SunCoke Energy Partners Offers Segment-Topping 11.3% Dividend Yield (SXCP)

By: Ned Piplovic,

In a tough mining sector that has been declining for more than a decade, SunCoke Energy Partners LP (NYSE:SXCP) currently offers investors a best-in-class dividend yield of 11.3%.

Unfortunately, while the dividend yield paints a positive picture, the company has been facing some headwinds recently. Despite having the highest dividend yield among its peers, the current yield is actually more than 15% below the company’s own 13.4% dividend yield average over the past five years.

After initiating distributions in May 2013, SunCoke Energy Partners boosted its payout amount for 10 consecutive quarters before starting to distribute a flat $0.594 quarterly distributions for the subsequent 10 periods. However, the company reduced its quarterly distribution for the second quarter of 2018 to the current $0.40 distribution amount.

While the payout amount reduction lowered the dividend yield, a unit price decline of 22% over the past year counteracted some of that reduction and helped maintain the dividend yield level. A distribution payout cut and a declining unit price are not generally indicators that investors seek out when looking for potential investments.

However, while the company fell slightly short of analysts’ earnings consensus estimate for the third quarter, it took unforeseen losses due to higher-than-expected outage costs from a machinery fire at one of its facilities, as well as higher depreciation expenses due to revisions in estimated useful lives of certain assets in the Domestic Coke segment.

Because of these additional expenses and lower output, the company has already lowered its adjusted earnings for the entire 2018 by approximately 2.4%, which should already be reflected in the current price. Therefore, investors who believe that the unit price is near a bottom might decide to take advantage of the current discounted price.

During the third-quarter results call, Mike Rippey, President and CEO of SunCoke Energy Partners, L.P., commented, “We continue to be pleased with strong operating performance at CMT [Convent Marine Terminal] as our customers continue to leverage our unique capabilities to capitalize on the attractive export market and our Middletown and Haverhill coke facilities continue to perform in line with our expectations.”

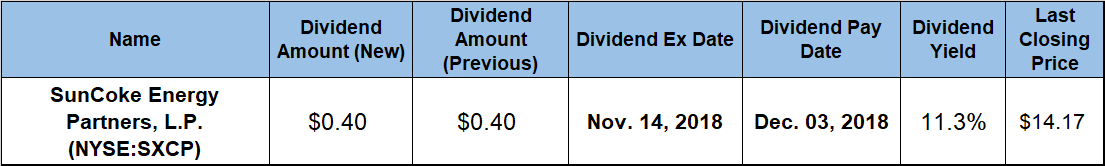

The partnership will make its next round of distributions on the December 3, 2018, pay date to all its shareholders of record prior to the November 14, 2018, ex-dividend date.

SunCoke Energy Partners LP(NYSE: SXCP)

Headquartered in Lisle, Illinois, and founded in 2012, SunCoke Energy Partners, L.P. primarily produces coke used in the blast furnace production of steel and also provides handling and mixing services of coal and other aggregates through two business segments — Domestic Coke and Logistics. Additionally, the company captures the excessive amounts of heat generated as a byproduct of the coke manufacturing process and uses that heat to generate steam and electricity, which it then sells to contracted industrial and municipal customers. Furthermore, the firm’s logistics business has terminals that can mix and transload more than 40 million tons of coal annually and also has a total storage capacity of approximately 3 million tons. Currently, the company owns two coke-making and heat recovery operations in Ohio and one in Illinois. Also, the logistics business segment has two handling and mixing facilities in West Virginia, with one additional facility each in Louisiana and Indiana.

The partnership’s unit price spiked 23% between the beginning of the trailing 12-month period and its 52-week high of 21.70 on January 26, 2018. After this brief spike, the price reversed direction and declined 36% before bottoming out on October 31, 2018, at $13.84. The unit price gained 2.4% over the subsequent two trading sessions to close on November 2, 2018, at $14.06.

The current $0.40 quarterly distribution corresponds to a $1.60 annualized payout and an 11.3% forward dividend yield. While lower than the partnership’s own five-year average, SXCP has the highest current dividend yield in the Nonmetallic Mineral Mining industry segment. Additionally, SXCP’s current yield is more than 50% above the average yield of the segment’s dividend-paying companies and nearly five times the average yield of the entire Basic Materials sector.

While delivering an overall total loss of 7.5% for the trailing 12 months, the partnership’s unitholders nearly doubled their investment over the past three years with a total return rate of almost 90%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic