United Community Banks Hikes Quarterly Dividend 25% (UCBI)

By: Ned Piplovic,

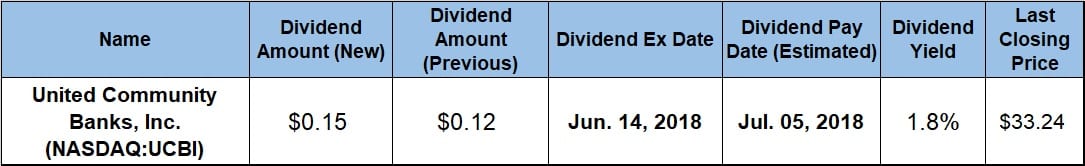

United Community Banks, Inc. (NASDAQ:UCBI) hiked its quarterly dividend 25% to keep pace with its rapidly increasing share price, which nearly doubled since February 2016 and more-than tripled over the past five years.

The company’s current quarterly dividend hike raises the dividend yield more than 28%, compared to a 14% one year ago, to reach its current yield of 1.8%. While this dividend yield is lower than average yields in the overall Financial sector, the UCBI’s current yield still outperformed the average yield of it regional peers.

The bank has built its business by emphasizing customer service and has received the top rankings among the Southeast regional banks on the J.D. Power U.S. Retail Banking Satisfaction Study for 2018, as well as the previous four consecutive years. Forbes also included the company in its 100 Best Banks in America in 2018, which was UCBI’s fifth consecutive appearance on that list. The bank’s focus on retail customers could turn out to be a good business expansion strategy among the rising number of customers who are dissatisfied with the perceived lack of similar customer service commitment to small and non-institutional customers by the large international banking institutions.

The company set its next ex-dividend date for June 14, 2018, and will make its next dividend distribution to all eligible shareholders on July 5, 2018.

United Community Banks, Inc. (NASDAQ:UCBI)

Based in Blairsville, Georgia and founded in 1950, United Community Banks, Inc. operates as the bank holding company for United Community Bank. The bank provides a full range of standard consumer and commercial banking products including lending, cash management, deposit and investment solutions, such as deposit accounts, money market deposits and certificates of deposit (CDs). Additionally, the company also provides wire transfers, brokerage services, payment processing and owns an insurance agency. As of May 2018, the company operated 145 Branch locations, three loan offices and more than 150 standard Automated Teller Machines (ATMs) in Georgia, North Carolina, South Carolina and Tennessee. The company also operated more than 1,200 ATM’s inside Publix supermarkets across the four states, as well as Alabama, Florida as far as Key West and eight locations in Richmond, Virginia.

The company’s boost increased the quarterly dividend from $0.12 in the previous quarter to its current $0.15 distribution, which converts to a $0.60 annualized payout and currently yields 1.8%. The company initiated dividend distributions in 2002 and boosted its annual dividend amount every year through 2009. In addition to the rising annual dividends, the company distributed over that period several special dividends in the form of cash distributions or additional shares.

However, in the aftermath of the 2008 financial crisis, the company suspended its dividends and did not resume its quarterly dividend distributions until July 2014. Since resuming dividend distributions, the company hiked its annual dividend every year and advanced its total annual payout amount five-fold over the past four years. This extraordinary level of increase is equivalent to an average growth rate of nearly 50% per year.

Despite the rapid dividend growth, the UCBI’s yield was not able to keep pace with the company’s share price growth over the past five years. Therefore, the current 1.8% dividend yield is nearly 45% below the company’s 3.3% five-year average yield. However, the current yield did advance more than 28% compared to the 1.4% dividend yield one year ago.

Similarly, the bank’s current yield is more than 40% below the 3.13% average yield of the entire Financials sector but almost 11% higher than the 1.6% simple average yield of all the companies in the Southeast Regional Banks industry segment.

While the quarterly dividend payouts provided shareholders with a steady flow of rising dividend income, the company’s share price grew even faster. The share price pulled back 4.6% in the first three month of the trailing 12-month period and reached its 52-week low of $24.67 on September 7, 2017. However, after bottoming out in early September 2017, the share price resumed its long-term uptrend and advanced more than 35% by May 21, 2018, to reach its 52-week high of $33.45. The company’s share price closed on June 6, 2018, at $33.82, which was just 1% below the 52-week high. Additionally, the June 6, 2018, closing price was 31% higher than it was one year earlier and 37% above the 52-week low from September 2017.

The company’s rising dividend distributions and its asset appreciation rewarded shareholders with a combined total return of nearly 30% over the past 12 months, a total return of 78% over the past three years and a total return of 157% over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic