Will Trade War with China Hurt Caterpillar or Is the Current Share Price Drop A Buying Opportunity? (CAT)

By: Ned Piplovic,

Caterpillar, Inc. (NYSE:CAT) has been paying rising annual dividends for 24 consecutive years and had nearly tripled its share price between January 2016 and the beginning of 2018.

However, the recent developments in trade relations with China and what some analysts see as an impending trade war might hurt the company’s sales in China and cause a continuing share price decline. While the company managed to deliver reliable and rising dividend income for decades, its share price lost 40% of its value between mid-2014 and the end of 2015.

Despite a 15% decline since its 52-week peak in January 2018, the company’s share price is more than 50% higher and has combined with the rising dividend distributions for a total return of more than 60% over the past 12 months.

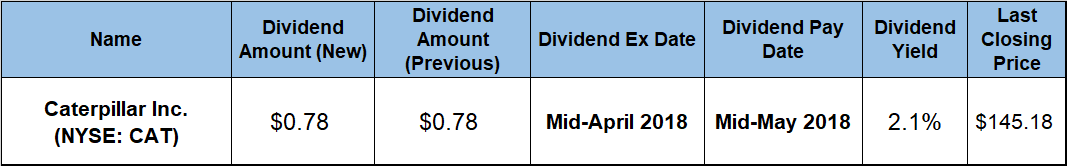

Investors who are convinced that the trade war will not be an issue and that the company will keep boosting dividend income and achieving capital appreciation can receive the company’s next payout by investing before the next ex-dividend date to become a shareholder of record. The company has not announced its upcoming dividend date yet. But based on its past schedule, Caterpillar should make its dividend declarations by late next week and announce an ex-dividend date near April 19, with a pay date approximately one month later, around May 20, that would keep the same $0.78 quarterly distribution amount for the next quarter.

Caterpillar, Inc. (NYSE:CAT)

Caterpillar Inc. manufactures and sells construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives for industrial application. The company’s Construction Industries segment offers backhoes, loaders, prep tractors, excavators, graders, asphalt pavers, etc.

CAT’s Resource Industries business segment provides electric rope and hydraulic shovels, landfill and soil compactors, track and rotary drills, hard rock vehicle and continuous mining systems, as well as mining, off-highway and articulated trucks. Additionally, the Energy & Transportation segment offers reciprocating engine-powered generators, turbines, centrifugal gas compressor, diesel-electric locomotives and other rail-related products and services. Founded as the Caterpillar Tractor Co. in 1925, the company changed its name to Caterpillar Inc. in 1986 and its headquarters are in Peoria, Illinois.

The company’s share price declined 1.2% over the first 10 days of the trailing 12-month period and hit its 52-week low of $93.10 on April 13, 2017. However, after this minor detour, the share price resumed its rising trend. The share price reached and eclipsed its previous all-time high from 2012 by early September and continued to set one new all-time high after another. When the share price peaked at $170.89 on January 22, 2018, it was more than 80% above the 52-week low from April 2017.

Unfortunately, the overall market selloff at the end of January and fears of a trade war resulted in a trend reversal and Caterpillar’s share price lost more than 15% by April 4, 2018, when it closed at $145.18. However, that closing price was still 56% higher than the 52-week low from April 2017 and 54% higher than it was one year earlier.

The company’s current $0.78 quarterly dividend is 1.3% higher than the $0.77 distribution from the same period last year. This current quarterly payout is equivalent to a $3.12 annualized dividend amount for 2018 and a 2.1% forward yield. While the 2.1% yield might not seem very high compared to some other sectors where top equities offer double-digit yields, Caterpillar’s current yield is significantly above average yields of its industry peers.

The company’s current 2.1% yield is 79% above the 1.2% simple average yield of the entire Industrial Goods sector and 130% higher than the 0.93% average yield of all companies in the Farm & Construction Machinery market segment. Additionally, as the highest yield in that segment, CAT’s current yield is even 82% higher than the 1.12% average yield of only dividend-paying companies in the Farm & Construction Machinery segment.

Additionally, Caterpillar has doubled its annual dividend payout amount over the past 10 years and enhanced its total annual dividend nearly six-fold over the past two decades by compounding the annual payout at an average rate of 9.1% per year since 1998.

The combination of rising dividend income and a relatively steady asset appreciation offered the company’s shareholders a total return of 61% over the past 12 months and a 92% total return over the past three years. While tariffs and trade war fears might put downward pressure on Caterpillar’s share price in the short term, long horizon outlook appears brighter and the company should be able to continue distributing rising dividends and growing its share price over the long term.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic