TE Connectivity Offers Investors 10% Dividend Boost (TEL)

By: Ned Piplovic,

TE Connectivity LTD. (NYSE:TEL) rewarded its shareholders with annual dividend hikes for the past seventh consecutive year and boosted its quarterly dividend payout another 10% for the upcoming distribution.

While the company’s current 1.9% dividend yield might seem unattractive to investors seeking higher levels of income, TE Connectivity’s current dividend yield outperforms the average yields of the overall Technology sector by a significant margin and is on par with the average yield of its dividend-paying peers in the segment.

Additionally, the company supplements its consistently growing dividend payouts with a steady asset appreciation and minimal volatility nearly since its incorporation. Therefore, investors interested in a technology stock with a combined benefit of a steady dividend income and strong asset appreciation that offered double- and triple-digit percentage total returns over the past few years, should take a closer look at TE Connectivity LTD.

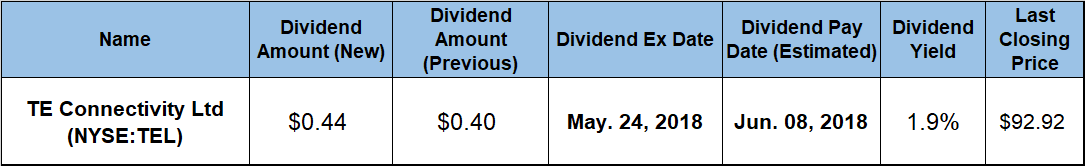

After completing their research into the company’s fundamentals successfully, investors who find that the TEL fits within their investment strategy, should act quickly to ensure eligibility for the next round of TE Connectivity’s dividend distributions on the June 8, 2018 pay date. The company will distribute dividend on that pay date to all shareholders of record before the May 24, 2018 Ex-dividend date.

TE Connectivity LTD. (NYSE:TEL)

Based in Schaffhausen, Switzerland, the company was spun off from Tyco International plc and incorporated under the Tyco Electronics Ltd. name in 2007. The company changed its name to TE Connectivity Ltd. in 2011. TE Connectivity Ltd. designs, manufactures and sells electronic connectivity and sensors solutions globally. The company’s Transportation Solutions business segment primarily provides terminals, connector systems, components, sensors, relays, application tooling, wires and heat shrink tubing for use in the automotive, commercial transportation and sensor markets. Furthermore, the Industrial Solutions segment offers similar equipment and components for oil and gas, industrial equipment, aerospace, defense and energy markets. In addition to providing the same component assortment to the data devices, subsea communications and appliances markets, the Communications Solutions segment also provides, undersea telecommunication systems and antennas specific to these markets. TE Connectivity Ltd. currently offers its products to approximately 150 countries and distributes its products primarily through direct sales to manufacturers and third-party distributors.

The company stared distributing dividends in the third quarter of 2009, approximately two years after the company’s spin-off from Tyco International and incorporation as a separate entity in mid-2007. The company managed to boost its annual dividend every year since 2011. Over the past seven consecutive years, the company maintained a 13.5% average annual dividend growth rate and enhanced its total annual dividend payout 175%.

The company’s current quarterly payout of $0.44 is a result of a 10% dividend boost over the $0.40 amount paid in the previous period. This new quarterly dividend amount corresponds to a $1.76 annualized dividend payout for 2018 and yields 1.9%, which is identical to the company’s average yield over the past five years.

While lower than average yields in some high-yield sectors, TE Connectivity’s current yield is nearly 70% than the average yield of the entire Technology sector and the same average of the overall Diversified Electronics market segment. Additionally, the company’s current yield matches the 1.9% average yield of the segment’s only dividend-paying companies.

The company’s share price experienced its 52-week low of $73.89 on May 18, 2017 after a brief 2.8% dip just three days after the onset of the trailing 12-month period. After its 52-week low, the share price ascended more than 43% with minimal volatility before closing at its 52-week high of $105.75 on March 9, 2018. The share price pulled back slightly after its March 2018 peak and closed approximately 10% below the 105.75 peak price at $95.05 on May 14, 2018. While lower than its 52-week high, this closing price was 25.1% higher than it was one year earlier and 28.6% above its 52-week low from mid-May 2017. Additionally, the current closing price is 114% higher than it was five years ago.

TE Connectivity’s investors enjoyed a combined total return of 26.35% over the trailing 12 months. Shareholders that invested in the company few years ago fared even better. The total return on shareholder’s over the past three years exceeded 43% and the shareholders enjoyed a 128.3% total return over the past five years.

Dividend increases and decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic