W.P. Carey Delivers 72 Consecutive Quarterly Dividend Hikes (WPC)

By: Ned Piplovic,

W.P. Carey, Inc. (NYSE:WPC) — a commercial properties equity real estate investment trust (REIT) — has rewarded its shareholders with a string of quarterly dividend hikes over the past 72 consecutive quarters.

The trust began distributing dividends after its formation in 1998. While the current streak of consecutive quarterly dividend hikes did not begin until July 2001, the trust has delivered annual dividend hikes from the beginning. To maintain its REIT designation and enjoy the tax advantages of this status, W.P. Carey must distribute at least 90% of its annual earnings to shareholders. The current dividend payout ratio of 117% indicates that, in addition to all of its earnings, the trust also distributed to its shareholders funds from other sources, such as cash reserves or asset liquidations.

A payout ratio of more than 100% would be generally a cause for concern with most equities. However, REITs already must distribute a minimum of 90% of their earnings. Therefore, a payout ratio of slightly above 100% is not too alarming, especially if it only happens over a short time horizon. This appears to be the case with W.P. Carey. While still slightly above the 100% level, the W.P. Carey’s current payout ratio has been declining over the past few years and is significantly lower than the trust’s 165% payout ratio average over the past five years.

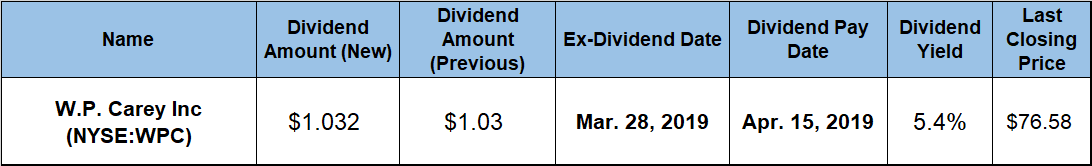

In addition to the slow-but-steady quarterly dividend hikes, the trust continues to deliver its shareholders a relatively reliable asset appreciation to complement the dividend income flow. After a careful examination to make sure that the trust’s financial characteristics align with their investment strategy, interested investors might consider adding WPC’s stock to their portfolio. All investors that act and claim stock ownership before the upcoming March 28, 2018, ex-dividend date, will be eligible to receive the next round of dividend distributions. The trust will distribute the next installment of dividend income payouts on the April 15, 2019, pay date to all its shareholders of record prior to the ex-dividend date.

W.P. Carey, Inc. (NYSE:WPC)

Based in New York City and founded in 1973, W. P. Carey, Inc. became a publicly traded company in 1998 and changed its status to an equity real estate investment trust (REIT) in 2012. The company primarily invests in commercial properties that include office, warehouse, industrial, logistics, retail, hotel and self-storage properties in North America, Europe and Japan. Additionally, the firm provides long-term sale-leaseback and build-to-suit financing for companies. As of December 31, 2018, W. P. Carey owned and managed more than 131 million square feet of rentable space, which was spread among 1,163 buildings and had a total asset value of $8.3 billion. Geographically, 63.4% of facilities are in the United States and 6.1% in Germany. Poland, Spain, The Netherlands, the United Kingdom, Italy and other countries account for less than 5% each. The REIT’s current occupancy rate is 98.3% and the average lease term is 10.2 years. Additionally, the REIT manages a series of non-traded publicly registered and private investment programs with assets under management of more than $14 billion.

The trust’s current 0.2% quarterly dividend hike raised the quarterly payout amount from $1.03 in the previous period to the current $1.032 payout. This quarterly payout corresponds to a $4.128 annualized dividend amount and currently yields 5.4%. While investors seek equities with rising share prices, W. P. Carey’s share price advanced considerably faster than the REIT’s dividend payout amount, which suppressed the current yield more than 8% lower than the trust’s own 5.9% average yield over the past five years.

However, while trailing its own five-year average yield by a small margin, W. P. Carey’s current dividend yield outperformed the 3.05% average yield of the entire Financials sector by more than 77%. Additionally, the trust’s current yield is also 77.3% higher than the 3.04% average yield of its peers in the Property Management industry sector, as well as in line with the average yield of the segments only dividend-paying equities.

Since embarking on the current streak of 72 consecutive quarterly dividend hikes, W. P. Carey has enhanced its quarterly payout amount 144%. This level of dividend growth translates to an average growth rate of 1.2% per quarter, or 4.8% annually for the past 19 years. Additionally, the trust raised it total annual dividend payout 150% since beginning dividend distributions in April 1998 for an average annual growth rate of 4.5% over the past 21 years.

In addition to the steadily rising dividend distributions, the trust delivered a double-digit-percentage asset appreciation for a combined total return of 30% over the past 12 months. Furthermore, the trust delivered total returns of 46% and 53% over the past three and five years, respectively.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic