Stellus Capital Investment Offers 10% Dividend Yield (SCM)

By: Ned Piplovic,

The Stellus Capital Investment Corporation (NYSE:SCM) has been rewarding its investors with a steady dividendincome and a dividend yield of approximately 10% since the company’s formation in 2012.

In addition to the steady flow of dividend income, the company’s current dividend yield of 10% presently outperforms average industry yields. Furthermore, the company has complemented its robust dividend income with share price growth most of the time since the beginning of 2016. The share price experienced a double-digit-percentage decline between the beginning of the trailing 12-month period in July 2017 and its 52-week low in early February 2018. However, since its February low, the share price has regained almost all those losses and technical indicators hint that the share price could continue to rise.

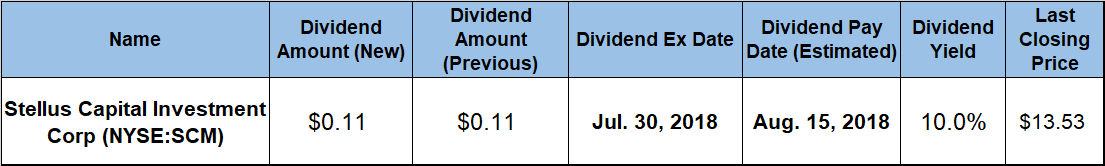

If the share price indeed continues its recent uptrend, the current pullback could be an opportunity for investors to pick up a few discounted shares and enjoy a little asset appreciation while collecting a 10% quarterly dividend. However, interested investors must conduct their own research and take action before the company’s upcoming ex-dividend date on July 30, 2018. Doing so will guarantee investors eligibility for the next round of quarterly dividend distributions on the August 15, 2018, pay date.

Stellus Capital Investment Corporation (NYSE:SCM)

Formed as a spin-off from the D. E. Shaw & Company in 2012, the Stellus Capital Investment Corporation is an externally managed, closed-end, non-diversified management investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940. Stellus Capital Investment Corporation’s investment objective is to maximize the total return to its stockholders in the form of current income and capital appreciation. The firm invests primarily in private middle-market companies — typically those with $5.0 million to $50.0 million of EBITDA (earnings before interest, taxes, depreciation and amortization) — through various types of debt financing, often with a corresponding equity investment. Stellus Capital Management — an investment advisory firm led by the former head and certain senior investment professionals of the D. E. Shaw & Co’s direct capital business – is SCM’s investment adviser and manages its investment activities. The Stellus Capital Investment Corporation manages its investments through two platforms — private credit and energy private equity. As of April 30, 2018, the firm had more than $1.5 billion of assets under management. The company spread these assets across 20 industries with the three largest accounting for a third of those assets — Software,13%; Healthcare & Pharmaceuticals,10% and Business Services, 10%. Geographically, the firm invested more than one quarter of the firms currents assets under management in Texas (26%). California with an 11% share and New Jersey with an 8% share rounded out the top three.

Starting in December 2012, the company distributed quarterly dividends through the end of 2013. In 2014, the firm switched to distributing its dividends monthly and has paid the same $0.133 monthly amount for the past 57 consecutive months. This monthly distribution amount corresponds to a $1.36 annualized payout and a 10% dividend yield at current share prices. While slightly lower than the firm’s 10.9% average dividend yield over the past five years, the current dividend yield is almost 230% above the 3.05% average yield of the entire Financials sector and 36.7% higher than the 7.35% average yield of all the companies in the Equity Closed-End Funds market segment. Even ignoring the companies that do not pay any dividends, SCM’s current dividend yield is still more than 20% above the 8.35% average yield of only dividend-paying companies in the segment.

The company’s share price began the trailing 12-month period with a 4% rise towards its 52-week high of $ 14.29 on October 27, 2017. After peaking in late October 2017, the share price encountered some volatility and declined 20.6% before bottoming out at $11.34 on March 1, 2018. However, since its 52-week low, the share price regained almost 75% of those losses and closed on July 18, 2018, at $13.53. This closing price was within 5.3% of the October high, just 1.5% below the share price from one year earlier and 19.3% above the March low.

The small share price drop offset some of the dividend gains and offered shareholders a total return of almost 8% over the past 12 months. While the total return over the past five years was nearly 37%, shareholders earned the best total return of nearly 53% over the past three years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic