Warren Buffett’s Top 10 Dividend Stocks

By: Ned Piplovic,

By Ned Piplovic

Berkshire Hathaway has not paid a cash dividend since 1967 and, if Warren Buffett has his way, it never will. But investors still can take advantage of Warren Buffett’s investing skill and collect regular dividend income by investing in Berkshire Hathaway holdings.

Shareholders of Berkshire Hathaway must accept Warren Buffett’s view of not paying dividends. A proxy resolution to consider paying “a meaningful annual dividend” was in the works for the 2014 annual meeting but the resolution never made it into the meeting’s agenda. However, a tally of the proxy votes revealed that 98 percent of those shareholders voted against paying a dividend.

While the Berkshire Hathaway stock is not a practical choice for dividend-seeking investors, most of Berkshire Hathaway’s holdings do pay dividends. Out of the current 47 Berkshire Hathaway stocks, 31 stocks — two thirds — pay a regular dividend. The weighted average dividend yield for those stocks is 2.12 percent.

However, the weighted average dividend yield for the top 10 Berkshire Hathaway dividend-paying stocks is 3.56 percent.

At the end of this article, you can find a chart listing all 31 holdings that are currently generating dividend income for Warren Buffett.

However, before you look at the full list, here are the top ten dividend-paying Berkshire Hathaway holdings, with charts showing a brief dividend payout history for each individual equity.

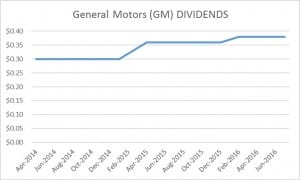

1. General Motors (NYSE: GM)

At 4.78 percent, this stock’s dividend yield is the highest among current Berkshire Hathaway holdings. The dividend has been increasing again since 2009 when it was cut due to company’s bailout and restructuring. The 2009 cut was the only dividend decrease in more than 20 years.

The share price as of the close of trading on September 30, 2016, was about $31.77, which is 15 percent less than the 52-week high. The stock price range was $26.69-$36.88 during that 12-month period.

Connect with Ned Piplovic

Connect with Ned Piplovic