Three Dividend-paying Pharmaceutical Funds to Buy in Wake of Big U.S. Bank Failure

By: Paul Dykewicz,

Three dividend-paying pharmaceutical funds to buy for income are supported by products people need amid the uncertainty of the second-biggest U.S. bank failure, Russia’s unrelenting war in Ukraine, inflation and recession risk.

The three dividend-paying pharmaceutical funds to buy offer investors exposure to stocks of various sizes, including large-cap companies with market capitalizations of $10 billion and up, as well as mid caps of $2 billion to $10 billion. Investors received an unexpected jolt of bad news on Friday, March 10, when regulators shut down America’s 17th-largest commercial financial institution, Silicon Valley Bank, of Santa Clara, California.

Other major risks for investors include Russia’s continuing invasion of Ukraine, a 6.4% inflation rate during the past year and plans for the Fed to keep raising ratees that could put the U.S. economy in jeopardy of a recession. Investors who want a diversified portfolio of dividend-paying pharmaceutical funds, including biopharmaceuticals, can choose among several exchange-traded funds (ETFs), said Bob Carlson, a pension fund chairman since 1995 and head of the Retirement Watch investment newsletter. Carlson said he likes the simplicity of choosing funds for investors seeking exposure to an array of drug company stocks of various sizes, including small caps of between $2 billion and $250 million.

Retirement Watch head Bob Carlson discusses investing with Paul Dykewicz.

Three Dividend-paying Pharmaceutical Funds to Buy for Diversification

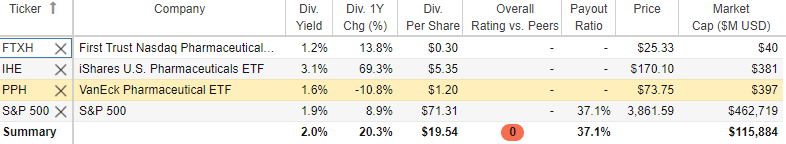

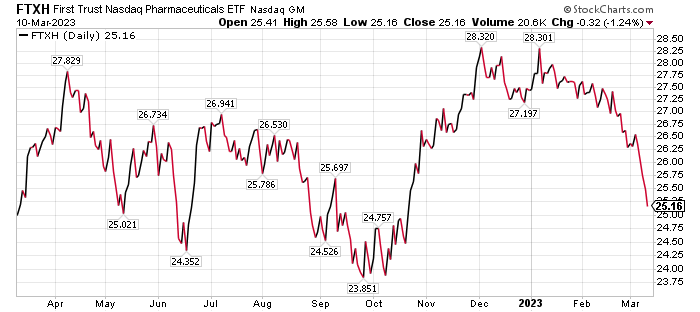

First Trust Nasdaq Pharmaceuticals (FTXH) has earned higher returns over time compared to an alternative ETF, but it is the more volatile of his two choices, Carlson said. The fund generally holds smaller companies that are trading at lower valuations, compared to the portfolios of competing pharmaceutical ETFs, he added.

“As a result, the companies owned by the fund tend to have lower dividends and stock buybacks than others in the industry,” Carlson said.

Courtesy of www.StockRover.com. Learn about Stock Rover by clicking here.

In addition, FTXH is a concentrated fund that recently held 30 positions and had 58% of the portfolio in the 10 largest positions. The portfolio can change rapidly, with the ETF having a 77% turnover rate in the last year, Carlson counseled.

Recent top holdings included Merck & Co. (NYSE: MRK), Gilead Sciences (NASDAQ: QILD), Bristol-Meyers Squibb (NYSE: BMY), Johnson & Johnson (NYSE: JNJ) and Amgen (NASDAQ: AMGN). The fund had a 2.55% return in 2022 but has dipped 7.67% so far in 2023.

Chart courtesy of wwww.stockcharts.com

Three Dividend-paying Pharmaceutical Funds to Buy as Protection Include IHE

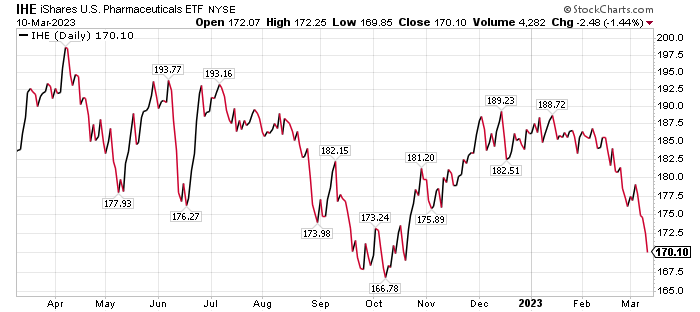

A more conservative choice than FTXH is iShares U.S. Pharmaceuticals (IHE). The fund tries to track the Dow Jones U.S. Select Pharmaceuticals Index. Since IHE seeks to mirror an index, the fund has a much lower turnover ratio of only 20% compared to FTXH.

IHE recently had 48 positions, with 74% of its portfolio consisting of its 10 largest positions. Top holdings were Johnson & Johnson, (NYSE: JNJ), Eli Lilly (NYSE: LLY), Catalent (NYSE: CTLT), Zoetis (NYSE: ZTS) and Viatris (NASDAQ: VTRS).

The fund declined 4.87% in 2022 and is down 8.61% so far this year.

Chart courtesy of www.stockcharts.com

Three Dividend-paying Pharmaceutical Funds to Buy Feature PPH

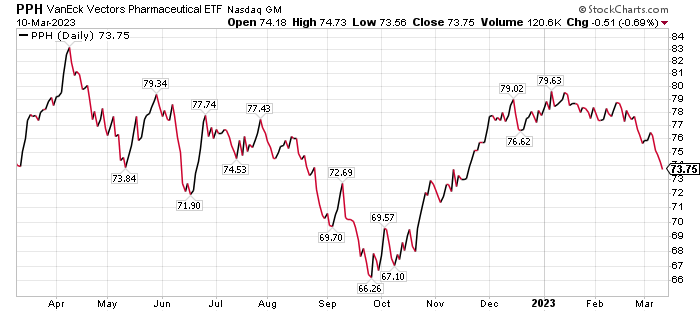

The third dividend-paying fund to buy is the VanEck Vectors Pharmaceutical ETF (PPH). The position, recommended by Jim Woods in his Intelligence Report investment newsletter, remains up about 15% since he first highlighted it in August 2020 amid the COVID-19 pandemic. Of course, there has no doubt been pressure on this sector of late, he acknowledged.

Jim Woods leads Intelligence Report and the High Velocity Options service.

PPH is one of four funds in the Intelligence Report newsletter’s Tactical Trends Portfolio, with only the newest one recommended earlier this year not showing a total return of close to 10% or above. For aggressive investors, Woods heads the High Velocity Options service that produced a 134.34% gain in call options of Brazil’s Zale SA, a mining and minerals stock, within just 30 days. He closed that trade less than three months ago to help his subscribers lock in profits.

Chart courtesy of www.stockcharts.com

The top five positions of PHH are Johnson & Johnson (NYSE: JNJ), Novo Nordisk A/S ADR (NYSE: NVO), Merck (NYSE: MRK), AbbVie Inc. (NYSE: ABBV) and Zoetis Inc. (NYSE: XTS). The fund has 54% of its assets in its top 10 holdings.

Seasoned Investor Skousen Shows the Value of Stops to Safeguard Gains

Another seasoned investment professional who has successfully invested in pharmaceutical stocks is Mark Skousen, PhD, who recommended a profitable one in his Forecasts & Strategies investment newsletter as the overall market struggled during the pandemic. The dividend-paying stock rose 54.76% from December 2015 to July 2021, including part of the COVID-19 crisis.

One of the challenges of investing in pharmaceutical stocks is entering and exiting at the right times, since new product development is not guaranteed to succeed. Skousen chose a large-cap stock and held it through the first part of the COVID-19 pandemic.

The stock, New York-based Pfizer Inc. (NYSE: PFE), turned into a profitable investment when the company astutely teamed up with a smaller industry partner, BioNTech SE (NASDAQ: BNTX), a Mainz, Germany-based biotechnology company that has grown beyond the mid-cap stage and now is at the low end of the large-cap range with a market cap of $31.31 billion. Even though Pfizer did not acquire BioNTech, the two companies formed a partnership to provide one of the world’s first and most effective COVID-19 vaccines.

BioNTech was a mid-cap stock as recently as 2019, when it had a market cap of $7.68 billion before the pandemic. Its partnership with Pfizer produced and distributed a highly effective vaccine. The share prices of BioNTech and Pfizer both rose during the pandemic but Skousen, who also leads the Five Star Trader advisory service that features stocks and options, identified weakness developing in the stocks and the market when he informed his subscribers to take profits. Skousen also tracks inflation and recession risk closely and he has been called one of the top 20 living economists.

Mark Skousen, a scion of Ben Franklin and head of Five Star Trader, meets Paul Dykewicz.

Xenon is Alternative to Three Dividend-paying Pharmaceutical Funds to Buy

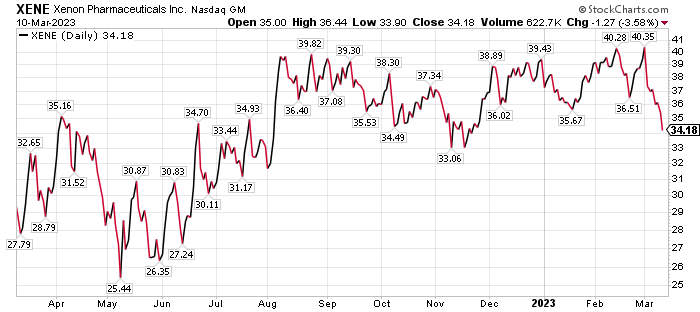

Vancouver, Canada-based Xenon Pharmaceuticals Inc. (NASDAQ: XENE), with a market capitalization of $2.272 billion, is a clinical stage biopharmaceutical company that is developing therapeutics to improve the lives of patients with neurological disorders. Xenon is rated to “outperform” the market by the Chicago-based William Blair investment banking and wealth management firm.

The investment firm calculated an estimated fair value of $47 per share to Xenon, based on a risk-adjusted net present value of the company’s key products sold in the United States and the European Union. The company’s niche is to provide a novel product pipeline of neurology therapies to address areas of high unmet medical need, with a focus on epilepsy.

With a significantly differentiated selective “voltage-gated ion channel modulator platform,” de-risked mechanisms of action for generalized antiseizure medications (ASMs) and a targeted therapy approach for pediatric EEs, Xenon is positioned as a potential market leader in that pediatric treatment, as well as a possible large provider in the broad epilepsy market.

Chart courtesy of wwww.stockcharts.com

Xenon improved its cash position in June 2022 with a public offering that boosted its cash, cash equivalents and marketable securities to $720.8 million at year-end 2022, compared to $551.8 million at the end of 2021. Based on current operating plans, including the completion of the XEN1101 Phase 3 epilepsy studies, Xenon’s management estimated having sufficient cash to fund operations into 2026.

The company reported no revenue in fourth-quarter 2022 and $9.4 million for full-year 2022, compared to $3.7 million and $18.4 million for the same periods in 2021, respectively. For 2022, the decrease of $9.0 million was primarily due to the Neurocrine Biosciences collaboration; completion of all performance obligations for an upfront payment in March 2022 and the June 2022 end of the research component of the collaboration. In addition, $3.0 million was recognized under an agreement with Pacira BioSciences in the year ended 2021, whereas the agreement did not produce any revenue in 2022.

“Prescribing physicians are seeking new, differentiated therapeutic options that improve upon existing anti-seizure medications, and we remain committed to improving the lives of patients with epilepsy,” said Ian Mortimer, Xenon’s president and chief executive officer. “We look forward to important clinical milestones this year including the anticipated topline read-out in the third quarter from our XEN1101 Phase 2 X-NOVA study of a major depressive disorder, as well as an anticipated data read-out from our partners at Neurocrine from their Phase 2 study in adult patients with focal onset seizures in the second half of the year.”

Rising Small Cap Worth Watching Amid Three Dividend-paying Pharmaceutical Funds to Buy

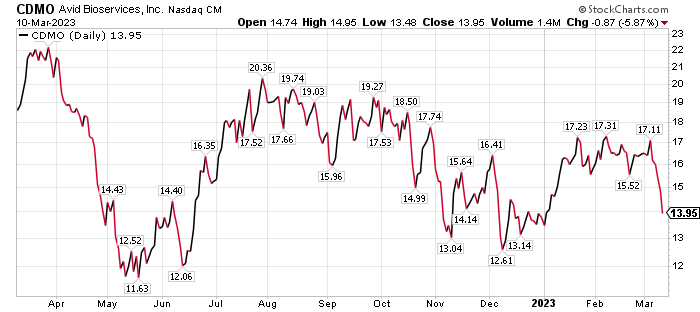

Tustin, California-based Avid Bioservices (CDMO), with a market cap of $1.01 billion, is a contract development and manufacturing organization, or a CDMO. It explains why the company’s leaders chose CDMO as the stock’s ticker symbol, said Michelle Connell, head of Dallas-based Portia Capital Management.

Avid provides manufacturing facilities to other biotech companies, since the industry is constrained and is “very short” on capacity. To address the problem, Avid is in the process of more than doubling its capacity, Connell continued.

Michelle Connell leads Dallas-based Portia Capital Management.

Connell said she prefers CDMO to other biotech companies since it is not developing pharmaceuticals, thereby it lacks dependence on Food and Drug Administration (FDA) approval, Connell counseled. Biotech companies that are dependent upon FDA approval are binary, either winning or losing, she added.

“Thus, there can be huge risk owning one or two pure biotech plays,” Connell said.

Last quarter, CDMO failed to meet its earnings estimates. However, since Avid is building out capacity, the company’s management remains very optimistic, she added.

Avid increased its guidance for future quarters when it missed its latest earnings, Connell continued. She further pointed out that, unlike many biotech plays, Avid is profitable in terms of net income and cash flow. Even though the stock is not quite big enough to reach the low end of the mid-cap category, Connell said she likes it well enough to rate the rising small cap as her top choice in both groups.

“Its operating cash flow has been positive for the past three years,” Connell said. “Like most biotechnology stocks, Avid had negative performance in 2022. However, this year the stock is up over 20%. As the company is still cheap on a price-to-earnings as well as price-to-sales basis, I believe the stock has additional upside of 10 to 20% in the next 12 months.”

Chart courtesy of www.stockcharts.com

Connell counseled not to buy a full investment position in Avid in any rush amid current market weakness.

She predicted there will be opportunities to add to positions, Connell said.

Micro-Cap Pharmaceutical Stocks Offer Another Way to Invest in the Industry

Another way to invest in biopharmaceuticals is through micro-cap stocks. That is the niche of futurist George Gilder’s Moonshots advisory service, which intentionally limits its circulation to enhance its exclusivity. The Moonshots track record has been sterling as an outperforming advisory service that may have a new pharmaceutical pick soon after Gilder and Senior Analyst Richard Vigilante recently returned from a trip to Israel to conduct due diligence on prospective investments.

In face, my stock column next week will feature small- cap pharmaceutical stocks, but investors interested in micro-cap alternatives may appreciate knowing Moonshots’ portfolio companies jumped an average of 84%, double the gains of the NASDAQ, from July 2019 to February 2023, counting only closed positions. I have requested an further information from globe-trotting Gilder and his team as they seek out companies developing the kinds of new paradigms that investors crave.

Wagner Mercenary Boss Blames Russia for Not Providing Enough Ammunition

The head of Russia’s Wagner private army complained in recent days that his soldiers are not receiving the needed ammunition to gain control of Bakhmut, a fiercely contested city in eastern Ukraine. Wagner’s leader Yevgeny Prigozhin was quoted as saying his army’s inadequate ammunition supply could be due to bureaucracy or a ‘betrayal.”

Russian forces have yet to surround the city, Ukrainian officials said. Civilians there reportedly number in the thousands and are mostly cut off from humanitarian relief.

Russia has absorbed more combat deaths in Ukraine during its first year of war than in all its wars combined since the end of World War II, according to research from the Center for Strategic and International Studies (CSIS). The average number of Russian troops killed per month is 25 times the number per month in Chechnya and 35 times those killed in Afghanistan.

“The Ukrainian military has also performed remarkably well against a much larger and initially better-equipped Russian military, in part due to the innovation of its forces,” the CSIS wrote.

Xi Voices Hostility After FBI Chief Says COVID-19 Likely Came from Lab in China

China’s leader, Xi Jinping, and his new Foreign Minister Qin Gang accused U.S. leaders in recent days of suppressing China’s development and creating conflict between the two countries. The criticism came after FBI Director Christopher Wray said on Tuesday, Feb. 28, that COVID-19 likely leaked out of a laboratory in China. It marked the first public opinion of that kind from the FBI about the origins of the virus that caused a global pandemic.

“The FBI has for quite some time now assessed that the origins of the pandemic are most likely a potential lab incident in Wuhan,” Wray told Fox News. “Here you are talking about a potential leak from a Chinese government-controlled lab.”

Worldwide COVID-19 deaths rose to 6,881,955 people, with total cases of 676,609,955, Johns Hopkins University reported on March 10, its last day of collecting data about the pandemic after three years of round-the-clock tracking. COVID-19 cases in the United States totaled 103,804,263, while deaths reached 1,123,836 as of March 10, according to Johns Hopkins University. Until recent reports that China had more than 248 million cases of COVID-19, America had ranked as the country with the most coronavirus cases and deaths.

The U.S. Centers for Disease Control and Prevention reported that 269,650,596 people, or 81.2% of the U.S. population, have received at least one dose of a COVID-19 vaccine, as of March 8. People who have completed the primary COVID-19 doses totaled 230,142,115 of the U.S. population, or 69.3%, according to the CDC. The United States has given a bivalent COVID-19 booster to 50,821,425 people who are age 18 and up, equaling 19.7% as of March 8.

The three dividend-paying pharmaceutical funds to buy provide income and some protection from the big bank failure, Russia’s raging invasion of Ukraine, elevated inflation and recession risk. The three dividend-paying pharmaceutical funds may attract investors seeking exposure to drug companies that provide medications that are needed regardless of a bank collapse, Russia’s war and economic uncertainty.

Connect with Paul Dykewicz

Connect with Paul Dykewicz