UPS Offers Shareholders 18 Years of Rising Dividend Distributions (UPS)

By: Ned Piplovic,

Back in November of 1999, the United Parcel Service (NYSE: UPS) declared its initial quarterly distribution, and in the 18 years since then, the company has never failed to pay a rising dividend.

Over the past five years, UPS’ rising dividend payments managed to outpace the company’s robust asset appreciation, which has maintained a steady growth trend since the aftermath of the 2008 financial crisis. As a result, the current 3% dividend yield exceeds the five-year yield average by more than 8%.

Except for the share price decline in 2008, the company has proven itself a reliable source of capital growth and rising dividend income, with minimal volatility to be found in its trading history. Current financial results for UPS show no warning signs of a disruptive impact or major headwind for the share price. Moreover, the company has beaten analysts’ earnings expectations in the past three consecutive quarters.

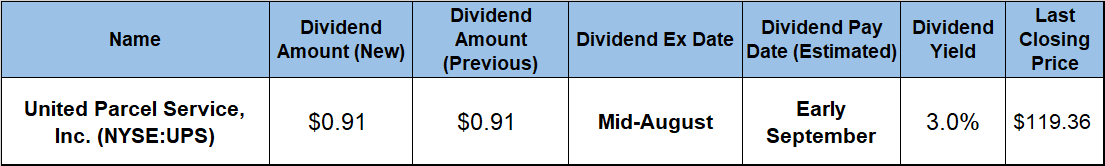

UPS has not yet declared an ex-dividend date for its upcoming distribution, but the company historically goes “ex” in the middle of August and sets the pay date in early September. No change is expected in the quarterly payout amount, which currently sits at $0.91 per share.

United Parcel Service, (NYSE:UPS)

Headquartered in Atlanta, Georgia and founded in 1907, the United Parcel Service, Inc. provides letter and package delivery, specialized transportation, logistics and financial services. The company operates through three business segments — U.S. Domestic Package, International Package and Supply Chain & Freight. The U.S. Domestic Package segment offers time-definite delivery of letters, documents, small packages and palletized freight through air and ground services in the United States. The International Package segment provides guaranteed day and time-definite international shipping services in international markets. This segment offers guaranteed time-definite express options, including Express Plus, Express and Express Saver. Lastly, the Supply Chain & Freight segment provides international air and ocean freight forwarding, customs and truckload freight brokerage, warehousing, distribution, mail and consulting services in approximately 220 countries and territories. Additionally, this segment provides less-than-truckload (LTL) and truckload services to customers in North America.

In support of its freight and logistics operations, UPS also offers shipping, visibility and billing technologies, as well as insurance, financing and payment services. As of May 2018, the company operated more than 1,800 facilities, a ground fleet of approximately 120,000 package cars, vans, tractors and motorcycles, including more than 9,000 alternative fuel and advanced technology vehicles. The company’s air fleet comprises of 244 wholly-owned aircraft, as well as an additional 320 aircraft chartered or leased on a short-term basis.

UPS began the trailing 12-month period by spiking more than 20% to a 52-week high of $134.09, which it reached on January 21, 2018. However, after that spike, the share price fell close to 25% and went into negative territory. The March 23 low of $101.66 effectively erased all gains over the past two years. However, the share price recovered quickly and returned to its levels from one year earlier in just one month. Currently, UPS trades close to $120 a share, or just 11% short of the January peak, 8.3% higher than of was one year earlier and 17.4% above the March 2018 low.

This time last year, UPS was paying an $0.83 per share distribution every quarter, which makes the current $0.91 quarterly dividend 9.6% higher. The current 3% yield is almost 9% higher than the company’s 2.8% average yield over the past five years, as well as almost 60% above the 1.92% simple average yield of the entire Services sector.

It should be noted, though, that the Services sector is quite diversified. Therefore, I believe a comparison of UPS to its industry peers gives a better indicator of yield performance. So, as the highest yield in the Air Delivery & Freight Services industry segment, UPS’ current yield is almost triple the average yield of all companies in the segment, and 77% higher than the average yield of the sector’s dividend-paying companies.

The last 18 years have seen UPS advance its total annual dividend amount by 435%, which is equivalent to an average growth rate of almost 10% every year. This rising dividend combined with the company’s asset appreciation meant that shareholders saw a total return of nearly 12% over the past year and a 26.6% total return over the past three years. The total return over the past five years was 55.5%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic