TransMontaigne Partners Rewards Shareholders with 8.3% Dividend Yield (TLP)

By: Ned Piplovic,

TransMontaigne Partners L.P. (NYSE:TLP) has boosted its total annual dividend payout amount every year since the company started distributions in 2005. It currently offers its shareholders an 8.3% dividend yield.

In addition to 13 years of consecutive annual dividend hikes, the company has also increased its quarterly dividend amount for the past 12 consecutive quarters. Furthermore, TransMontaigne’s current dividend yield is on par with the average yield of the company’s dividend-paying peers and above overall industry averages.

While the share did not perform as well as the company’s dividends did over the past 18 months, the share price has been rising, albeit with significant volatility, as part of an overall uptrend after bottoming out at the end of first quarter.

After spending more than a year below the 200-day moving average (MA), the 50-day MA finally broke above the 200-day MA in a bullish manner at the beginning of September 2018. Since then, the trend indicates a potential continuation of the slow ascent. However, the share price has somewhat struggled to remain above the moving averages at all times. While the share price broke above both moving averages for the first time in 2018 on July 18, the price had dipped back below the 200-day MA by the second week of August. While share price was below both moving averages as recently as October 2, the share price closed above both moving averages on October 18, 2018. Furthermore, the 50-day MA was marginally hovering over the 200-day MA at this time.

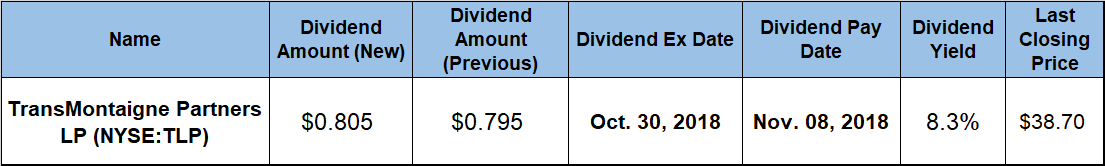

It might be too early for some investors to call this a growth signal. However, investors with higher risk tolerance might consider taking advantage of the extraordinary dividend yield and collect the dividend income distributions. Then, they might choose to wait and see whether the share price will surge higher. To collect the distributions on the November 8 pay date, investors must be shareholders of record prior to the October 30, 2018, ex-dividend date.

TransMontaigne Partners L.P. (NYSE:TLP)

Headquartered in Denver, Colorado and founded in 2005, TransMontaigne Partners L.P. provides integrated storage, transportation and related services to customers engaged in the trading, distribution and marketing of light and heavy refined petroleum products, crude oil, chemicals, fertilizers and other liquid products. The company operates around 50 product terminals, more than 850 individual storage tanks, 38 million barrels of storage capacity and approximately 300 miles of pipelines throughout Florida, Oklahoma, Missouri, Arkansas, Ohio and Louisiana. Additionally, TransMontaigne Partners operates a 7-million-barrel terminal and storage facility in the Port of Houston.

The share price entered the trailing 12 months on a downtrend that started back in March 2017. Starting from its 52-week high of $41.90 on October 18, 2017, the share price lost 17% of its value before reaching the 52-week low of $34.79 on March 9, 2018 – almost exactly one year after the most recent downtrend began. Since bottoming out in early March, the price gained more than 11% and closed on October 18, 2018 at $38.70, which was just 7.6% lower than one year earlier.

The current $0.805 quarterly dividend is 1.26% higher than the previous period’s $0.795 amount and 6.6% above the $0.755 quarterly payout from the same period last year. This current quarterly distribution converts to a $3.22 annualized distribution and an 8.3% forward dividend yield, which is 12.4% above the company’s own 7.4% five-year average.

Additionally, the 8.3% dividend yield is more than 250% above the 2.35% average dividend yield of the entire Basic Materials sector, as well as nearly 85% higher than the 4.51% simple average dividend yield of all the companies in the Oil & Gas Pipelines industry segment.

Over the past 12 consecutive quarters, the company enhanced its quarterly payout more than 20%, which is equivalent to an average growth rate of 1.6% per quarter. Additionally, the 13 years of consecutive boosts enhanced the total annual payout almost four-fold, which corresponds to an average annual growth rate of 10.8%.

The share price recovery from its 52-week low in March fell just a little short and the company delivered a total loss of nearly 2% over the past 12 months. However, the longer-term total returns were substantially higher. The five-year total return exceeded 25% and the three-year total return was just short of 52%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic