Three Dividend-paying Sports Leisure Stocks to Buy as Russian Missiles Continue to Fly

By: Paul Dykewicz,

Three dividend-paying sports leisure stocks to buy as Russian missiles continue to fly feature a U.S. motorcycle company and two full-line sporting goods and outdoor recreation retailers.

They should power through various economic problems such as high inflation, further interest rate hikes by the U.S. Federal Reserve and recent technology industry layoffs. Neither should the three dividend-paying sports leisure stocks to buy be derailed by financially struggling social media business such as Twitter Inc., which billionaire Elon Musk recently purchased.

Meanwhile, Russia’s ongoing invasion of Ukraine is creating a humanitarian crisis as temperatures drop below freezing in the capital of Kyiv and plunge even further in the countryside. The three dividend-paying sports leisure stocks to buy are not as vulnerable to the conflict as many other companies that are directly affected by the fighting or rely on supplies from that region of the world.

Three Dividend-paying Sports Leisure Stocks to Buy as Russian Missiles Aimed at Civilians Continue to Fly

In addition, Ukraine’s energy infrastructure has been severely damaged and left impaired by Russia’s attacks in many parts of the country. The situation deteriorated so badly that U.S. Secretary of State Antony Blinken recently announced $53 million in new aid to help restore Ukraine’s power grid.

Russia’s continuing attacks of neighboring Ukraine risk escalating its war to other nearby countries that are part of NATO. Two Russian-made missiles landed in Poland and caused the death of two civilians on farms in a village roughly four miles, or 6.4 kilometers, west of the Ukrainian border on Tuesday afternoon, Nov. 15. The Russian-made missiles either came from Ukraine’s attempt to fend off the aggressor’s attacks or misfires from Russia that unintentionally reached Poland. Regardless of how missiles killed the two civilians in the NATO nation of Poland, they died due to Russia’s so-called “special military operation” that began on Feb. 24.

“This is not Ukraine’s fault,” NATO Secretary-General Jens Stoltenberg said. “Russia bears ultimate responsibility.”

Russia’s sustained attack of Ukraine has killed more than 100,000 people on each side, according to Mark Milley, Chairman of the U.S. Joint Chiefs of Staff. He also estimated Russia’s invasion created 15 million to 30 million Ukrainian civilian refugees.

Harley-Davidson Leads Three Dividend-paying Sports Leisure Stocks to Buy

Harley-Davidson Inc. (NYSE: HOG), a Milwaukee, Wisconsin-based motorcycle manufacturer founded in 1903, is rated a ‘buy” with a $60 a share by BofA Global Research. The valuation is based on 11-12x the investment firm’s fiscal year 2023 earnings per share estimate of $5.15. Key reasons for the optimistic outlook include new rider interest, increased focus on per unit profitability with a goal of improving Harley-Davidson Motor Company (HDMC) margins to 2014-2015 levels and demographics shifting to a tailwind as the U.S. population of people aged 35-55 grow to add core customers for HOG U.S. retail sales.

Supply chain constraints have drastically restrained new motorcycle sales. However, total new and used motorcycle sales are up, according to IHS registration data. BofA’s full-year 2022 forecasts of HOG’s new motorcycle sales assumes that worldwide shipments are more than 10% below 2019 levels. Due to HOG’s recent production shutdown, 10,000-12,000 shipments were impacted in 2Q 2022, but BofA predicted HOG should recapture lost production in the second half of the year.

Mark Skousen, PhD, has successfully recommended Harley-Davidson in the past through his Home Run Trader advisory service. The last time he did so, subscribers who followed his advice were able to collect a 12.64% gain in the stock and 144.44% in related call options.

Mark Skousen, Forecasts & Strategies chief and Ben Franklin scion, meets Paul Dykewicz.

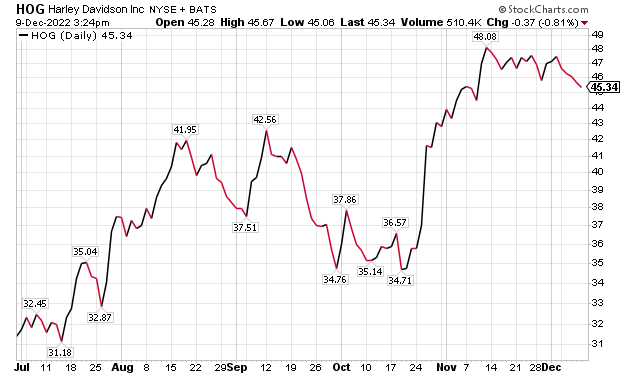

Skousen, who also leads the Forecasts & Strategies investment newsletter, is a free-market economist who uses his knowledge of emerging trends to help him invest in sectors when they have favorable tailwinds. The recent share-price performance of Harley-Davidson shows the company’s prospects are on the rise.

Chart courtesy of www.stockcharts.com

Three Dividend-paying Sports Leisure Stocks to Buy as ‘HOG’ Roars Like a Lion

Harley-Davidson recently reported third-quarter 2022 earnings per share (EPS) of $1.78, compared to BofA’s estimates of $1.52, led by a 19% year-over-year increase in global shipments, which jumped 57,061 versus estimates of 56,469 as HOG recovered the “lion‘s share“ of volume from a second-quarter production shutdown. Motorcycle and related revenue increased 23.8%, and the financial services earnings before interest and taxes (EBIT) margin reached 38.3%.

Michelle Connell, a former portfolio manager who leads Portia Capital Management, of Dallas, Texas, spoke highly of Harley-Davidson’s outlook. No other motorcycle brand exceeds Harley-Davidson in reputation and prestige, Connell continued. Ownership of a Harley-Davidson motorcycle is seen as an entrance into an elite club of members seeking adventures, she added.

Those purchases play into the theme that consumers are seeking experiences when buying the products, Connell said. Those consumers are not simply motivated by purchasing “things,” Connell counseled.

Concerns of Harley-Davidson losing relevance with baby boomers is not valid, Connell opined. The company has established programs that help their motorcycles appeal to younger riders, including females, she added.

Michelle Connell heads Portia Capital Management, of Dallas, Texas.

“Harley-Davidson is starting to reap the rewards of the five-year plan that it announced in May 2020,” Connell said. “This plan is three-plunged in approach: expansion of the Harley-Davidson brand into new markets and buyers, as well as products; improve profitability; and introduce electric motorcycles.”

Due to its solid brand recognition, five-year corporate plan and its compelling and attractive financial metrics, Connell said the stock has a place in a long-term investor’s portfolio that needs consumer discretionary names. But on weakness, she recommended, to capture potential upside of 20-25% by the end of 2023.

Three Dividend-paying Sports Leisure Stocks to Buy: Get Your Kicks from Dick’s Sporting Goods

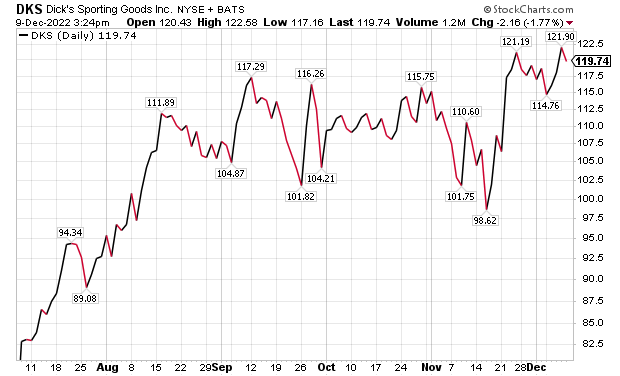

Pittsburgh-based Dick’s Sporting Goods (NYSE: DKS) is the largest full-line sporting goods and outdoor recreation retailer in the United States, offering differentiated product lines and elevated private label assortment, according to BofA. The investment firm gave the stock a $140 price objective and a “buy” rating. The company continues to benefit from the shift to solitary leisure activities, as well as improving demand for the footwear it sells.

Downside risks to meet that price objective are a weakening of the macro environment and rising gas prices, as well as potential secular headwinds in the golf category, weakened customer traffic trends, higher-than-expected cost pressures and the risk of a more competitive pricing environment. The company’s stock has surged since the summer but has further room to rise, BofA assessed.

Connell said she likes Dick’s Sporting Goods but prefers Harley-Davidson. Dick’s Sporting Goods sells virtually every imaginable athletic product and it is where I bought my last softball glove.

Chart courtesy of www.stockcharts.com

Three Dividend-paying Sports Leisure Stocks to Buy Include Academy Sports

Jim Woods, who leads the Bullseye Stock Trader advisory service and the Successful Investing newsletter, also is an avid weightlifter and fitness buff. He previously recommended a fitness stock that soared. Subscribers to his Bullseye Stock Trader service who followed his guidance could have notched returns of 23.54% in the stock and 100.76% gain in the related call options he chose.

Paul Dykewicz, head of Bullseye Stock Trader meets with Jim Woods in Washington, D.C.

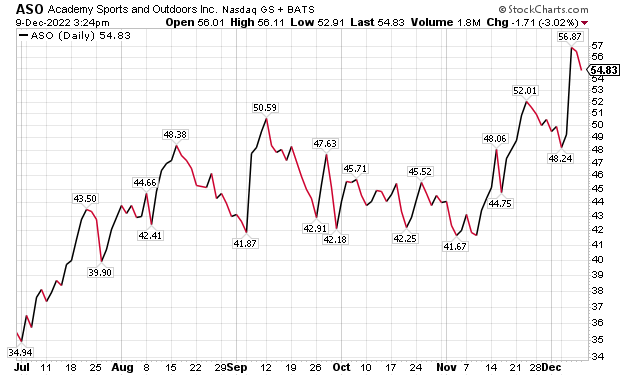

Investors who want to do likewise may want to consider Academy Sports + Outdoors (NASDAQ: ASO), of Katy, Texas. Originally founded in 1938 as a family business, Academy Sports has grown to 268 stores across 18 states. The mission of Academy Sports is to provide “Fun for All,” offering a localized merchandising strategy and value proposition to connect with a broad range of consumers. The product assortment focuses on key categories of outdoor, apparel, footwear and sports and recreation through both national and private label brands.

BofA set a $68 price objective on Academy Sports, based on 10 X 2023 Generally Accepted Accounting Principles (GAAP) earnings per share (EPS), in-line with the average price-to-earnings (P/E) ratio for the athletic/sporting goods retail group. Key reasons include: the long-term EPS compound annual growth rate (CAGR) is in line to slightly above Athletic/Sporting Goods Retail group average of 13%, a broad range of high demand “solitary leisure” merchandise and value-oriented products that should benefit from favorable demographics as budget-conscious millennials enter their “household formation” years and increasingly shop at discount store, BofA wrote in a recent research note.

Risks to Academy Sports reaching BoA’s target price are the emergence of Amazon as a more significant competitor, Nike choosing to allocate product differently in the future, competitive pressures such as expansion by Dick’s Sporting Goods into value-oriented apparel and extension of Kohl’s and Target active products, reliance on Chairman Ken Hicks and increased regulation affecting the sale of firearms and ammunition. An update on Academy Sports should be provided on Dec. 7 when the company is scheduled to report its third-quarter fiscal 2022 financial results before the market opens.

Chart courtesy of www.stockcharts.com

Three Dividend-paying Sports Leisure Stocks to Buy Affected by COVID-19 Cases

With COVID becoming less of a problem than during the past couple of years, fitness aficionados may be tempted to increase their participation in group leisure. But any companies that are affected by supply chain snags could be hurt by China’s security apparatus moving quickly to quash mass protests that followed strict lockdowns as cases of COVID-19 swept the country during the past week or so.

China’s police patrolled streets, checked cell phones and called some demonstrators to warn them against continuing their civil unrest. That response has reduced protests about the country’s zero-COVID policy that is slowing economic growth and had led many people to publicly oppose the controversial lockdown policy of China’s leader Xi Jinping. If China’s authorities do not pay attention to the concerns of their citizens, draconian lockdowns could cause intensified clashes and bog down supply chains.

COVID-19 cases in the United States totaled 98,961,736 and deaths reached 1,081,410, as of Dec. 2, according to Johns Hopkins University. America has the dreaded distinction of amassing the most COVID-19 cases and deaths of any nation. Worldwide COVID-19 deaths totaled 6,639,746 people, while total cases reached 644,655,254, Johns Hopkins reported on Dec. 2.

The U.S. Centers for Disease Control and Prevention reported that 267,346,533 people, or 80.5% o the U.S. population, have received at least one dose of a COVID-19 vaccine, as of Nov. 30. Those who have completed the primary COVID-19 doses totaled 228,369,460, of the U.S. population, or 68.8%, according to the CDC. The United States also has given a bivalent COVID-19 booster to 37,885,266 people who are age 18 and up, accounting for 14.7% of the U.S. population in that age group.

Despite Russia’s leaders calling their country’s attacks against Ukraine a “special military operation,” firing into Ukraine unrelentingly and causing the death of two Polish civilians, investors stil have good place to put their money. The three dividend-paying sports leisure stocks to buy give investors a way to navigate risk and pursue reasonable returns and income payouts amid increased economic risks.

Connect with Paul Dykewicz

Connect with Paul Dykewicz