Targa Resources Corporation Offers 7% Dividend Yield, 35% One-Year Total Return (TRGP)

By: Ned Piplovic,

Targa Resources Corporation (NYSE:TRGP) — a midstream energy assets management company — currently offers its shareholders a 7.1% dividend yield. It has also produced five annual dividend hikes in the past seven years.

While boosting its total annual dividend amount five times in seven years is a relatively positive sign, it is worth mentioning that the company’s missed dividend hikes in the past two consecutive years. However, even with flat dividend payouts in the past two years, Targa Resources still managed to quadruple its annual dividend amount since initiating dividend distributions in 2011. Despite the flattening of the annual dividend distributions curve, the company still offers a dividend yield that outperforms its industry and segment peers by a wide margin.

One reason for the stagnating dividend payouts has been the company’s cash flow, or rather, lack of cash flow. Therefore, the company has been forced to partner with private equity firms, sell non-core assets and issue equity to finance its growth. As a result, Targa Resources is currently trading for more than 15 times cash flow, which is 25% higher than the 12-time average of its peers.

However, the company has partnered with Kinder Morgan (NYSE:KMI) on the Gulf Coast Express pipeline project, as well as already formed or expanded joint ventures with additional midstream companies in order to expand its assets in several regions. These expansion projects should start paying off soon by manifesting themselves as both faster earnings and cash flow growth. The additional growth should free up some cash to allow the company to resume hiking its annual dividends.

In addition to the above-average dividend yield, the company‘s share price has not only recovered from losing nearly 90% of its value between mid-2014 and early 2016, it has produced strong growth over the past 12 months. The one-year asset appreciation exceeded 25% and combined with dividend distributions for a total return of nearly 35% for the trailing 12 months.

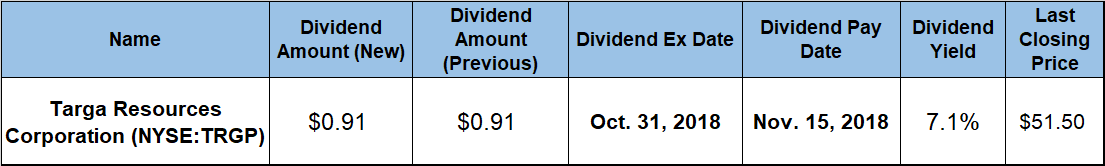

Investors who agree with the company’s bullish outlook over the near term must act before the October 31, 2018, ex-dividend date on March 15, 2018, in order to claim eligibility for the next round of dividend distributions on the November 15, 2018, pay date.

Targa Resources Corporation (NYSE:TRGP)

Headquartered in Houston, Texas and founded in 2005, the Targa Resources Corporation, together with its subsidiary — Targa Resources Partners LP — owns, operates, acquires and develops a portfolio of midstream energy assets in North America. The company operates in two segments – Gathering & Processing and Logistics & Marketing. Targa Resources engages in gathering, compressing, treating, processing storing, fractionating, transporting and selling of natural gas, natural gas liquids (NGL), other NGL products, crude oil and refined petroleum products. Additionally, the company offers NGL balancing and transportation services to refineries and petrochemical companies. As of September 2018, the company owned and operated approximately 27,000 miles of natural gas pipelines, 37 processing plants and 39 storage wells with a gross storage capacity of nearly 70 million barrels. Additionally, the company leased and managed almost 640 railcars, approximately 130 transport tractors and 18 company-owned pressurized NGL barges.

The company’s current $0.91 quarterly dividend translates to a $3.64 annualized payout and a 7.1% forward dividend yield. This current yield is almost 18% higher than the company’s own 12% dividend yield average over the past five years. Furthermore, the current yield is also 182% above the 2.5% average dividend yield of the entire Utilities sector, as well as more than double the 3.24% simple average dividend yield of the Gas Utilities industry segment. The current 7.1% dividend yield is also 55% higher than the 4.57% simple average of only dividend-paying companies within the segment.

Even without dividend hikes in the past two years, Targa Resources enhanced its total annual dividend payout nearly four-fold since starting dividend distributions in 2011. That level of progress corresponds to an average growth rate of 21.5% per year over the past seven years.

The share price hit its 52-week low of $40.35 very early in the trailing 12-month period, on October 25, 2017. From that low, the share price gained 45% before it peaked at $58.51 on October 2, 2018. Since the early-October peak, the share price pulled back 12% and closed on October 24, 2018 at $51.50, which was 21.6% higher than one year earlier and 27.6% above its 52-week low.

While the company delivered a total loss of nearly 10% over the past five years, the more recent share price growth provided a total return of nearly 11% over the past three years and 35% over the past 12 months.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic