The Best Dividend Stock to Buy in 2021

By: Jonathan Wolfgram,

The best dividend stock to buy in 2021 has a partial monopoly in the oil and gas midstream industry and represents the largest natural gas pipelines in North America.

Kinder Morgan (NYSE:KMI) is a massive energy infrastructure company, operating in the oil and gas midstream industry. The company moves refined petroleum, crude oil, natural gas, CO2, condensate and several other products through nearly 100 thousand miles of pipelines.

Beyond transportation, KMI runs 144 terminals housing several kinds of petrochemical commodities, all of which are located near large urban centers throughout the United States. Investing in KMI is largely an investment in energy midstream transportation, storage and handling services. Its stable cash-flows, high-dividend distributions, monopolistic advantages and impressive first-quarter results for 2021 put it at the top of its peers and positioned it to perform well in the future.

The Best Dividend Stock to Buy in 2021: Kinder Morgan Offers High Cash Flow

KMI obtains the majority of its income from long-term contracts with sizable companies. These contracts can take one of two forms: take-or-pay, where KMI reserves a set capacity for its customers and is paid regardless of the customers’ usage, and fee-based, where KMI is paid a set fee by usage but regardless of commodity price. As a result, the contracts obtained by KMI are minimally influenced by the volatility of the greater oil and gas industry, making its incoming cash-flow consistent and highly stable.

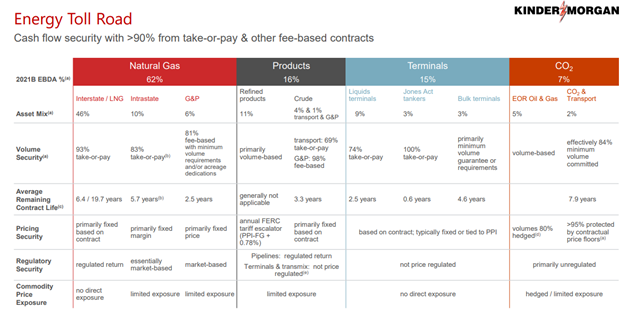

Shown in the table below is a graphic representation of KMI’s top income generators, as well as the volume security, the average contract life, commodity price exposure, and pricing and regulatory security.

Source: company presentation.

While Kinder Morgan’s contract structure protects it from industry volatility, the majority of its clients have little volatility to begin with. Over 76% of KMI’s customers have either a great deal of credit support or are large, investment-grade-rated companies. The strength of its customer base plays a crucial role in KMI’s steady stream of cash flows, underpinning its high dividend distributions and yearly share buybacks to give money back to its investors.

The Best Dividend Stock to Buy in 2021: KMI’s High Dividend Yield of 5.7% May Grow

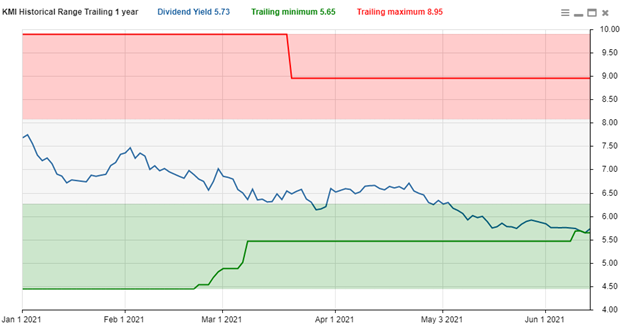

Kinder Morgan distributes a quarterly dividend of $0.27. When annualized, this is equivalent to a yearly dividend of $1.08. The company’s high dividend yield of 5.7% is relatively standard for the oil and gas midstream industry, which averages a 6.1% dividend yield, but KMI’s yield is sitting at an annual low.

The chart below shows the dividend yield of KMI at every point year to date (YTD), alongside the trailing maximum and trailing minimum for the year prior in the red and green lines, respectively.

Chart provided by StockRover, start your free trial here.

The gradual decrease in dividend yield can be attributed to KMI’s rising stock price over the same period. With one-year returns of 30.9%, its stock price has soared in the recent past alongside the company’s growing sales and increasing cash flow from new customers. Despite Kinder Morgan’s overall dividend yield dip, the rapid influx of cash has allowed the company to increase its dividend distribution at a fast pace — with the company boosting its dividend for the last three consecutive years and averaging a 10.5% rise each year.

This steady dividend growth, coupled with the gradually decreasing dividend yield, mean Kinder Morgan has room to increase its distribution in the near future.

There is an area of risk in this assumption: Kinder Morgan has a payout ratio of 129.6%. This is well over the stable range for most companies — generally, 35-55% is considered a strong, sustainable payout ratio — but can be explained by the company’s high cash influx and large property ownership.

Although KMI is not a real estate investment trust (REIT) itself, it has a similar model for profit. The company has a steady stream of cash from long-term contracts and, more importantly, has a large amount of its assets tied up in depreciable property. These factors make it possible for KMI to mark off the depreciation of its properties as incurring a loss (even when they are increasing in asset value) and arguably under-report its overall profit, even as a surplus of cash is brought in by its clientele.

For more information on this phenomenon and how companies can remain stable with payout ratios over 100%, read our article Why Do REITs Have High Payout Ratios?

The Best Dividend Stock to Buy in 2021: Kinder Morgan Rivals High Barriers to Entry

Kinder Morgan enjoys a number of competitive advantages compared to its peers, especially its sheer size and market share dominance. KMI transports roughly 40% of all natural gas consumed in the United States, with similar numbers reflected in its other top commodities. In North America, the company is the largest transporter of natural gas, the No. 1 transporter of independent refined products and the biggest operator of independent terminals.

The vast reach of its infrastructure allows KMI to transport commodities affordably on routes inaccessible by many of its competitors. In several regions of North America, KMI has a monopolistic advantage — it is the only company able to transport oil from Canada to Asia. This allows KMI to set favorable terms and continue its profitable and safe contract structure.

The high barriers to entry in the oil and gas industry make disruption of the status quo very difficult — luckily, the status quo strongly favors Kinder Morgan. If the monopolistic advantages of the company are broken, it would have to come at substantial cost to its peers. Yet, for the majority of KMI’s competition, investing the necessary resources to build pipelines that rival KMI’s on its unique routes is unlikely to be a profitable venture.

The Best Dividend Stock to Buy in 2021: KMI reported 67.8% Rise in Q1 2021 Revenue

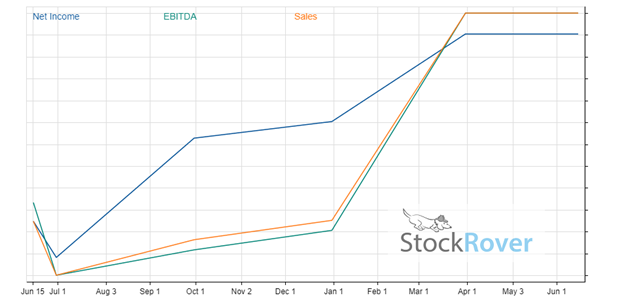

In addition to its sharp revenue increase, KMI reported an adjusted EBITDA (earnings before income taxes, depreciation and amortization) of $2.8 billion, compared to its Q1 2020 EBITDA of $1.8 billion. Net income, EBITDA and revenue are charted below for the trailing 12-month period.

Chart provided by StockRover, start your free trial here.

The excess cash flow has been used for two primary purposes: redistributing money back to shareholders via increased dividend distribution and share repurchases, and accelerating the company’s debt repayment. In Q1 2021, KMI decreased its debt by $1.3 billion to a total of $30.6 billion. This continues Kinder Morgan’s trend of debt repayment in the last several years. Indeed, Kinder Morgan has paid down more than $12 billion of debt since 2015.

Kinder Morgan has an optimistic outlook continuing this trend of quick increases. The company projects its yearly EBITDA to be $7.6-$7.7 billion, approximately a 10% increase over last year. Additionally, its yearly discounted cash flow (DCF) is projected to be around $5.2 billion, a 13% increase over 2020. From this quarter’s earnings, it plans to reinvest $0.8 billion into long-term projects fueling future growth and still will have $2 billion in DCF left over for dividends and discretionary capital.

The Best Dividend Stock to Buy in 2021: KMI Has Long-Term Customer Contracts

With the longest pipelines in North America already built, KMI has a stable customer base locked into long-term contracts to produce an incredibly reliable cash stream. Rapid growth in Q1 2021 brought Kinder Morgan additional cash flows to fuel major projects, dividend increases and debt repayment. We expect this upward trend to continue in the near future.

Smart investors should consider purchasing what we consider the best dividend stock to buy in 2021 before it further increases its dividend or reports additional growth in Q2 and Q3 this year.

Related Articles:

3 Best Dividend Stocks to Buy Now

3 Dividend Growth Stocks to Buy Now

Top 10 Best Screening Tools for Investors

25 High Dividend Stocks in 2020 to Consider Buying

10 High Dividend Stocks Under $20

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Jonathan Wolfgram

Connect with Jonathan Wolfgram