTCBB:QNBC) rewarded its shareholders with a 3.2% boost to its quarterly dividend and double-digit-percentage share-price growth in the past 12 months, which combined for a total return of nearly 20% over the same period.

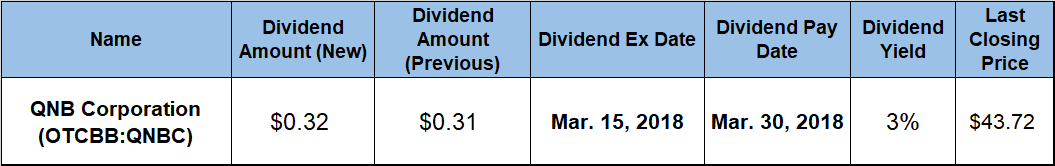

In addition to the current quarterly dividend hike, the company boosted its annual dividend payout consecutively over the past eight years and 19 out of the past 20 years. QNB Corporation’s next ex-dividend date will be on March 15, 2018, and the company will distribute the next quarterly dividend to its shareholders just two weeks later on March 30, 2018.

QNB Corporation (OTCBBYSE:QNBC)

Based in Quakertown, Pennsylvania, and founded in 1877, the QNB Corporation operates as the holding company for QNB Bank, which offers commercial and retail banking services for the residents and businesses in southeastern Pennsylvania. The company provides various demand deposit accounts, time deposit products and individual retirement accounts.

Additionally, the company also offers private and commercial loans, title insurance products, merchant services and mortgage banking services, as well as retail brokerage, securities and advisory services. In addition to its main corporate office, the company operated 12 branch offices in Bucks, Montgomery and Lehigh counties as of January 2018.

The company’s current $0.32 quarterly dividend distribution is 3.2% above the $0.31 payout in the previous quarter. This current quarterly amount converts to a $1.28 annualized payout for 2018 and yields 3%. Because the share price grew faster than the annual dividend payout amount, the current yield has been suppressed and is currently 18.7% below the company’s own 3.6% average yield over the past five years.

Since its only dividend cut in 2010, the company has boosted its annual dividend payout at an average rate of 3.7% per year and enhanced its total annual payout by one third over the past eight consecutive years. Over the past two decades, the total annual dividend distribution amount increased four-fold by growing at an average rate of 7.1% per year.

While below the 5.2% average yield for the entire Financial sector – which is driven higher than other sector averages by high-yield segments like Residential and Office REITs, mutual funds and asset management companies – QNB’s current yield outperformed the average yields of its industry peers. QNB’s 3% yield is almost 60% higher than the 1.84% simple average yield of the entire Northeast Regional Banks market segment and more than 30% above the 2.24% average yield for QNB’s dividend-paying peers in the segment.

Over the past 12 months, the share price experienced minimal volatility on its path towards its double-digit percentage growth. The share price started its trailing 12 months (TTM) from its 52-week low price of $38.00 and ascended 10.5% over the following 60 days with minimal volatility. In the first half of May 2017, the share price encountered some resistance at the $42.00 level, pulled back slightly and traded flat around the $40.50 level for the subsequent five months. The share price finally broke through the $42.00 resistance level in late October and rose another 18.5% to reach its new all-time high of $46.25 just before the overall market sell-off on January 29, 2018.

After gaining 31% between its low on March 1, 2017, and its new all-time peak in late January 2018, the share price pulled back with the rest of the market and declined 5.5% to close on February 28, 2017 at $43.72. This share price was 15.1% higher than the 52-week low from the beginning of March 2017 and 75% higher than it was five years earlier.

While QNB’s 3% current yield and its 15% one-year share price increase are not as high as growth rates for some other equities, QNB managed to sustain its growth over an extended period. Over the past 12 months the company rewarded its shareholders with a total return of nearly 20%. Additionally, the three-year total return exceeds 67% and the total return over the past five years is nearly 110%. Going back to 2009 – the beginning of the current consecutive annual dividend hikes streak – the share price rose 165% and combined with the cumulative dividend income for a total return of 224% over the past eight years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic