Regency Centers Corporation Resumes Dividend Hikes with Five Consecutive Annual Boosts (REG)

By: Ned Piplovic,

After a dividend cut in 2009 and several years of flat dividend payouts, Regency Centers Corporation (NYSE:REG) resumed offering shareholders annual dividend hikes and boosted its annual payout over the past five years.

The dividend cut in 2009 was the company’s only quarterly dividend reduction since the company started paying dividends in 1994. Additionally, the company offered 19 consecutive annual dividend hikes prior to the 2009 cut. Including the past four years of dividend hikes, the company boosted its annual dividend 76% of the time over the past 25 years.

Aside from a 70% drop decline during 2007 and 2008 and a smaller drop over the past two years, the company also grew its share price almost 85% of the time over the same 25-year period. Despite the recent decline, the share price has been rising over the past six months and technical indicators hint at a continuation of the current uptrend.

After languishing below the 200-day moving average (MA) since February 22, 2018, the 50-day MA reversed direction started advancing at the beginning of June 2018. The 50-day MA advanced from 7.3% below the 200-day MA on May 30, 2018 to within 0.8% of the 200-MA by August 7, 2018. At the current pace the 50-day MA could break above the 200-day MA in a bullish manner within the next 5 to 10 days. With the current share price above both moving averages, this would be a clear indicator that the share price could have more room on the upside.

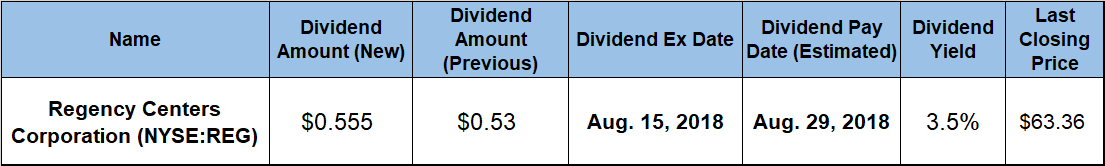

Therefore, interested investors should consider taking a position prior to the company’s next ex-dividend date on August 15, 2018, and ensure eligibility for the next round of dividend distributions on the August 29, 2018, pay date.

Regency Centers Corporation (NYSE:REG)

Headquartered in Jacksonville, Florida, and formed in 1963, the Regency Centers Corporation is a qualified real estate investment trust (REIT). The company is also a component of the S&P 500 Index. Regency Centers owns, develops and operates shopping centers located in affluent and densely populated trade areas. As a share of Net Operating Income (NOI), the company’s top five markets make up 43% of the company’s income. Top grocers, such as Wegman’s, Whole Foods, Kroger and Publix, anchor 80% of the company’s current properties. As of June 2018, the company owned 428 centers comprising nearly 60 million square feet of retail space nationwide, as well as 21 national offices and 14 additional retail properties under development. Additionally, based on average base rent (ABR), no more than 14% of the company’s leases expire in any given year, which minimizes income fluctuations. As of June 30, 2018, the company had approximately 9,300 tenants, with the top 10 tenants generating 20% of ABR.

The share price rose nearly 6% at the onset of the trailing 12-month period before reaching its 52-week high of $70.37 on December 18, 2017. After peaking in mid-December 2017, the share price declined 21% towards its 52-week low of $55.58 on February 8, 2018. After bottoming out at the beginning of February, the share price regained 53% of these losses to close on August 7, 2018, at $63.36. This closing price was still 4.8% lower than one year earlier, but 14% above the February low and 30% higher than it was five years ago.

The quarterly dividend increased 4.7% from $0.53 in the same quarter last year to the current $0.555 quarterly amount. This new quarterly distribution corresponds to a $2.22 annualized amount for 2018 and yields 3.5%, which is 13% higher than the company’s own 3.1% average dividend yield over the past five years. Furthermore, Regency Centers Corporation’s current yield outperformed the 2.99% average yield of the entire Financials sector.

Even with a 36% dividend cut in 2009, the company enhanced its total annual dividend amount more than 60% over the past 25 years, which is equivalent to an average dividend growth rate of nearly 2% per year. However, in just five years since resuming dividend hikes in 2014, the company managed to advance its total annual payout 20%, which corresponds to an average growth rate of 3.7% per year.

Despite the rising dividend, the recent share price decline resulted in a total loss of 1.3% over the past 12 months. However, an additional share price growth of just $1, or 1.6%, would erase the loss completely. Over the past three years, the company offered a total return of 11.3% and a total return of 42% over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic