The Clorox Company Boosts Quarterly Dividend Amount 14.3% (CLX)

By: Ned Piplovic,

The Clorox Company’s (NYSE: CLX) next quarterly dividend will increase the company’s total annual payout by over 14%.

Clorox has been boosting its annual dividend payout for more than four decades and generally complements its long-term, rising dividends with steady asset appreciation. However, increased market volatility and several substantial market sell-offs in 2018 have affected the company’s share price growth over the trailing 12-month period. Investors who believe that Clorox has the strength to challenge its recent highs once again can own shares for a very nice bargain right now.

The upcoming April 24, 2018 ex-dividend date is coming up soon, so investors attracted to this stock should conduct their research and move quickly to qualify for the next round of dividend distributions.

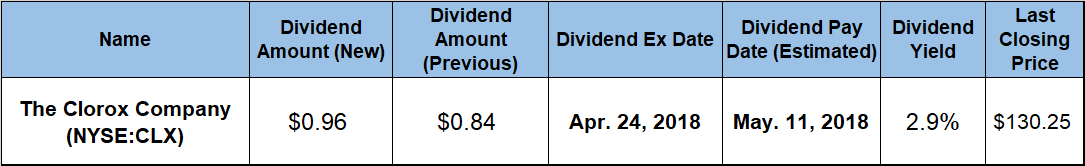

The Clorox Company (NYSE:CLX)

Founded in 1913 and headquartered in Oakland, California, The Clorox Company manufactures and markets consumer and professional products. The company operates through four segments: Cleaning, Household, Lifestyle and International. In its product lineup, the company offers laundry additives, home care products, stain fighters and color boosters under the Clorox, Formula 409, Liquid-Plumr, Pine-Sol, S.O.S. and Tilex brands, as well as naturally derived products under the brand name Green Works.

In addition to the above products, Clorox makes charcoal products under the Kingsford and Match Light brands. Other brand names in the Clorox portfolio include Glad, Fresh Step, and Scoop Away. Additionally, the company owns Hidden Valley, KC Masterpiece, Kingsford and Soy Vay brands used for dressings and sauces, the Brite water-filtration and filters brand and the Burt’s Bees brand of natural personal care products.

Clorox started paying dividends in 1968 and has boosted its annual dividend payout for the past 42 consecutive years. Over the past 20 years, the Clorox Company managed an average growth rate of 9% per year, which has enhanced the company’s total annual dividend payout by a whopping 465% since 1976. Because of its long-term rising dividend history, Clorox is a member of the exclusive Dividend Aristocrats list. This list currently contains 51 S&P 500 companies with market capitalizations of more than $3 billion and a streak of boosting annual dividends for at least 25 consecutive years.

When a company raises its dividend by 10% or more in a single quarterly payment, the high percentage can often be confusing as it sounds better than the actual reality of the numbers. For example, a company that normally pays an $0.08 per share quarterly dividend could claim a 25% increase in its dividend payout by simply raising its distribution to $0.10 per share quarterly – a mere two cent increase However, in Clorox’s case, the actual increase is just as impressive as the double-digit percentage it claims.

That is because Clorox boosted its current quarterly dividend from $0.84 previously to a $0.96 quarterly payout. This new quarterly amount equates to a $3.84 annualized dividend. The previous annual payout was $3.36, so investors can expect to receive $0.38 per share more in dividends over the next year.

With a forward yield of 3.0%, Clorox’s yield is currently 15% higher than its own average of 2.6% over the past few years. The current yield also outperforms the 1.84% average yield of the entire Consumer Goods sector by 64% and is more than 154% higher than the simple average yield of all the companies in the Cleaning Products market segment. Clorox currently has the highest dividend yield in the Cleaning Products segment.

At the end of last year, the company’s share price was up more than 12% above its April 2017 levels. However, Clorox subsequently lost all those gains and currently trades marginally below its level from one year ago. The share price rollercoaster ride over the last year includes: a gain of nearly 20% in less than 60 days, a 17% loss of its peak value in three months and a recent 5% gain. Clorox closed on April 5, 2018 at $130.25, just 2% below its level from April 2017 and 47% higher than it was five years earlier.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic