Sotherly Hotels Rewards Investors With 7% Dividend Yield (SOHO)

By: Ned Piplovic,

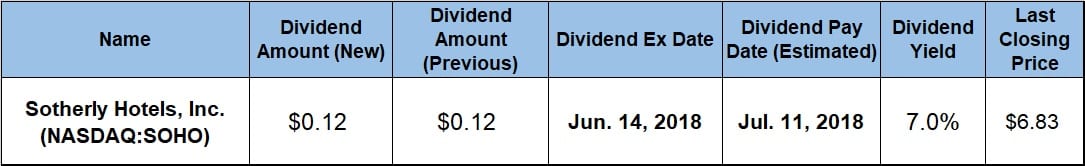

Sotherly Hotels, Inc. (NASDAQ:SOHO) offered its shareholders a seventh consecutive annual dividend hike and a current dividend yield of 7%.

The company cut its quarterly dividend from $0.17 in the fourth quarter of 2008 to a $0.01 quarterly amount for 2009 and paid just three dividend installments over the subsequent three years. However, after the company resumed hiking its dividends in 2012, the dividends rose quickly to the current $0.12 distribution amount.

The company’s share price experienced a decline similar to the company’s dividend in the aftermath of the 2008 financial crisis, tumbling from its all-time high of nearly $11 in July 2007 to less than $1 by February 2009. However, the share price reversed direction and rose back above $8 by May 2015 before pulling back to approximately $5 at the end of 2016.

Since the beginning of 2017, the share price has been fluctuating with moderate volatility but continues to maintain its overall growing trend. While the volatility still exists, the share price’s technical indicators hint at a continued growth trend, at least for the near term.

Therefore, investors looking to collect a 7% dividend income on their investment with a potential for additional gains through asset appreciation should do their due diligence to make sure that this equity and the accompanying risk fit their current investment strategy. The company has set its next ex-dividend date for June 14, 2018, and will distribute its next dividend payment to all its eligible shareholders on the July 11, 2018, pay date.

Sotherly Hotels, Inc. (NYSE:SOHO)

Headquartered in Williamsburg, Virginia, and organized in 2004, Sotherly Hotels Inc. is an equity real estate investment trust (REIT). The trust focuses on acquisition, renovation and upbranding of upscale, full-service hotels in the southern United States. Currently, the REIT’s portfolio consists of 12 hotels with more than 3,000 rooms and approximately 160,000 square feet of meeting space. These hotels are independently owned and operated by hotel brands, including Hilton Worldwide, InterContinental Hotels Group, and Starwood Hotels and Resorts. The company’s strategic plan is to add another eight hotels in the Southeast region over the next several years.

The company’s share price entered the trailing 12-month period on a downtrend and lost nearly 15% towards its 52-week low of $5.84 on September 7, 2017. The share price lingered below the $6 level until the beginning of November and then spiked to $6.84 by mid-December 2017, only to drop back down below $6 by late February 2018. After that drop, the share price advanced 17.5% and reached its 52-weeek high of $6.99 on April 10, 2018.

Since the mid-April peak, the share price pulled back 2.3% and closed on June 4, 2018, at $6.83, which was nearly identical to the share price from one year earlier and 17% higher than the 52-week low from September 2017.

Since resuming dividend distributions in 2012, the REIT has raised its annual dividend for the past seven consecutive years and 16 out of the last 23 quarters, or nearly 70% of the time. The current $0.12 quarterly dividend amount is 4.3% higher than the previous period’s $0.115 distribution amount. This new quarterly payout converts to a $0.48 annualized distribution and a 7% forward dividend yield.

Over the past seven consecutive years, the REIT’s annual dividend distribution grew at a remarkable average rate of 57.5% per year or more than 17% each quarter. While the current annual dividend is 24 times higher than the 2011 annual payout of $0.02, that low dividend skews the growth rate calculation. However, even compared to the $0.09 total quarterly dividend payouts in 2012, the current yield is still 430% higher, which corresponds to a 32.2% average annual growth rate.

In addition to being more than 45% above the REITs own 4.8% five-year average dividend yield, the current 7% dividend yield is almost 125% above the 3.13% average yield of the entire Financials sector. As the highest current dividend yield in the Hotels & Motels REITs industry segment, Sotherly’s current 7% dividend yield is 51% higher than the 4.64% simple average yield of only dividend-paying companies in the segment, as well as more than double the average dividend yield of all the REIT’s peers in the segment.

The company’s share price experienced a significant drop in the second half of 2015, which translated to a 1.5% total loss over the past three years despite the strong dividend income growth and a high dividend yield. However, the company’s share recovered over the past 12 month and combined with the rising dividend to offer shareholders a total return of 11.7%. Additionally, the total return over the past five years was nearly 90%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic