Three Dividend-Paying Media Stocks to Buy for the COVID-19 Rebound

By: Paul Dykewicz,

Three dividend-paying media stocks to buy feature traditional broadcasting behemoths that investment experts view as candidates to beat the market during the economy’s ongoing COVID-19 rebound.

The three dividend-paying media stocks produce huge cash flows to support their payouts and are finding ways to stay relevant in a world in which social media companies are becoming the fast-growing darlings of investors. All three dividend-paying stocks to buy should be aided by increased advertising dollars that are starting to be allocated with the U.S. economy reopening after the lockdown of non-essential business during the worst of the COVID-19 crisis.

The coronavirus contributed to the economy falling into a recession in March when COVID-19 lockdowns led to massive layoffs of workers that included 20.7 million jobs cut in April alone. However, a positive sign emerged when retail sales soared 17.7% in May to mark the biggest monthly climb since 1992, according to the U.S. Commerce Department. That jump more than doubled estimates of economists as U.S. governors began easing coronavirus-related restrictions and trillions of dollars in federal stimulus started to take effect, following retail sales drops of 14.7% in April and 8.3% in March.

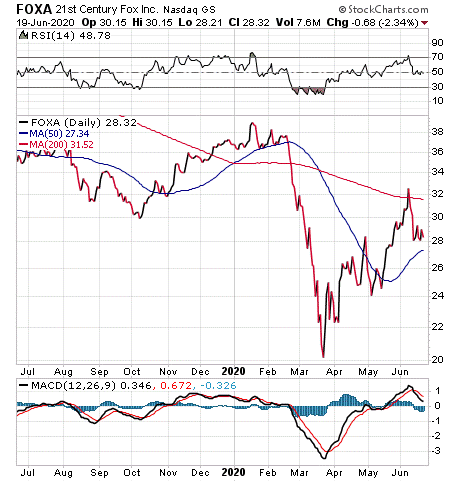

Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, told me he favors Fox (NASDAQ:FOXA). Fox pays a dividend and offers a respectable yield of 1.59%.

Chart courtesy of www.StockCharts.com

The stock has not fully joined the rally since the market’s March lows, said Carlson, who also leads the Retirement Watch advisory service. Fox further should benefit significantly from a rebound in sports-related programming, the resumption of new programming projects and the economic recovery generally, he added.

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz during an interview before social distancing became the norm after the outbreak of COVID-19.

Disney Joins List of Three Dividend-Paying Media Stocks to Buy

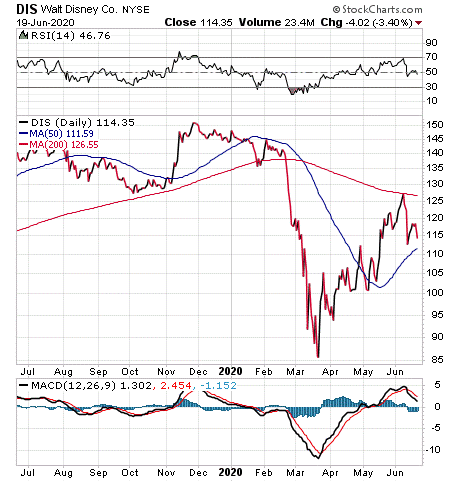

Jessica Reif Ehrlich, an analyst at Bank of America/Merrill Lynch, wrote optimistically about the Walt Disney Company (NYSE:DIS) in a research note on Monday, June 15, sticking with her buy rating on the stock but raising her price target 18.7% from $123 to $146.

Disney shares are trading at 21 times 2021 EPS and 19 times 2022 earnings per share (EPS), offering a “compelling entry point” to buy a best-in-class stock, Reif Ehrlich wrote. Investors should keep in mind Disney suspended its semiannual dividend for the first half of its current fiscal year that was supposed to be paid in July to save $1.6 billion, if the company chose to keep its existing twice-a-year reward to shareholders of $0.88 per share.

Chart courtesy of www.StockCharts.com

Disney has needed to shut down all its theme parks in recent months due to the coronavirus spreading worldwide. For the intermediate term, Reif Ehrlich wrote that she still expects significant COVID-19 disruption from months of shutdown as it implements new operating procedures and seeks to regain its share of consumer discretionary spending.

Her price objective of $146 is based on a sum-of-the-parts valuation that encompasses a target with a 14x multiple based on 2021 estimated normalized adjusted EPS. Downside risks to her price objective include a significant slowdown in ESPN’s growth due to customer cord cutting, weakened consumer confidence, uncertainties about the Disney+ rollout, a possible catastrophic event on theme park attendance, any film flops and advertising weakness due to weak audience delivery and economic conditions, she added.

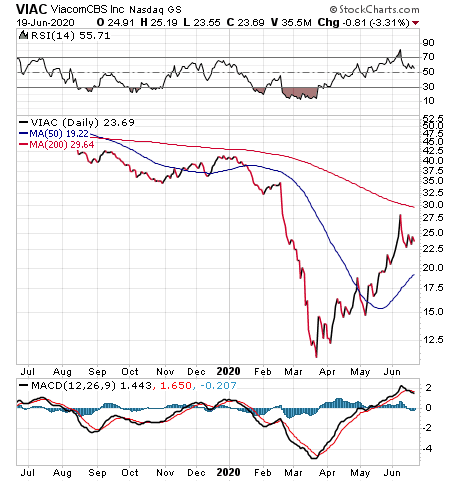

ViacomCBS Inc. Completes the List of Three Dividend-Paying Media Stocks to Buy

ViacomCBS (NYSE:VIAC) is the third of the trio of dividend-paying media stocks to buy and it offers the biggest yield of 3.92%. With advertising dollars flowing back to broadcasters, the ISI Evercore investment firm raised its price target on Viacom on June 14 to $24 from $20.

Traditional U.S. media company management teams in the last few weeks indicated their near-term focus centers on changes to the “upfront” advertising model, the return of some sports programming to the airwaves, the upcoming political advertising cycle and an industry-wide content production pipeline. The advertising sales process was disrupted by the COVID-19 pandemic as television programmers continued to see cancellations from brands that had committed to upfront advertising in advance last year.

Chart courtesy of www.StockCharts.com

“Given a scarcity of available sports inventory combined with pent-up demand among consumers to tune into sports broadcasts, the backdrop for advertising sales on sports inventory is likely a big positive for programmers in the near term,” according to ISI Evercore. “ViacomCBS, in particular, benefited from overwhelming demand for last weekend’s Charles Schwab Challenge, and Fox has similarly had success selling NASCAR inventory.”

Non-Dividend-Paying Facebook Is Another Media Stock to Consider

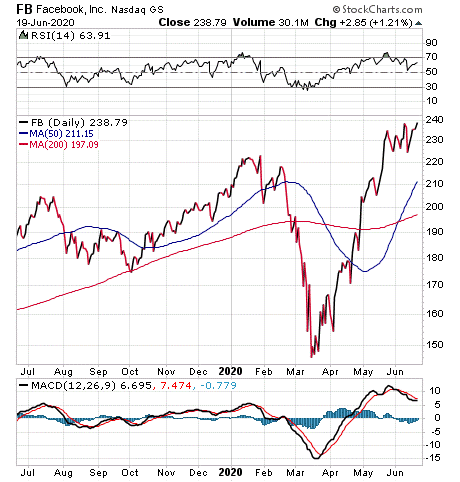

Facebook Inc. (NASDAQ:FB) is the media stock recommended by Jim Woods, who leads the Successful Investing, Intelligence Report and Bullseye Stock Trader advisory services.

“That stock is outpacing 97% of all other publicly traded companies in terms of relative price strength,” said Woods, who uses that measure as part of his premium Bullseye Stock Trader advisory service.

Woods, who also chooses recommendations with economist Mark Skousen, PhD, for the Fast Money Alert trading service that include call options, advised that Facebook is one of the social media companies that has become a popular target for politicians.

Facebook has been a “juggernaut” of late, with the stock spiking 11% year to date, and more than 56% since falling to its most-recent low on March 16, Woods told me.

The surge in Facebook shares has come despite falling ad revenue, Woods told me. However, the COVID-19 shutdowns are not normal, and shelter-in-place orders by governors throughout the United States have led to record social media use, he added.

Chart courtesy of www.StockCharts.com

“But because of the contraction in the economy, there’s been a major contraction in advertising spending in all media — and social media is no exception,” Woods said.

Paul Dykewicz meets with Jim Woods before COVID-19 to discuss new investment opportunities.

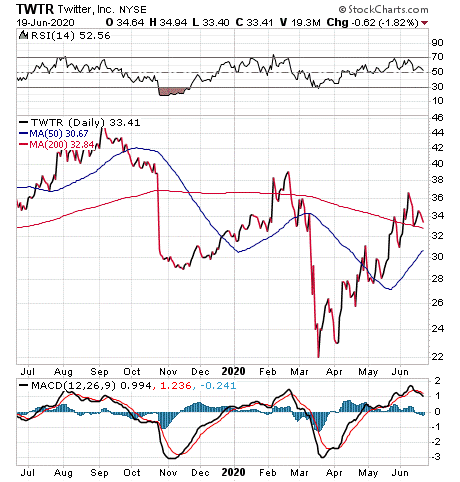

Twitter Is One More Non-Dividend-Paying Stock for Non-Income Investors

“If we do get an improving ad economy, I still like Twitter,” said Hilary Kramer, host of a national radio program called “Millionaire Maker” and head of the Value Authority and GameChangers advisory services. Even though Twitter does not pay a dividend, the company keeps growing and ultimately could emerge as a potential acquisition target, she added.

Chart courtesy of www.StockCharts.com

Kramer added that she would not be surprised if “upfront” purchase of advertising is “dead” in a post-COVID-19 world.

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

COVID-19 has caused 8,750,501 cases and 461,813 deaths globally, along with 2,296,809 cases and 121,402 deaths in the United States, as of June 19. America has more than twice as many cases and deaths as any other country, including China, where COVID-19 originated.

The three dividend-paying media stocks to buy feature established broadcasting giants with strong cash flows and an improving advertising outlook. Any investors following the Wall Street adage of “sell in May and go away” would have missed out on the market rebound in May, and the three dividend-paying media stocks to buy seem ready to rise in the months ahead.

To read the rest of Paul’s investment column, please click here.

Connect with Paul Dykewicz

Connect with Paul Dykewicz