State Bank Financial Boosts Quarterly Dividend (STBZ)

By: Ned Piplovic,

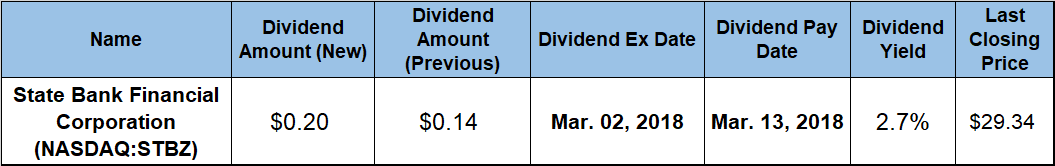

State Bank Financial Corporation (NASDAQ:STBZ) rewarded its shareholders with a 43% dividend hike in the first quarter of 2018 after failing to boost its annual dividend last year for the first time since it started making the payments in 2012.

The current payout hike makes up partially for the missed dividend boost last year by enhancing the distribution at a rate that is 38% higher than the company’s average growth rate over the past six years. In addition to the extraordinary dividend boost and a 2.7% yield, the company advanced its share price nearly 9% for a double-digit percentage combined total return over the past 12 months.

The company will distribute the next dividend on March 13, 2018, to all its shareholders of record before the next ex-dividend date, which is set for March 2, 2018.

State Bank Financial Corporation (NASDAQ:STBZ)

Headquartered in Atlanta, Georgia, and founded in 2005, the State Bank Financial Corporation operates as the bank holding company for State Bank and Trust Company. The bank provides customary banking services, including deposit services and short-term to longer-term certificates of deposits.

The company also provides various types of individual and business loans, cash management accounts, disbursement services and on-line cash management systems. Additionally, the company offers payroll services, including automated human resources information systems, payroll, benefits and labor management services. The company operates eight mortgage production offices and more than 30 banking locations throughout 15 counties in Georgia.

As indicated earlier, the company has been distributing dividends to its shareholder since 2012 and failed to hike its annual dividend for the first time in 2017. However, to start 2018, the company boosted its quarterly payout 42.9% from $0.14 in the previous quarter to the current $0.20 distribution. This current quarterly amount is equivalent to a $0.80 annualized payout and a 2.7% forward yield. Also, this year’s hefty payout boost is nearly 95% higher than the company’s 1.4% average yield over the past five years.

Despite the missed dividend boost last year, the company enhanced its annual dividend payout at an average rate of 31.1% per year. This level of annual growth raised the total annual dividend almost 570% compared to the annualized first-year dividend of $0.12 that the company distributed in 2012.

State Bank Financial Corporation’s current 2.7% yield is nearly 48% below the simple average of all the equities in the Financials sector. However, compared to the more appropriate peers in the Southeast Regional Banks segment, State Banks’s current 2.7% yield is almost 60% higher than the 1.7% average of the entire segment. Additionally, the company’s current yield is 21.65% above the 2.26% average yield of only dividend-paying companies within the market segment.

Notwithstanding the pullback in early February 2018 with the rest of the market, the company’s share price performed well over the past year. After an 8.7% drop from $26.99 one year ago, the share price reached its 52-week low of $24.64 on March 22, 2017. However, after bottoming out in mid-March 2017, the share price rose 27.5% with mild volatility to peak at $31.42 on November 29, 2017. Between the November peak and the end of January 2018, the share price experienced some volatility, but traded relatively flat in the $29 to $31 range.

During the first week of February 2018, the share price plunged 7.7% to $28.50 and then moved up slightly to close on February 13, 2018, at $29.34. That closing price was 8.7% higher than at the beginning of the trialing 12-month period and 19.1% higher than the 52-week low from March 2017. Additionally, the current share price is 80% higher than it was five years ago.

Short-term and long-term investors gained from the company’s combined benefit of rising dividends and appreciating assets. The shareholders received a combined total return of 12.7% over the past year, a 58.3% total return over the past three years and a 91.6% total return over the most recent five-year period.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic