Western Union Offers Shareholders 8.6% Dividend Boost (WU)

By: Ned Piplovic,

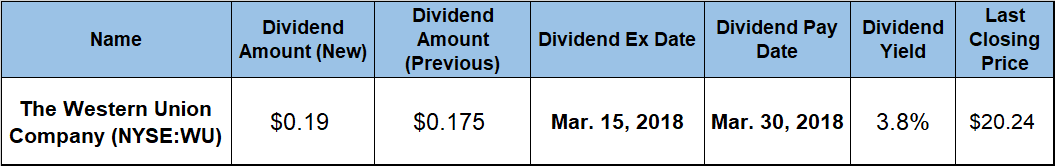

The Western Union Company (NYSE:WU) rewarded its shareholders this quarter with an 8.6% quarterly dividend boost and a 3.8% forward dividend yield.

The share price experienced some volatility and a significant pullback in the first half of the trailing 12-month period. However, the share price has recovered all those losses and is currently trading marginally above its price level from 12 months earlier and nearly 10% higher than its 52-week low from early July 2017.

The company’s next dividend ex-date will be on March 15, 2018, and the pay date follows just two weeks later, on March 30, 2018.

The Western Union Company (NYSE:WU)

The Western Union Company traces its origins back to the New York and Mississippi Valley Printing Telegraph Company, which was founded in 1851 in Rochester, New York. However, after more than a century of name and ownership changes, the company emerged in its current form in September 2006 — when the First Data Corporation spun off the Western Union operation and brand name as an independent, publicly traded company with its focus on money transfers and payment services with its headquarters in Englewood, Colorado. The company operates in three segments — Consumer-to-Consumer, Consumer-to-Business and Business Solutions.

The share price entered its current trailing 12-month period on a downtrend and continued to lose more than 8% between late February and early July 2017 when the share price reached its 52-week low of $18.47 on July 6, 2017. After bottoming out at the beginning of July 2017, the share price embarked on a slow uptrend and continued to face some volatility. At the turn of the year, the share price spiked more than 14% between December 26, 2017, and January 8, 2018, to reach its 52-week high of $21.49. After trading above the $20.50 level for most of January, the share price lost more than 11% of its value during the market pullback and fell from $21.16 on January 26, 2018, to $18.81 on February 8, 2018.

Since that double-digit-percentage loss, the share price recovered 61% of its losses and closed on February 24, 2017, at $20.24, which was just 0.5% higher than it was on February 27, 2017, and almost 6% lower than its price peak from January 8, 2018. However, the February 24, 2017, closing price was almost 10% above the July 2017 bottom and continues to trend higher.

The company’s 50-day Moving Average (MA) dropped below the 200-day MA in mid-March 2017 and remained below for the next eight months. However, the 50-day MA crossed back above the 200-day MA in mid-November 2017 and continues to ascend, which could indicate a continued near-term uptrend. The current 50-day MA of $20.03 is nearly 3% higher than the 200-day MA of $19.48. Additionally, the current share price is above both moving averages after recovering from a brief dip below both moving averages on February 8, 2018.

While the share price struggled to provide asset appreciation to the company’s shareholders in the past year, the dividend distributions continued to deliver rising income at above-average yields. The company hiked its current $0.19 quarterly dividend payout 8.6% from the previous quarter’s $0.175 distribution. This new amount is equivalent to a $0.76 annualized distribution for 2018 and a 3.8% forward yield, which is 17.3% higher than the company’s own 3.2% average yield over the past five years.

Additionally, Western Union’s current yield exceeds the 1.97% average yield of the entire Services sector by more than 90%. The company’s current yield also surpasses the 1.14% average yield of all the companies in the Personal Services segment by more than 220%. Western Union’s yield is currently the highest yield in the entire Personal Services segment and — other than H&R Block’s 3.55% yield — all other yields are below 2%.

Since emerging as an independent company in 2006, the company failed to hike its annual dividend only twice. Over that period, the company grew its annual dividend amount at an average rate of 34.2% per year. The main driver behind this high growth rate was a hike from $0.06 in 2008 to $0.25 in 2009. However, after establishing that level of dividend distributions, the annual dividend amount continued to rise at a more moderate rate. Over the past four consecutive years, the annual dividend payout rose at an average rate of 11% per year.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic