Walmart’s Dividend Policy Rewards Shareholders with More Than Four Decades of Annual Dividend Boosts (WMT)

By: Ned Piplovic,

While Walmart’s (NYSE:WMT) current dividend yield hovers only slightly above the 1.99% average yield of the overall market, the company has adopted a dividend policy of consecutive annual dividend boosts fueled by long-term revenue growth.

Four years after initially making its shares available to the public in 1970, Walmart initiated dividend distributions in March 1974. Since declaring that first annual dividend of $0.05 per share, WMT has increased its annual cash dividend every year.

Just over the past two decades, Walmart enhanced its total annual dividend distribution amount nearly 18-fold. That level of dividend advancement corresponds to an average annual growth rate of 15.5%.

However, while the annual dividend boosts continue, the annual growth rate has subsided in the more recent periods. The company has been boosting its annual dividend payout by $0.01 – or approximately 2% – for the March pay date every year since 2013. Walmart generally announces its dividend distributions for the entire year in advance. Therefore, investors likely are accustomed to Walmart’s annual dividend declaration that should occur in the next two weeks. If the company continues the same pattern of annual dividend boosts from the past few years, Walmart should announce an increased dividend of $0.53 per share to be paid over each of the upcoming four quarters beginning with the April pay date.

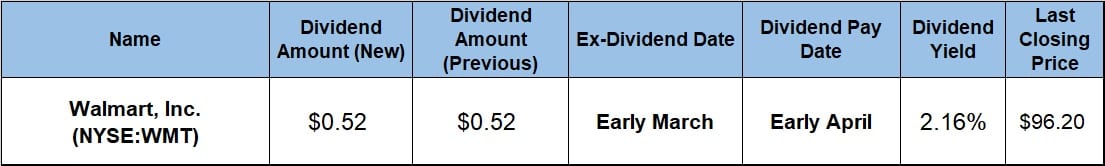

Investors should complete their own due diligence to confirm that Walmart’s current outlook is a good match for the investors’ portfolio strategy. However, investors who deem WMT’s stock investment-worthy should plan to acquire the shares before the next ex-dividend date, which could occur as early as the first week of March, but most likely set for the second week that March. Investors who claim stock ownership before the early-March ex-dividend date will ensure eligibility to receive the next round of dividend distributions, which will most likely be set for the first week of April.

Walmart, Inc. (NYSE:WMT)

Based in Bentonville, Arkansas, and founded in 1945, Walmart Inc. engages in the retail and wholesale segments in various formats worldwide. The company operates through three segments: Walmart U.S., Walmart International and Sam’s Club. The company officially changed its name in February 2018 from Wal-Mart Stores, Inc. to Walmart Inc. Through its nearly 12,000 stores of various forms and e-commerce sites under 65 banners in 28 countries, the company offers a variety of grocery products, consumable goods, electronics, photo processing services, stationery, automotive, hardware and paint, sporting goods, outdoor living and horticulture. Additionally, the company also offers apparel, shoes, jewelry, home furnishings, housewares, small appliances, toys, crafts and seasonal merchandise. In addition to the merchandise, the company offers fuel and auto-repair services, as well as financial services and related products, including money orders, prepaid cards, fund wiring, money transfers, check cashing and consumer credit services. As of 2018, the company had approximately 2.3 million employees globally, of which more than 65%, or 1.5 million, work in the United States.

Dividends

The company’s current $0.52 quarterly dividend payout is 2% higher than the $0.51 distribution amount from the same quarter last year. This new quarterly dividend amount converts to a $2.08 annualized payout and a 2.16% forward dividend yield. Because the dividend growth failed to match the growth rate of Walmart’s share price, the current yield is 12% below the company’s own 2.5% average yield over the past five years. While the streak of five consecutive annual dividend boosts resulted in an 11% enhancement of the total annual dividend payout amount, the share price advanced 33% over the same period, which suppressed the current yield even with the steady annual dividend boosts.

However, despite trailing its own average yield over the last five years, Walmart’s current 2.16% yield is 6% higher than the 2.04% average yield of the entire Services sector, as well as 66% above the 1.30% simple average yield of all the companies in the Discount & Variety Stores industry segment. Additionally, Walmart’s current yield is at the same level as the 2.16% simple average yield of the segment’s only dividend-paying companies.

The dividend income was sufficient to offset a small share-price decline and limit shareholders’ total loss per share to just 0.5% over the past 12 months. Long-term shareholders enjoyed a 42% total return over the past five years and a 57% total return over the last three years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic