WEC Energy Group Pays Rising Dividends for 14 Successive Years (WEC)

By: Ned Piplovic,

In the aftermath of a nearly 50% dividend cut in 2000 and two and a half years of flat quarterly payouts, WEC Energy Group, Inc. (NYSE: WEC) has made an impressive recovery, having paid a rising dividend over the past 14 consecutive years.

At current share price levels, WEC Energy yields 3.3% and pays a dividend that is more than five times the annual payout from a decade and a half ago, when WEC first began raising dividends again. Aside from two noticeable pullbacks, the share price has also been growing in tandem with the dividend over the last two decades.

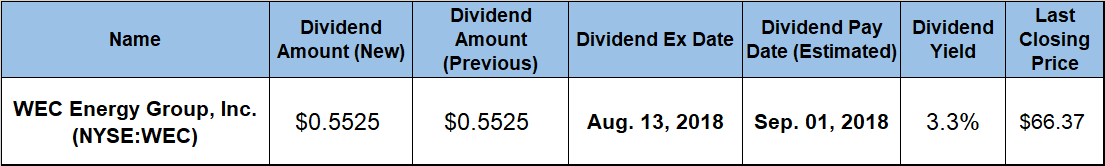

WEC Energy will distribute its next quarterly dividend on the pay date of September 1, 2018 to all shareholders of record prior to the August 13, 2018 ex-dividend date.

WEC Energy Group, Inc. (NYSE:WEC)

Headquartered in Milwaukee, Wisconsin and tracing its origins to the formation of the Milwaukee Electric Railway and Light Company in 1896, WEC Energy Group, Inc. provides regulated natural gas and electricity, as well as non-regulated renewable energy services in the United States. The company operates through six segments: Wisconsin, Illinois, Other States, Electric Transmission, Non-Utility Energy Infrastructure, and Corporate & Other.

In addition to electricity generation, the company provides electricity transmission services, natural gas retail distribution services and transportation of customer-owned natural gas, as well as the generation and distribution of steam. WEC’s electricity and natural gas distribution services cover, respectively, approximately 1.6 million and 2.8 million residential, commercial and industrial customers in Wisconsin, Illinois, Michigan and Minnesota. As of June 2018, the company’s total assets included nearly 70,000 miles of electric distribution lines, almost 50,000 miles of natural gas distribution and transmission lines, as well as an electric power generating capacity of 8,700 megawatts.

During WEC’s second-quarter earnings call – which took place on July 31, 2018 – the company reported strong results and exceeded analysts’ expectations for the fifth consecutive quarter. Based on consolidated total revenue of $1.7 billion for the second quarter, WEC Energy reported net income of $231 million, or earnings per share (EPS) of $0.73. This was a 16% increase over total earnings of $199.1 million in the same period last year. In addition, the $0.73 EPS number was 9% higher than the $0.67 EPS estimate expected by Wall Street analysts.

In terms of share price performance, WEC began the current 12-month period with a rise of almost 11% to reach a 52-week high of $69.53 on November 14, 2017. However, WEC gave back all of those gains and then some between November and June 2018 when the share price reached its 52-week low, resulting in a total loss of 15.6% from the November 2017 high. By the end of July 2018, though, WEC had regained much of those losses and was just 4.5% short of the November 2017 peak. The closing price on July 31, 2018 was $66.37, which was 5.4% higher than it was one year earlier and 13.3% above the 52-week low from June 2018.

WEC’s quarterly distribution is currently $0.5525 per share, which is 6.2% higher than this time last year and translates to a $2.21 annualized payout. The 3.3% dividend yield is level with the company’s five-year average and 30% higher than the average yield of the overall Utilities sector. The company’s rising dividend distributions have enhanced the annual payouts more than 450% over the past 14 consecutive years, which is equivalent to an average growth rate of more than 12% per year.

Suffice it to say that the combination of rising dividend payouts and steady asset appreciation rewarded the company’s shareholders with robust total returns over the past several years. Just over the past 12 months, shareholders enjoyed a total return of nearly 9%, with the three-year and five-year total returns coming in at 47% and 72%, respectively.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic