The Dividend Champions Companies

By: Ned Piplovic,

Dividend Champions are simply stocks that have boosted their annual dividend income distributions for at least the last 25 consecutive years.

While similar to the Dividend Aristocrats, the Dividend Champions list includes more securities as it has no market capitalization requirement. The original market capitalization minimum for inclusion in the Dividend Aristocrats list was $3 billion. In addition to the minimum capitalization requirement, Dividend Aristocrats also must be components of the S&P 500 Index. Since the current minimum market capitalization for inclusion in the S&P 500 of $5.3 billion exceeds $3 billion, the capitalization minimum for inclusion among the Dividend Aristocrats is effectively obsolete.

In addition to some requirements regarding each stock’s minimum trading frequency and volume, this single market cap requirement limits the Dividend Aristocrats to just 65 companies. Alternatively, the Dividend Champions list offers 138 companies as of December 2020.

In addition to all 65 Dividend Aristocrats, the Dividend Champions list includes 72 additional companies that are not components of the S&P 500 Index. Among those, the smallest company (Calvin B. Taylor Bankshares, Inc., OTC:TYCB) has a market capitalization of less than $100 million.

Why Dividend-Paying Securities?

Why do investors seek dividend-paying securities instead of focusing solely on capital gains? Just like sector diversification, diversification across different investment vehicles and types is also a requirement for any well-balanced investment portfolio. Investors invest in dividend-paying securities in order to gain a source of steady income distributions.

Long-term capital gains compounded over extended time horizons are crucial for building wealth over long periods. However, certain classes of investors — such as retirees — require a reliable income source to cover their ongoing living expenses without needing to reach into their long-term investment positions. Therefore, stocks and other equity types with preferably rising dividend distributions meet all income requirements for those investors that need the cash flow.

Equities with very long streaks of consecutive annual dividend hikes tend to deliver lower yields than some high-yield equities with short dividend histories. However, equities with a long history of rising dividend payouts tend to pay steadier and more reliable dividend income distributions and are more likely to maintain their dividend income distributions in the future.

Unfortunately, even financial experts are not in complete agreement whether paying dividend distributions has any impact on the overall stock performance. Alternatively, a back-tested history of equity performances indicates that dividend distributions, especially over an extended time frame, are necessary for strong total returns over extended periods. Based on the historical information, publicly traded companies that have long streaks of rising dividend distributions generally deliver above-average total returns and reduced stock price volatility. Regardless of whether dividend distributions drive stock performance or are merely a byproduct of strong asset appreciation, dividend-paying companies might be an excellent fit for most individual investors’ portfolio strategies.

Rising Dividends for the Long Term

To deliver desirable levels of dividend distributions, some companies adhere to specific dividend policies, which lay out the level of dividend distributions and the timing of payout increases. However, companies can change their dividend policies at will and without any prior notice. While a company can change or abandon its dividend policies at any time, any failure to maintain dividend payouts and boosts that were anticipated by the shareholders could cause significant stock sell-offs and capital outflows.

However, in addition to following up on its dividend payout commitments to keep existing shareholders, a company can use its promise of annual dividend hikes and successful execution of that promise to attract potential new investors as well. The ability to deliver a long streak of rising dividend payouts indicates that the company is confident in delivering robust future earnings and a steady level of cash flow.

Furthermore, long-term efficient capital management and a robust operational performance also signal to potential investors that the company has the ability to survive market downturns and still deliver strong total returns on investments. As Dividend Champions have boosted their annual dividend for more than two decades, it is safe to assume that most of these companies are able to adapt to changing markets and technologies, as well as to overcome recessions and political changes.

The List

David Fish developed the list and first published the Dividend Champions spreadsheet online in December 2007. Mr. Fish was a long-time contributor to Seeking Alpha and other online financial outlets, in addition to creating the Dividend Champions list and updating the list for more than a decade. Justin Law took over the responsibility of updating and publishing the list after Mr. Fish passed away in May 2018.

The list is available on the DRiP Investing Resource Center’s website. In addition to the current list, this web page also provides an archive that includes every monthly list since the initial publication in December 2007. Furthermore, the downloadable spreadsheet includes also two additional lists — Dividend Contenders and Dividend Challengers.

The Dividend Contenders list currently comprises 278 companies that have increased their annual dividend payouts between 10 and 24 consecutive years. Similarly, Dividend Challengers are companies that have delivered at least five years of consecutive annual dividend hikes but have not yet reached the 10-year mark that is needed to become a Dividend Contender. In addition to the 138 Champions and the 278 Contenders, there are 307 Challengers for a total of 722 companies across all three lists.

Why 25 Years?

There is no specific reason to choose 25 years as the demarcation point for designating any company a Dividend Champion. However, the 25-year time frame is long enough to establish a reliable and stable dividend growth history but not too short to include some companies with more volatility in their dividend distribution patterns.

For instance, Dividend Kings — a subgroup of Dividend Aristocrats that requires at least 50 consecutive years of annual dividend hikes — currently comprises only 29 companies. While these companies have impressive records of rising dividend hikes, the limited selection can leave any investor without good options to meet their investment portfolio strategy. Furthermore, the 25-year criterion limits the list to slightly more than 100 companies, which is still manageable for a detailed analysis and offers a good selection of diversified investment options.

Alternatively, lowering the cutoff to 10 years more than triples the number of companies to 415 Dividend Champions and Contenders combined. Needless to say, analyzing 415 equities is significantly more time-consuming. Therefore, while mostly arbitrary, the 25-year cutoff generates a manageable list of relatively diverse companies that deliver long-term rising dividend income payouts.

Current Dividend Champions by Sector

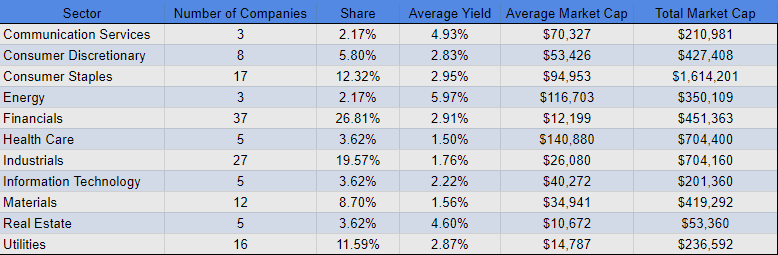

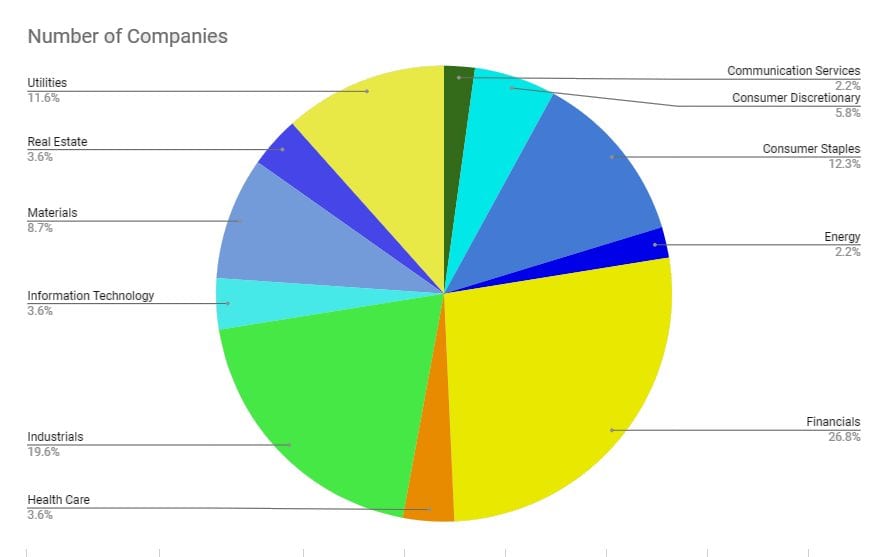

The 138 companies currently in the Dividend Champions list represent 9 different sectors. However, the distributions are allocated quite unevenly amongst the sectors. Over a quarter of the Dividend Champions — 37 out of 138 — represent the Financial sector. Additionally, with 92 companies combined, the top three sectors by company count — Financials, Industrials and Consumer Defense — account for two-thirds (66.6%) of all companies on the list. The sector with the fewest companies — the Energy sector — has only three.

However, the Energy sector delivers the second-highest average market capitalization of more than $116 billion per company. It trails Healthcare, which has an average market capitalization of nearly $141 billion. All other sectors average below the $100 billion mark.

The table and the chart below provide the complete details by sector, updated December 2020.

Summary

Summary

Despite delivering slightly lower absolute returns in any given year or quarter, Dividend Champions, Contenders, Aristocrats, Kings, etc. reward their investors with a reliable dividend income, rising dividend payouts and reduced volatility. All these factors favor the strong long-term returns that are desired by long-term investors.

The Dividend Champions list offers investors a selection of relatively good choices for long-term investing. Even without a detailed analysis, most of the companies on the Dividend Champions list deliver solid returns. However, just like with any other investment, investors must conduct their own analysis and due diligence to ensure that the selected equities meet their individual investment portfolio goals.

Related Articles:

5 Best Dividend Aristocrats to Buy Now

The Dividend Aristocrats Investing Strategy and Stocks List

The Best Dividend Aristocrats ETFs

Why Invest in the Dividend Aristocrats?

The S&P 500 Dividend Aristocrats — Everything You Need to Know

What are the Dividend Aristocrats?

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic