Saul Centers REIT Offers 4.1% Yield, Hikes Dividend 5 Consecutive Years (BFS)

By: Ned Piplovic,

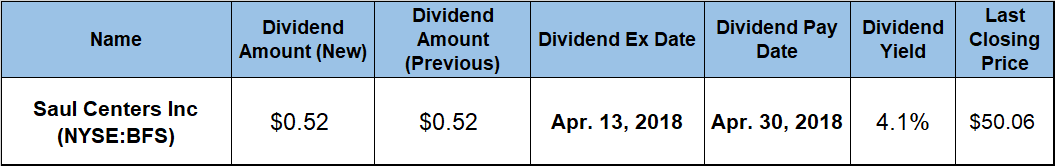

Saul Centers, Inc. (NYSE:BFS) offers a current dividend yield of 4.1% and only has cut its annual payout twice since it started to reward its shareholders with dividend distributions in 1993.

While the company’s dividend continues to rise and to give the company’s shareholders increased dividend income, the share price has been declining since the beginning of the year. However, some analysts estimate that the share price should be valued almost 20% higher, which could mean that the current price drop could be a buying opportunity, at least in the short term.

Another benefit of the current share price decline is that it increases the dividend yield for investors who take a position now. Investors who are convinced that the share price might bounce back should do their research and take a position before the company’s next ex-dividend date on April 13, 2018, to ensure eligibility for the next round of dividend distributions on the April 30, 2018, pay date.

Saul Centers, Inc. (NYSE:BFS)

Founded in 1993 and based in Bethesda, Maryland, Saul Centers, Inc. is an equity real estate investment trust (REIT). The company operates and manages nearly 60 shopping center and office properties in six U.S. states and the District of Columbia, totaling more than 9 million square feet of leasable space. The REIT generates approximately 85% of its cash flow from properties in the metropolitan Washington, D.C./Baltimore area.

The share price began its trailing 12-month period with a decline of more than 10% from $62.76 on March 20, 2017, to $56.33 by May 1, 2017. After the brief decline, the share price reversed its trend and ascended 16% to arrive at its 52-week high of $65.30 by October 13, 2017. Unfortunately, the share price growth stalled after the October peak and the share price pulled back slightly by the end of 2017. Furthermore, the share price then dropped more than 15% in the first two months of 2018 to reach its 52-week low of $48.93 on February 28, 2018.

In addition to the steep decline, the share price endured a significant amount of volatility during February. However, after March 1, 2018, the volatility subsided, and the share price rose 2.7% to close at $50.27 on March 13, 2018.

While the REIT’s share price lost some of its value in early 2018 and is not giving any clear indication of a potential rising trend, the company’s dividend income continues to grow. The company’s current $0.52 quarterly dividend distribution is equivalent to a $2.08 annualized dividend distribution and a 4.1% forward yield. The most recent dividend boost occurred in the last quarter and the current quarterly distribution is 2% higher than it was in the last quarter of 2017.

The REIT’s current yield is 27.6% above the company’s own 3.2% average yield over the past five years. In addition to exceeding its own average over the past several years, the REIT’s current yield is almost 10% higher than the 3.7% average yield of all companies in the overall Financial sector and on par with the simple average yield of the company’s peers in the Real Estate Development market segment.

After cutting its annual dividend payout in two subsequent years following the 2008 financial crisis, the company raised its annual distribution amount for the past five consecutive years. Over that period, the total annual payout amount rose at an average growth rate of 7.6% per year and boosted the total annual dividend amount by 44% since 2010.

The risk-averse investors most likely will look for returns on their investment elsewhere. However, some investors might look at the current price pullback as a buying opportunity. While many REIT’s struggle with brick-and-mortar retail properties, Saul Centers generates 85% of its cash flow from an area surrounded by half of the 10 richest counties in America, which could be an opportunity for positive returns.

Investors who are looking at a longer time horizon and can forego their current cash income from this REIT could consider converting their dividend distributions to additional shares. Saul Centers, Inc offers its own dividend reinvestment Plan (DRIP) in which common shareholders can purchase shares with no fees and receive an additional 3% discount on the share price.

Want more? Read our related articles:

The Ultimate Guide to Investing in REITs

Why Do REITs Have High Dividend Payout Ratios?

The 13 Types of REIT Stocks and How to Invest in Them

Investing in REITs: Pros and Cons

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

Connect with Ned Piplovic

Connect with Ned Piplovic