Three Top Dividend-paying Exchange-traded Funds Highlighted by Retirement Expert

By: Emily Mirabelli,

Three top dividend-paying exchange-traded funds highlighted by retirement finance expert Bob Carlson may offer investors key advantages.

Diversification, profit and security are important factors in an investor’s decision making, especially in a market that appears to be tanking. Investors can find the answers they need in one alternative: dividend-paying exchange-traded funds (ETFs).

Such ETFs are a great option for investors in this uncertain economy. They come with lower expense ratios and fewer commissions to brokers than buying individual stocks, and their price moves throughout the day as their shares are traded to add to their liquidity.

Moreover, because there are multiple assets within an ETF, they are popular for investors looking to diversify. ETFs can hold various types of investments, including stocks, commodities, bonds or a mixture of them.

The following ETFs offer a generous dividend of above 6%, which can be reinvested or saved, a moderate expense ratio and sound diversification: JPMorgan Diversified Return International Equity ETF (JPIN), Cambria Emerging Shareholder Yield (EYLD) and Cambria Trinity (TRTY).

Two of the three featured ETFs have been recommended by retirement-finance expert Bob Carlson, the editor of Retirement Watch, which can be subscribed to on his website Retirementwatch.com.

Further, his Spotlight Series is an accumulation of special reports focusing on different and important aspects of retirement, as well as worksheets for retirees to use in their own planning.

Carlson has written several books, including his latest, “The New Rules of Retirement.” Further, he has served on the Board of Trustees of the Fairfax County Employees’ Retirement System since 1992 and been chairman since 1995.

Jumping into the Three Top Dividend-paying ETFs with JPMorgan Diversified Return International Equity ETF (JPIN)

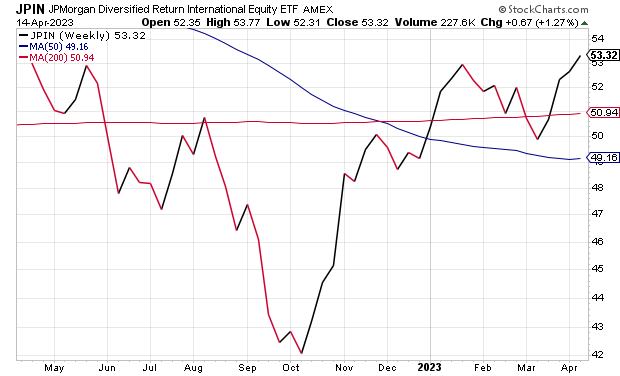

JPMorgan Diversified Return International Equity ETF (JPIN) is a leader in the dividend-paying ETF category, with a 6.70% dividend yield, set to be paid on Dec. 20, and a low expense ratio of 0.37%.

Founded in 2014, JPIN has 479 holdings and seeks exposure to market segments known for their historical strength, including finance, consumer non-durables and utilities, while diversifying risk across multiple regions and sectors.

JPIN’s risk diversification method works by filtering stocks and funds for value, momentum and quality factors. After assessing each security, they are assigned to one of 40 different allotments within the ETF.

Each allotment is weighted to contribute equal risk to the fund based on historic volatility, and the holdings are equally weighted within each of the 40 allotments. JPIN has $715.61 million in net assets and $647.79 million in assets under management.

As is visible in the chart below, the ETF had a steady decline year to date; however, it is beginning a climb which may entice investors looking to get in at a lower price.

Courtesy of Stockcharts.com

Coming in Second of the Three Top Dividend-paying ETFs with Cambria Emerging Shareholder Yield (EYLD)

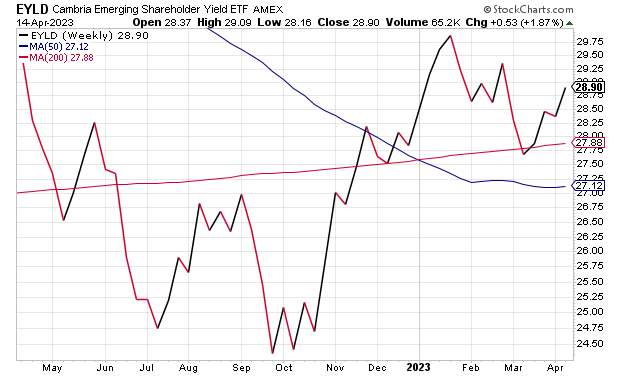

Launched in 2016, Cambria Emerging Shareholder Yield (EYLD) is a Bob Carlson recommendation. The ETF has a sturdy dividend yield of 6.31% and a fair expense ratio of 0.64%.

Carlson explained that “the fund’s parent company, Cambria, ranks dividend-paying stocks by the ability of their companies to continue paying or increase their dividends.” He added that the ranking uses a range of factors instead of the one or two used by most dividend-quality assessments. The fund generally buys the top 100 emerging market companies in the ranking.

The factors mentioned by Carlson are both fundamental and technical. The fundamental metrics include price to cash flow, price to book value and enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA). Other factors include the momentum and trend technical factors.

Once the ranking process is over, the top 100 stocks that receive the highest rankings in all the above categories are then selected and given equal weight within the final portfolio.

EYLD has net assets of $91.47 million and assets under management of $95.94 million. The fund is down 22.93% over 12 months and 8.58% in the last four weeks.

Much like JPIN, EYLD has seen a downward trend, but is beginning a recovery, which a great place for interested investors to get in at a discounted price.

Courtesy of Stockcharts.com

Wrapping up the Three Top Dividend-paying ETFs with Cambria Trinity ETF (TRTY)

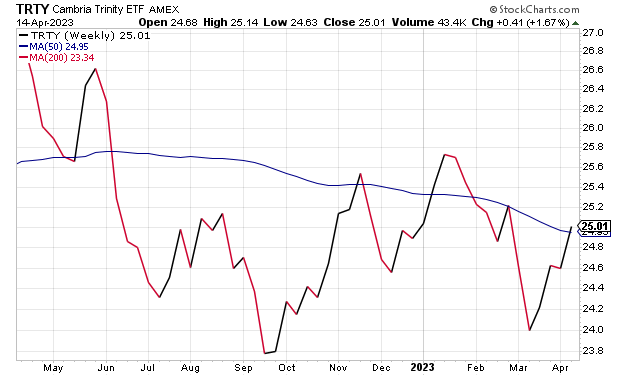

Last, but certainly not least, is Carlson’s second recommendation: Cambria Trinity ETF (TRTY).

TRTY is a tactical allocation fund with a 6.12% yield. But as Carlson explained, the yield price can change over time as the fund’s allocation to different assets changes. Though the yield may vary, its 0.50% expense ratio will not.

TRTY varies from the other two picks as it is set up in a fund-of-funds style. Simply, this ETF’s portfolio is composed of other investment funds rather than stocks, bonds or other securities.

Not only does the fund seek exposure to a wide variety of asset types and investments, but it also includes a broad geographic exposure. TRTY’s active manager looks for opportunities with absolute positive returns and lower risk than global market equities.

While there is not much detail about the ETF’s inner workings available to the average investor, retirement-finance expert Carlson was able to provide some extra insight on what the managers look for when choosing holdings.

“The managers look at three factors: value, momentum and market trends to allocate the fund among U.S. stocks, foreign stocks, bonds, real assets, cash and other investments,” he explained.

TRTY has $56.18 million in net assets and $98.29 in assets under management. As seems to be the trend in the market these days, TRTY is down 10.05% in the last four weeks but is up 22.13% over 12 months.

The ETF may have taken a dip, but it is apparent that it is a strong enough fund to rebound. It has seen sharp dips, but each one has been followed by a recovery.

Courtesy of Stockcharts.com

Conclusion: Three Top Dividend-paying Exchange-traded Funds of a Retirement Expert

Ultimately, these three top dividend-paying exchange-traded funds highlighted by retirement finance expert Bob Carlson may offer investors several advantages.

ETFs are a great option for investors in this economy, as they come with lower expense ratios and fewer commissions paid to brokers than buying individual stocks. Also, their price moves throughout the day as their shares are traded to add to their liquidity.

Moreover, as has been highlighted above, they are popular for investors looking to diversify. ETFs can hold various types of investments, including stocks, commodities, bonds or a mixture of assets.

So, while JPMorgan Diversified Return International Equity ETF (JPIN), Cambria Emerging Shareholder Yield (EYLD) and Cambria Trinity (TRTY) all may have recently seen a downturn, it is evident that they are once again heading upward. This is a great time for interested investors to get in at reduced prices.

For more of Bob Carlson’s insights, market picks and retirement finance information, it can all be found on his website, Retirementwatch.com. He offers monthly newsletters, weekly e-letters and paid special reports, which can also be accessed as part of his Spotlight Series.

Connect with Emily Mirabelli

Connect with Emily Mirabelli