Starwood Property Trust Offers Shareholders 8.5% Dividend Yield (STWD)

By: Ned Piplovic,

Starwood Property Trust, Inc. (NYSE:STWD) continues to reward its shareholders with an above-average dividend yield, which currently stands at 8.5% and has outperformed its industry peers’ average yields by a wide margin.

As a real estate investment trust (REIT), Starwood Property Trust, Inc. has been distributing dividend income to shareholders since its formation in 2009. The trust came into life as an effort of Starwood Capital to crate a real estate company with a diversified portfolio of services that would be more resilient against financial crises that the market experienced just the year before. At the time of its formation, the trust became the largest blind-pool company ever traded on the New York Stock Exchange and has grown to become the largest commercial mortgage REIT in the United States, with a market capitalization of more than $6 billion.

Before settling at its current annual rate, the trust enhanced its total annual dividend payout for the first four consecutive years after inception and five out the first six years. While the total payout has remained flat, the trust’s dividend yield remains above industry averages and averages nearly 9% over the past five years.

In addition to the robust dividend yield and despite recent volatility, the trust’s share price increased more than 40% since 2009. Furthermore, unlike many other equities that are still struggling to recover from corrections in late 2018 and deliver gains to their shareholders, the Starwood Property Trust rewarded its shareholder with double-digit percentage total returns over the past 12 months.

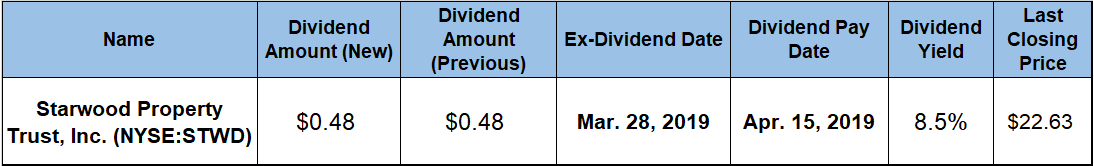

With six out of seven Wall Street analysts holding a “Buy” or “Strong Buy” recommendation, investors might consider doing their own in-depth research to find out whether Starwood Property Trust’s stock might fit well within their own investment portfolio strategy. However, interested investors should act and take their position before the trust’s next ex-dividend date on March 28, 2019. All eligible shareholders of record prior to that ex-dividend date will receive the upcoming round of dividend distributions on the trust’s April 15, 2019, pay date.

Starwood Property Trust, Inc. (NYSE:STWD)

Headquartered in Greenwich, Connecticut and formed in 2009, the Starwood Property Trust, Inc. operates as a REIT in the United States and Europe. The trust operates through three business segments — Real Estate Lending, Real Estate Property and Real Estate Investing and Servicing. The Real Estate Lending segment originates, acquires, finances and manages commercial first mortgages, subordinated mortgages, mezzanine loans, preferred equity, commercial mortgage-backed securities (CMBS), residential mortgage-backed securities, residential mortgage loans and other real estate-related debt investments. Furthermore, the trust’s Real Estate Property segment acquires and manages equity interests in commercial real estate properties, including multi-family properties. Lastly, the Real Estate Investing and Servicing segment manages and works out problem assets; acquires and manages unrated, investment grade and non-investment grade rated CMBS. This segment also originates conduit loans for the primary purpose of selling these loans into securitization transactions and acquires commercial real estate assets. The company chooses to operate as a REIT for federal income tax purposes. However, as required for all REIT, the company must distribute at least 90% of its taxable income to its stockholders to maintain the favorable tax status.

The trust continues delivering a steady $0.48 quarterly dividend as it has done over the past 20 consecutive quarters. This quarterly dividend payout is equivalent to a $1.92 annual distribution and an 8.5% forward dividend yield. Because of the static dividend payout amount and a rising share price, the trust’s current dividend yield is 3.6% lower than the trust’s own 8.8% average yield over the past five years.

Despite trailing its own five-year average, Starwood Property Trust’s current yield still outperformed the 3.15% average yield of the overall Financials sector by nearly 170%. Additionally, the trusts current dividend yield is also nearly double the 4.32% simple average yield of the trust’s peers in the Diversified REITs industry segment.

While flat over the past five consecutive years, Starwood Property Trust more than doubled its total annual dividend payout amount since the onset of dividend distributions in 2009. That level of advancement corresponds to an average growth rate of 8.8% per year.

The Starwood Property Trust managed to deliver positive combined returns to its shareholders. Over the past 12 month, the trust’s shareholders enjoyed a total return of 14.7%. Because the share price experienced a significant pullback in the second half of 2015 and reached its five -year low in February 2016, the five-year total return of 36% is lower than the 52% total return over the past three years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic