The Williams Companies Resumes Annual Dividend Hikes, Offers 4.5% Yield (WMB)

By: Ned Piplovic,

Featured Image Source: Company Website

After two years of annual dividend reductions, The Williams Companies, Inc. (NYSE:WMB) has offered its shareholders annual dividend hikes again for 2018. WMB sports a 4.5% current dividend yield.

The annual dividend boost for 2018 is just one of 13 annual dividend hikes in the past 15 years. Compared to previous annual dividend amounts, the 2018 total payout is on track to be 13% higher than last year and is already above the 2012 level.

The Williams Companies’ dividend cuts over the previous two years corresponded to a struggling share price, which lost more than 75% of its value between July 2015 and February 2016. However, the share price has recovered almost 40% of its losses and more than doubled since its five-year low from February 2016. The share price experienced another correction in the first quarter of 2018 but has resumed its rising trend in early April and has fully recovered those losses to close marginally above higher than it was one year earlier.

The share price recovery aided greatly in offering the company’s shareholders a positive total return over the past 12 months. While the one-year total return of 8% is not very high, it marks the company’s return to the positive side after delivering a total loss of nearly 30% over the past three years.

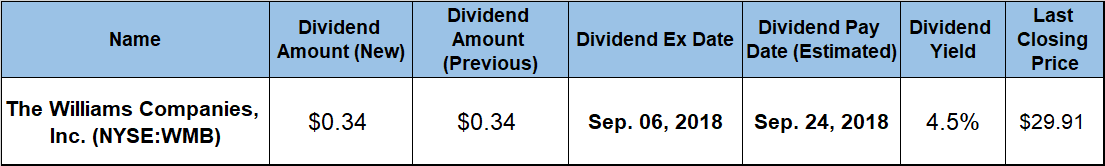

Investors whose own research and analysis indicates that the share price might continue its growth and that the current dividend boost is just the first in a new series of future dividend hikes should consider acting quickly. Taking a long position in this equity prior to the company’s next ex-dividend date on September 6, 2018, will ensure eligibility for the next round of dividend distributions. The company will distribute its next dividend payout to all eligible shareholders on the next pay date, which is currently set for September 24, 2018.

The Williams Companies, Inc. (NYSE:WMB)

Based in Tulsa, Oklahoma, and founded in 1908, the Williams Companies, Inc. operates as an energy company with more than 4 trillion cubic feet of proved natural gas and gas equivalents reserves, as well as almost 14,000 miles of natural gas gathering and interstate transport pipelines. One of the company’s two main pipeline branches stretches from the Pacific Northwest to Kansas and New Mexico. The other main pipeline connects the Gulf of Mexico production sites along the Texas, Louisiana and Alabama coasts with most of the eastern seaboard up to Pennsylvania and New Jersey — including the New York City metropolitan area. In addition to its pipeline transport operations, the company also provides natural gas gathering, treating, processing and compression services, as well as fractionation, storage, marketing and transportation services. Furthermore, the Williams Companies also offers crude oil deep-water production and transportation services.

The company’s current $0.34 quarterly payout amount is 13.3% above the $0.30 distribution from the same period last year. This new quarterly amount converts to a $1.36 annualized payout and a 4.5% forward dividend yield. The current dividend yield did not recover fully from the two years of dividend cuts and trails the company’s own 4.8% average yield by approximately 5%. Similarly, WMB’s current yield is approximately 7% below the 4.75% simple average yield of all the companies in the Oil & Gas Pipelines industry segment. However, the current 4.5% yield is almost double the 2.31% average yield of the entire Basic Materials sector. Even with two significant dividend cuts, the company managed to enhance its total annual dividend payout 17-fold over the past 15 years. That level of growth corresponds to an average annual growth rate of more than 22% per year.

The share price advanced more than 16% from the beginning of the trailing 12 months towards its 52-week high of $33.21 on January 8, 2018. However, the share price plummeted more than 26% from the late-January peak towards its 52-week low of $42.38 on April 6. After the April low, the share price regained more than 60% of its losses from the January peak and closed on August 29, 2018, at $29.91 — 2.7% higher than it was 12 months earlier. While the share price rose only marginally over the past 12 months, the company’s rising dividend income accounted for most of the 8.1% one-year total return. This is significantly better than the recent performance when the sharp share price decline in 2015 overpowered the dividend hikes to deliver only a 7.6% total return over the past five years and a 28.3% total loss over the past three years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic