Verizon Boosts Quarterly Dividend Payout 2.1% (VZ)

By: Ned Piplovic,

Verizon Communications, Inc. (NYSE:VZ) continued its streak of consecutive annual dividend hikes and enhanced its quarterly dividend payout amount another 2.1% for the upcoming round of dividend distribution in early November.

The company’s current streak of annual dividend hikes does not appear to be in danger of terminating any time soon. Verizon’s current dividend payout ratio of 31% indicates that the dividend distributions are well covered by the company’s earnings. Additionally, the company’s current ratio is almost 50% lower than the five-year average payout ratio of 59%, which suggests that the company has improved its earnings over the past few years.

In addition to the continued dividend growth, Verizon’s share price found its stride and embarked on a steady uptrend over the past six months, overcoming a significant dip in late 2017 and reaching new 52-week highs in mid-September 2018.

A portion of the share price advancement could be attributed to the investor confidence that Verizon will be successful in its rollout of the 5G network technology, which promises to speed up wireless network communication up to 1,000-fold over the current 4G technology. Furthermore, Verizon is on track to be the first U.S. mobile network operator to go live with the new technology — perhaps as early as October 2018.

Even before the introduction of the 5G technology, which should give the company a first-mover advantage over its competitors, Wall Street Analysts expected Verizon to report earnings per share increase of more than 21% over the same period last year.

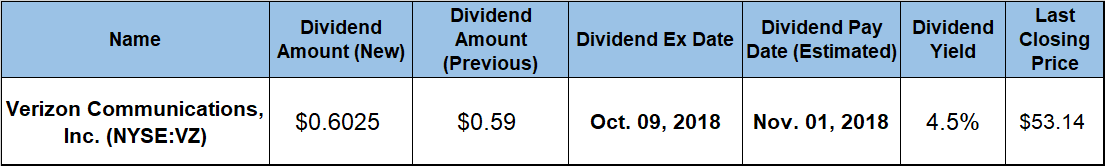

The company set its next ex-dividend date for October 9, 2018, and will distribute its next dividend just a few weeks later on its November 1, 2018 pay date.

Verizon Communications, Inc. (NYSE:VZ)

Founded in 1983 and headquartered in New York City, Verizon Communications Inc. provides communications, information and entertainment products and services. The company offers wireless voice and data services, internet access on various smart and basic phones, notebook computers and tablets. Additionally, Verizon offers Internet of Things (IoT) services that support devices used in fleet management and telematics, energy and agricultural technology, as well as smart community markets and wireless devices. The company’s Wireline segment offers high-speed Internet, Fios Internet, Fios video services and Voice over Internet Protocol (VoIP) telephone service. As of November 2017, 98% of U.S. population had coverage of Verizon’s current 4G LTE network.

While the company’s share price experienced moderate volatility over the past 18 months, it recovered all its intermediate losses and currently trades more than 7% above its level from one year earlier. After bottoming out at $44.11 in mid-November 2017, the share price spiked to more than $54 by the end of January 2018. However, that price level was extremely brief, and the share price dropped to slightly above $46 by the end of March. However, after reversing direction again in late March 2018, the share price rose nearly 20% before it reached its new 52-week high of $54.97 on September 12, 2018. The share price closed on September 26, 2018 at $53.14, which was 7.3% higher than one year earlier and more than 20% above the 52-week low from November 2017.

The company has enhanced its quarterly dividend payout amount 2.1% from the $0.59 quarterly dividend distribution in the same period last year to the current $0.6025 quarterly dividend payout. This new quarterly dividend distribution converts to a $2.41 annualized amount and maintains the company’s dividend yield at the 4.5% level – same as the average yield over the past five years.

While keeping pace with its own five-year average, Verizon’s current yield outperformed the 1.09% average yield of the overall Technology sector by more than four-fold. Furthermore, Verizon’s current yield is also nearly double the 2.36% average yield of all the companies in the Telecommunications industry segment.

The company started the past two decades with six years of flat annual dividend distributions before embarking on the current streak of 14 consecutive annual dividend boosts. Since 2004, the company advanced it total annual dividend payout amount 56%, which corresponds to an average growth rate of 3.3% per year.

The revived share price growth contributed significantly to the shareholders’ total return on investment of more than 13% over the past 12 months. However, the total return over the past three years was nearly three times higher at more than 37%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic