Triton International Offers 6% Yield, 20% One-Year Asset Appreciation (TRTN)

By: Ned Piplovic,

Triton International (NYSE: TRTN) saw share price appreciation of nearly 20% over the past year. Combined with a solid 6% dividend yield, investors in the company saw a total return of almost 26% over the past 12 months.

Despite exceeding analysts’ expectations in its fourth quarter and year-end results for 2017, Triton’s share price dropped 13.5% the day that the company announced its financial results. Apparently, analysts and investors interpreted the poor financial results reported by Triton’s main rivals — CAI International, Inc. (NYSE: CAI) and Textainer Group Holdings Limited (NYSE: TGH) — as negative signs for 2018 and projected that the overall shipping container rental market would perform poorly through the end of the year. However, those assumptions might be a little premature and Triton International might be a good equity choice for balanced overall returns from above-average dividend yields and share price growth.

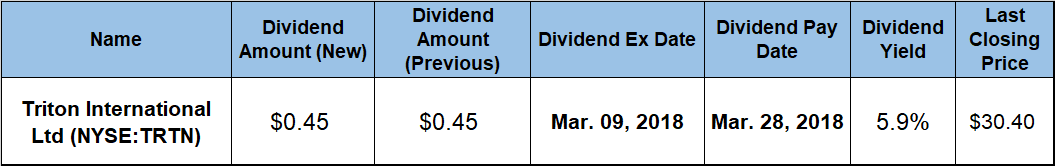

The company will distribute its quarterly dividend on March 28, 2018 to shareholders of record as of the March 9, 2018 ex-dividend date.

Triton International (NYSE:TRTN)

Based in Hamilton, Bermuda and founded in 1980, Triton International Limited engages in the acquisition, leasing and sale of intermodal containers and chassis to shipping lines and freight forwarding companies through two business segments — Equipment Leasing and Equipment Trading. In addition to leasing its own inventory, the company also manages containers that are owned by third parties. The company owns and operates more than 3.1 million containers and chassis that represent more than 5.1 million twenty-foot equivalent units (TEUs) of shipping capacity.

In July 2016, Triton Container International Limited and TAL International Group, Inc. merged, forming Triton International Limited. Since then, the company has been distributing the same $0.45 quarterly distribution. The current dividend amount converts to a $1.80 annual dividend and forward yield of 6%. By comparison, the average yield of the entire services sector is 2%. Additionally, Triton International’s current yield is 310% higher than the 1.45% average yield of the Rental & Leasing Services segment and 120% higher than the 2.66% average yield of only dividend-paying companies in the segment.

This outperformance in terms of dividend yield is not surprising, as Triton International currently has the highest yield of all the companies in the Rental & Leasing Services segment. With a yield of 5.5%, Aircastle Limited (NYSE: AYR) is Triton’s only peer in the segment with a yield above 3%.

Triton’s share price dropped 13.7% in the first two weeks of the trailing 12-months (TTM) and hit a 52-week low price of $21.98 on March 9, 2017. After the March bottom, the share reversed and rose to nearly double their value, reaching a 52-week high of $43.46 by November 9, 2017. As of February 23, 2018, the share price had pulled back 30% since its November 2017 peak, closing that day at $30.40, which is 19.4% higher than it was one year earlier and 38% higher than the share price’s 52-week low from March 2017.

Triton’s upper management believes that the company is well-positioned to handle any adverse market conditions in the near future. Triton’s Chairman and CEO Brian Sondey stated during the company’s results call on Feb. 12 that Triton’s upper management expects favorable market conditions for 2018, with solid demand growth and a well-controlled supply of containers. “We are also well protected from the risk of rising interest rates since over 86% of our debt is either fixed rate or hedged to fixed rates with interest rate swaps, and the weighted average life of our fixed interest rate debt and swaps was 48 months as of December 31, 2017.” Sondey added.

While the ocean shipping industry operates with long business cycles and might not be a good portfolio fit for all investors, Triton International might offer investors interested in sector the best potential for double-digit-percentage returns in 2018.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic