Speedway Motorsports Announces Quarterly Dividend, Yields 3% (TRK)

By: Ned Piplovic,

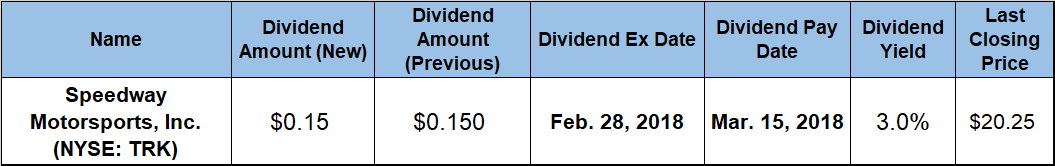

Speedway Motorsports, Inc.’s (NYSE:TRK) next quarterly dividend payout of 15 cents a share announced on Feb. 12, matches its previous distribution and maintains a current yield of 3%.

The company has been paying a steady $0.15 dividend for the past 24 consecutive quarters and has not reduced its annual dividend since the first quarter of 2002. TRK’s current yield outpaced the average yield of the Services sector and the Sporting Activities subsegment, so income-oriented investors should take notice.

The share price is slightly down for the year, after spiking above the long-term trend in late 2016. Over the long term, the company’s share price exhibits a slow, but steady uptrend.

The company will distribute its announced quarterly dividends on March 15, 2018, to all its shareholders of record at the end of day on March 1, 2018. The ex-dividend date is set for February 28, 2018.

Speedway Motorsports Inc. (NYSE:TRK)

A subsidiary of the Sonic Financial Corporation, Speedway Motorsports, Inc., promotes, markets and sponsors motorsports activities in the United States. The company owns and operates eight racing facilities that each host multiple events for the top U.S. racing series, including NASCAR, IndyCar Series, the National Hot Rod Association (NHRA) and the World of Outlaws. Additionally, Sonic Financial Corporation provides souvenir merchandising, food catering and beverage service at its facilities, as well as radio programming, production and distribution services.

Sonic Financial Corporation’s current quarterly dividend payout of $0.15 is equivalent to $0.60 annualized and produces a 3% forward yield, which is 3.2% higher than the company’s average yield over the past five years. While Speedway Motorsports has continued to pay the same flat dividend payout over the past six consecutive years, the company has doubled its total annual distribution since 2002.

Over the past 16 consecutive years, the company has hiked its annual dividend at an average growth rate of 4.4% per year. The company’s current Dividend Payout Ratio of 71% is a little high and investors should not be surprised if the company continues to pay flat dividends. However, that payout ratio level is not too elevated to warrant a dividend cut, barring any unforeseen events that would affect negatively on the company’s financial results.

The company’s current 3% yield is significantly lower than yields in the Financial sector and other high-dividend sectors. However, TRK’s current 3% yield is 51% higher than the 1.96% average yield of the entire Services sector. Compared to the 1.77% simple average yield of all the companies in the Sporting activities segment, Speedway Motorsports’ current yield is 67% higher. Excluding the companies that do not pay dividends raises the average yield to 2.8% and TRK’s current yield is still almost 5.5% higher than the average yield of only dividend-paying companies in the segment.

The share price has incurred volatility since its initial public offering in 1994 and dropped more than 70% between late 2007 and early 2009. However, while moderate volatility continued since March 2009, the share price’s general trend has been upwards. At the onset of the trailing 12-month period, the share price was declining from a late 2016 spike and dropped more than 22% before reaching its 52-week low of $16.93 by the end of May. After bottoming out on May 30, 2017, the share price recovered all the losses and rose a total 36.6% to reach its 52-week high of $23.12 on October 12, 2017, which was 5.6% higher than the $21.90 share price from February 16, 2017.

However, that peak turned out to be just another spike. The share price dropped more than 14% from its $22.98 closing price on Oct. 24 to the $19.76 closing price the following day, which brought the price into its long-term trend range. After the end of October 2017, the share price traded generally in the $19 to $20 range and closed at $20.25 on February 15, 2018. While that closing price is 7.5% lower than it was one year earlier, it is almost 19.6% higher than the 52-week low from the end of May 2017. However, nearly 80% of that growth occurred since November 1, 2017.

Headquartered in Concord, North Carolina, and founded in 1959, the company incorporated and listed on the New York Stock Exchange in 1994.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic