Valero Energy Corporation Rewards Shareholders With 70%-Plus One-Year Total Returns, 2.8% Dividend Yield (VLO)

By: Ned Piplovic,

Featired Image Source: www.valero.com

For more than five years, the Valero Energy Corporation (NYSE: VLO) has been offering steady asset appreciation and rising annual dividend payments, which combined, have generated double- or triple-digit-percentage total returns for shareholders.

Despite the fact that VLO’s share price nearly tripled in the last five years, the current 2.8% dividend yield is actually higher than the company’s own five-year average yield. Normally, a rapid share price increase would drive the dividend yield lower, but in this case, Valero has been raising its dividends sufficiently enough to be able to keep pace with the increasing price.

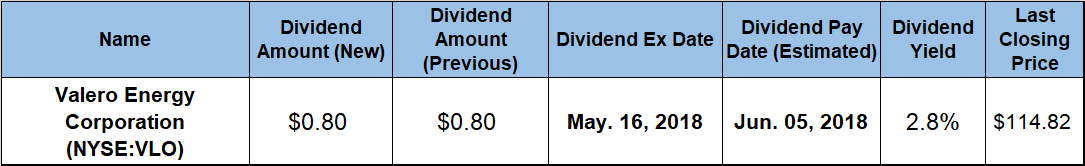

The company will distribute its next dividend on the pay date of June 5, 2018 to all shareholders of record prior to the May 16, 2018 ex-dividend date.

Valero Energy Corporation (NYSE:VLO)

Headquartered in San Antonio, Texas and founded in 1955, the Valero Energy Corporation operates as an independent petroleum refining and ethanol producing company in the United States, Canada, Ireland and the United Kingdom. It operates mainly through two business segments: Refining and Ethanol. The Refining segment produces conventional and premium gasolines, gasoline meeting the specifications of the California Air Resources Board (CARB), diesel fuels, low-sulfur diesel fuels, jet fuels, asphalts, petrochemicals, lubricants and other refined products. The Ethanol segment produces and sells ethanol, distiller grains and corn oil primarily to refiners and gasoline blenders, as well as to animal feed customers.

As of December 31, 2017, Valero owned 15 petroleum refineries with a combined throughput capacity of more than 3 million barrels per day, as well as 11 ethanol plants with a combined ethanol production capacity of approximately 1.4 billion gallons per year. VLO markets its refined products through wholesale rack and bulk markets, as well as through approximately 7,400 outlets under the Valero, Diamond Shamrock, Shamrock, Ultramar, Beacon and Texaco brand names.

Paying an $0.80 quarterly distribution right now, Valero’s current quarterly payout is 14.3% higher than the $0.70 dividend from the same period last year. On an annual basis, this payout converts to a $3.20 annual distribution and approximately a 2.8% dividend yield, which is just slightly higher than the company’s 2.7% average dividend yield over the past five years.

Valero Energy has a strong track record of raising its annual payout since the company started paying a dividend in 1997. After paying a flat dividend for the first three years in a row, Valero hiked its dividend every year between 2001 and 2009. In 2010, the company cut the annual dividend by two-thirds. However, after the company resumed paying rising dividends in 2011, it boosted its annual payout amount above the 2009 level in just two years. Over the past seven consecutive years, the company hiked its annual dividend 14-fold by boosting the annual payout amount at an average growth rate of 45.8% every year.

VLO shares experienced a small dip of less than 10% at the onset of the trailing 12-month period and reached a 52-week low of $60.69 on May 30, 2017. However, with some small declines along the way, the share price has risen to well over $100 by May 2018, a gain of almost 90% from the 52-week low. On May 9, VLO closed at $114.82, which was 72% higher than one year earlier and over 200% higher than it was five years earlier.

Indeed, Valero Energy Corporation has been rewarding its shareholders with outsized total returns for decades, and the past few years are no exception. In addition to the 70%-plus total return over the last 12 months, the past three and five years were in the triple-digit percentages, counting dividends, The three-year total return comes in slightly over 100%, and the total return over five years exceeds 220%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic