RPM International Raises Annual Dividend 43 Consecutive Years (RPM)

By: Ned Piplovic,

RPM International, Inc. (NYSE: RPM) offers shareholders more than four decades of consecutive annual dividend hikes, a forward 2.1% yield and long-term asset appreciation over the past two decades.

In comparison to some other high-yield sectors, RPM International’s current dividend yield doesn’t seem that impressive, but it outperforms the average yield of the overall Industrial Goods sector and is the third highest yield in the General Building Materials industry segment. Also, RPM’s current dividend payout ratio of 45% is lower than its 56% average over the past five years. This moderate payout ratio indicates that RPM’s dividend distributions are well covered by its earnings, so the company should be able to support continued annual dividend hikes.

In terms of share price appreciation, RPM has been on a long-term uptrend. Over the past five years, the stock price, not counting annual dividend payments, has nearly doubled. The combined benefit of rising annual dividend income and capital gains over the past 12 months meant that the company attained a double-digit-percentage total return.

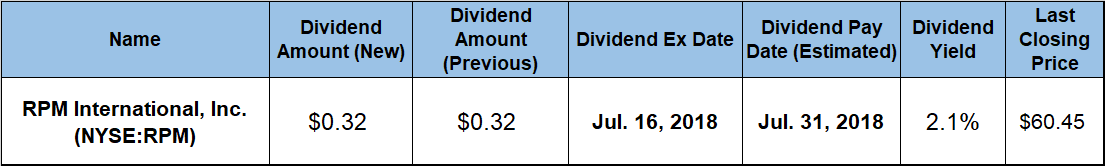

While the company’s share price has been ascending sharply this year, recent technical indicators suggest that it might not be too late for interested investors to add RPM to their portfolios. The company will distribute its next dividend on July 31, 2018 to all shareholders of record prior to the July 16, 2018 ex-dividend date.

RPM International, Inc. (NYSE:RPM)

Based in Median, Ohio and founded in 1947 as Republic Powdered Metals, RPM International Inc. manufactures, markets and sells chemical products for industrial, specialty and consumer markets. The company assumed its current name in 1971 to deemphasize the powdered metals aspect of its operation and reflect its expansion program into the rapidly consolidating paint and coatings industry at that time. RPM’s Industrial segment offers waterproofing, coatings, sealants, passive fire protection and fiberglass reinforced plastic gratings. Additionally, this segment’s products include corrosion control coatings, containment linings, fire and sound proofing products, insulation products, asphalt roofing materials, industrial floor coatings, epoxy adhesives and other specialty construction products. The Specialty segment manufactures fluorescent colorants and pigments, shellac-based-specialty and marine coatings, fire and water damage restoration products, carpet cleaning products, fuel additives and wood treatment products. Lastly, the Consumer segment offers professional use and do-it-yourself (DIY) products, caulk, sealant, adhesive, insulating foam, spackling and other general repair products. The company manufactures and distributes its products under more than 70 different brands, including Zinsser, Rust-Oleum, DAP, Day-Glo and Testors.

RPM shares traded mostly sideways during the year and a half prior to 2018, but then declined more than 13% from the onset of the trailing 12-month period until April 2, 2018, when the share price bottomed out at its 52-week low of $46.92. However, in early April, RPM advanced at a rapid pace and closed at its new 52-week high of $60.45 on July 6. This closing price was 11.5% higher than it was at the beginning of July the previous year, nearly 29% above the 52-week low from April 2018 and almost 80% higher than it was five years earlier.

Currently, RPM pays out a $0.32 quarterly dividend that is 6.7% above the $0.30 payout from the same quarter last year. If payouts continue at the same rate, investors can expect to receive $1.28 on an annual basis. The forward yield of 2.1% is more than 80% above the 1.16% average yield of the entire Industrial Goods segment. Furthermore, as the third highest yield in the General Building Materials industry segment, RPM’s current yield is nearly three times higher than the segment’s simple average yield of 0.74%.

Because of the explosive share price growth in the final days of June and early July, RPM, aided by the year’s dividend income, has a total return of nearly 14% over the past year. Over the past three years, the total return was more than twice that rate — nearly 29%. With a total return rate of 99.3% over the past five years, long-term shareholders effectively doubled their investment.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic