The Best Dividend Stock Nobody is Talking About

By: Jonathan Wolfgram,

The best dividend stock nobody is talking about is an undervalued, high-dividend chemical company poised to grow at an exponential rate.

The company we’re talking about is Westlake Chemical (NYSE:WLKP), of Houston. Westlake Chemical operates primarily in the United States and uses its operating interests through Westlake Chemical OpCo. Through OpCo, the company invests in and acquires ethylene production facilities, which it uses to convert ethane into usable ethylene.

In addition to ethylene, OpCo also sells propylene, crude butadiene, hydrogen and pyrolysis gasoline to Westlake and other United States companies.

Shown below is its price over a trailing one-year period

Chart generated using Stock Rover.

Chart generated using Stock Rover.

The Best Dividend Stock Nobody is Talking About has Strong Upward Momentum

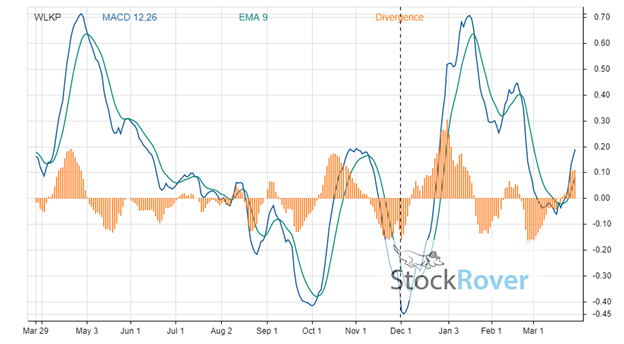

Momentum indicators indicate WLKP is oversold and trading at a meaningful discount. We can uncover this by checking out the moving average convergence divergence (MACD).

Chart generated using Stock Rover.

If you’re not familiar with MACD, here’s a brief explanation:

We can calculate MACD by subtracting the 26-period exponential moving average (EMA) — a trading indicator that determines when to enter and exit positions for short-term trades — from a shorter 12-period EMA. Comparing these two moving averages of the same security can give us insight as to where the stock price will go next.

The resulting line is the MACD line, shown in dark blue above. Then, a nine-day EMA of the MACD is plotted on top of the line, and can be used as a trigger for buy and sell signals. Traders may buy the underlying security when the MACD crosses above the signal line (then resulting in positive divergence, shown in orange) and sell when the MACD crosses below the signal line (resulting in negative divergence).

High divergence means a price increase is possible. Low divergence means it is more likely to drop than go up. In the case of this MACD chart, we see positive divergence as the MACD line crosses over the signal line, indicating the bullish tendencies of WLKP are strengthening and it may be a good time to buy.

To see more momentum data, you can generate plenty of technical charts like this through a free trial with Stock Rover.

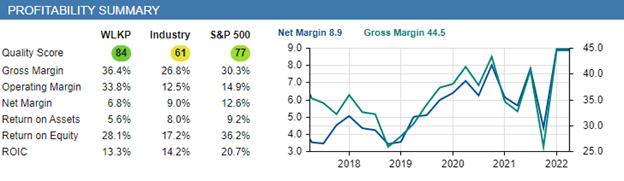

The Best Dividend Stock Nobody is Talking About is More Profitable than Industry Norms

With a gross profit margin of 36.4% — among other high markers — WLKP is considered more profitable than 84% of other publicly traded companies. Its gross margin is 35.8% higher than the industry average of 26.8%, and this sharp difference continues further when we analyze operating margin.

Chart generated using Stock Rover.

Although the industry average is favorable in net margin and return on assets, the return on equity is considerably higher, and return on invested capital (ROIC) is approximately the same.

The Best Dividend Stock Nobody is Talking About Pays a Consistent, High Dividend

Westlake Chemical has paid out a dividend every quarter since it began dividend distribution at the end of 2014. It currently pays $0.47 per quarter, annualizing to $1.89 distributed for each share. This, with the current share price of WLKP, means the company is consistently maintaining a dividend yield of 6.9%.

Shown below is the historical dividend yield for the entire history of WLKP’s dividend.

Chart generated using Stock Rover.

For nearly all of its time paying dividends, Westlake Chemical has kept its yield above 5%, an impressive feat. It is also worth noting that the current high dividend yield of 6.9% is surprisingly low for what the company typically delivers.

With an average dividend growth rate of 6.4% over the last 5 years, Westlake Chemical’s dividend payments — and its dividend yield — are likely to grow. It could become a massive payer in the savvy dividend investor’s portfolio.

Chart generated using Stock Rover.

The Best Dividend Stock Nobody is Talking About Has Fallen in Price

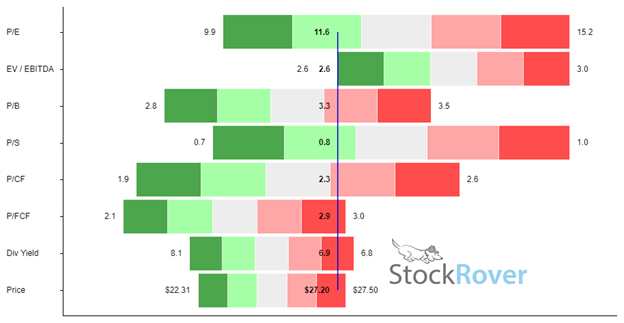

In both dividend distributions and profitability, Westlake Chemical is excelling, either reaching or surpassing its already high historical expectations. These expectations remain high for valuation metrics, but despite the price being low, several of these metrics indicate WLKP is a better value than it has ever been.

To visualize this clearly, we can use an analytical tool affectionately called the “Football Field.”

Chart generated using Stock Rover.

The Football Field is a graphic representation of historic values in several metrics. It plots the historical range of WLKP metrics over the trailing one-year period, then plots the current values relative to where they have been in the last year. In general, we hope to see the centerline (current values) in the green.

The company’s enterprise value / earnings before interest, taxes, depreciation and amortization (EV/EBITDA) is incredibly favorable right now, alongside its price-to-earnings ratio (P/E ratio) and its price-to-sale ratio (PS ratio). While price to free cash flow ratio (P/FCF) appears high at 2.9, compare this to the industry average of 12.0 and the S&P 500 average of 23.6. Although WLKP may not be as undervalued as it has been historically, the ultimately low P/FCF points to a significant and current undervaluation.

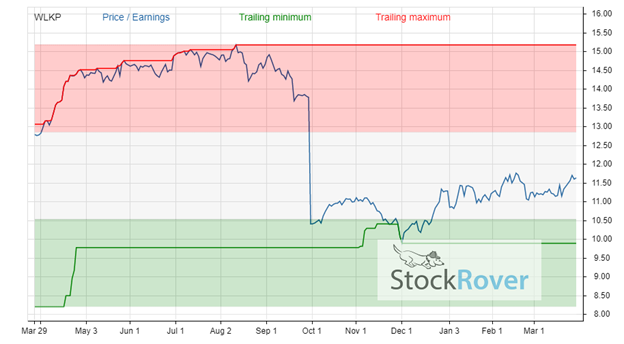

Investors interested in the historical range of WLKP’s P/E ratio can refer to the chart below. The red indicates a yearly maximum, while the green indicates a yearly minimum. The blue line is the actual trailing value.

Chart generated using Stock Rover.

Due to all of these indicators, we believe WLKP may be undervalued by as much as 35%, and expect it to rise to $36.00 as the market catches up.

Connect with Jonathan Wolfgram

Connect with Jonathan Wolfgram