United Security Bancshares Boosts Quarterly Dividend Payout 11% (UBFO)

By: Ned Piplovic,

United Security Bancshares (NYSE: UBFO) — a regional bank in California – is set to hike its quarterly dividend amount 11% for the upcoming distribution in mid-October.

For an eight-year period from 2008 through 2016, the bank suspended all dividend payments. Distributions resumed in 2017, and United Security has hiked the payout amount three times since then, effectively doubling the annual amount in less than two years. Despite paying no dividends for nearly a decade, the company had an excellent record of rising dividend distributions prior to 2008, with a boost to the annual dividend occurring every year since distributions started in 1998.

While United Security Bancshares is a small holding company with a market capitalization of only $190 million and approximately $825 million in assets, the company continues to expand in its market and offers steady financial results. For the second quarter of 2018, UBFO reported 33% growth in net income versus the same period last year, as well as a 54% increase for the six-month period. Furthermore, diluted earnings per share increased 56% from $0.25 for the first six months of 2017 to $0.39 for the same period in 2018.

Despite the low market capitalization, UBFO could be a good pick for investors interested in the Financials sector, but who are looking to stay away from leveraged risk and exposure to derivative investments. The company has rewarded its shareholders with a total return of more than 20% just over the past year, and investments over the past three and five years, respectively, have doubled and tripled in value.

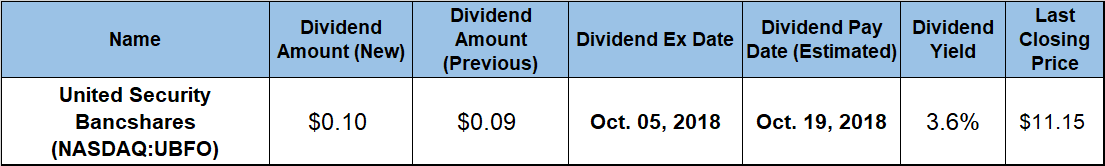

The company will distribute its next dividend on October 19, 2018 to all shareholders of record prior to the October 5, 2018 ex-dividend date.

United Security Bancshares (NYSE:UBFO)

Headquartered in Fresno, California and founded in 1987, United Security Bancshares operates as the holding company for the United Security Bank — a state-chartered bank that provides a range of commercial services in California. The company offers various deposit products, savings accounts, interest-bearing negotiable order of withdrawal accounts, money market accounts and certificates of deposit. Additionally, the bank’s loan portfolio consists of real estate mortgage, commercial, industrial, real estate construction and consumer loans, as well as agricultural and lease financing. As of September 2018, the bank provided its services through 11 branches and three loan centers in California’s Fresno, Madera, Kern and Santa Clara Counties.

UBFO’s third dividend hike in the last two years will be an 11.1% jump from $0.09 per share on a quarterly basis to $0.10 per share. This new quarterly dividend payout is equivalent to a $0.40 annualized distribution and a 3.6% forward yield. With the average dividend yield of the entire Financials sector currently at 3.07%, UBFO’s yield is higher by nearly 17%. Additionally, it is more than double the average yield of all the bank’s peers in the Pacific Regional Banks industry segment.

Remarkably, UBFO has enhanced its annual dividend almost five-fold since beginning quarterly dividend distributions in 1998. This level of annual dividend growth corresponds to an average growth rate of more than 8% per year for the past two decades, even counting the eight-year gap with no payments. If we disregard the gap, the figure increases to nearly 14%.

The share price here has gone through a similarly harrowing journey in the last decade. After losing 80% of their value in the aftermath of the 2008 financial crisis, UBFO shares have been rising steadily with only minor fluctuations since mid-2012. The start of the trailing 12-months saw the share price pull back 4.2% to 52-week low of $9.20. However, after that small pullback, the share price resumed its uptrend and reached its highest price over the past five years of $11.60 on January 17, 2018. The closing price on Sept. 26 of this year was less than 4% below the January peak at $11.15, marking a 16% advancement over the past 12 months and a 21.2% rise since November.

Despite just three quarterly dividend payouts in 2017, the company still managed to deliver a 20.6% total return over the past 12 months. Even without significant contributions from dividend payouts, the total returns were 137% over the past three years and 216% over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic