Sun Life Financial Boosts Dividend Distribution Payments Four Consecutive Years (SLF)

By: Ned Piplovic,

After a 20% dividend cut in 2009 followed by five years of flat annual dividend distribution payments, Sun Life Financial, Inc. (NYSE:SLF) resumed dividend hikes and boosted its annual dividend over the past four consecutive years.

In addition to the rising annual dividend payouts, the company’s current yield is almost 10% higher than the company’s five-year average yield and outperformed the average industry yields between 22% and 96%.

While experiencing some volatility and pullbacks in early 2018 from its January peak, the company’s share price still managed a small total return on shareholders’ investment over the past 12 months. However, the company rewarded shareholders that invested few years ago with total returns in excess of 40% over the past three and five years.

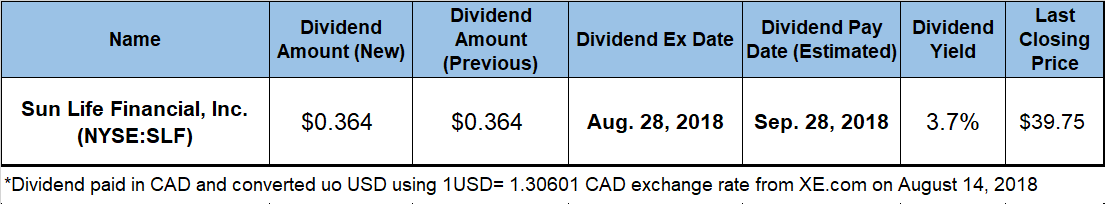

The company will distribute its next dividend on company’s September 28, 2018 pay date to all its shareholders of record before the August 28, 2018 ex-dividend date.

Sun Life Financial, Inc. (NYSE:SLF)

Headquartered in Toronto, Canada and founded in 1999, Sun Life Financial, Inc. is a financial services company that provides insurance, wealth and asset management solutions to individuals, corporate clients, high-net-worth individuals and families. The company operates through five business segments — Sun Life Financial Canada, Sun Life Financial United States, Sun Life Financial Asset Management, Sun Life Financial Asia and Corporate. The portfolio of Sun Life’s product and service offerings includes life, health, long-term disability, short-term disability, absence management, medical stop-loss and dental insurance, as well as vision and voluntary insurance, such as accident and critical illness. Additionally, the company provides a suite of voluntary benefits solutions to individual plan members, including post-employment life and health plans, asset management and group retirement products and services, contribution pension plans, defined benefit solutions and mutual funds. The company distributes its products through direct sales agents, managing general agents, independent general agents, financial intermediaries, broker-dealers, banks, benefits consultants and other third-party marketing organizations.

Sun Life’s current $0.364 (CAD $0.475) quarterly dividend is 9.2% higher than the $0.333 (CAD 0.435) payout from the same period last year. The upcoming quarterly dividend distribution converts to a $1.45 (CAD 1.90) annual payout, which is equivalent to a 3.7% forward dividend yield at the current share price levels. Compared to the company’s 3.6% average dividend yield over the past five years, the current 3.7% yield is 2.7% higher.

In addition to slightly outperforming its own five-year average yield, the company’s current yield outpaced the average yields of industry peers by much wider margins. Sun Life’s current yield is 22% higher than the 3% simple average yield of the entire Financials sector and almost twice the 1.87% average yield of all the companies in the Life Insurance industry segment. As the security with the second-highest yield in the Life Insurance segment, Sun Life’s 3.7% current yield even outperformed the 2.28% average yield of only the dividend-paying companies by more than 60%.

Over the past four years of consecutive annual dividend distribution hikes, the company advanced its total annual dividend amount by 32%, which corresponds to an average growth rate of 7.2%. Even with the 20% dividend cut in 2009 and five consecutive years of no dividend distribution hikes, the company still managed to enhance its total annual payout four-fold since initiating dividend distributions in 2000. This level of dividend growth translates to an even higher long-term average annual growth rate of 8.4%.

The 2008 financial crisis affected the company’s share price negatively, causing it to drop nearly 80% from its all-time high of more than $57 in late 2007 to slightly above $12 by early 2009. Despite moderate volatility, the share price has more than tripled since March 2009.

The share price passed through its 52-week low of $38.10 on August 30, 2017 and advanced almost 16% before it reached the $44.15 high on January 22, 2018. The share price encountered increased volatility over the past seven month and ultimately dropped 10% from the 52-week high in January to close at $39.75 on August 14, 2018. While down from the year’s peak, the August 14, 2018 closing price was still 2.6% higher than a year earlier, 4.3% above the August 2017 low and 25% higher than it was five years ago.

The small share price growth and rising dividend income have rewarded the company’s shareholders with a total return of 6.2% in the last 12 months, 40% over the past three years and nearly 44% over the past five years.

Dividend distribution increases and dividend distribution decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic